The collapse of a Californian bank triggered a rapidly-spreading banking crisis, with Europe suffering the brunt of it. European Banks, Financial Services firms and Insurers have fallen more than their US counterparts, while the risk of each one of those sectors in Europe has jumped.

The collapse of Silicon Valley Bank (SVB) and the forced takeover of Credit Suisse by UBS has raised fears of systemic risk contagion in the banking sector, triggering widespread selling of lenders’ equities and debt around the world. It has been European banks’ shares that have led losses, and the region’s banking sector risk has climbed above that of the global one.

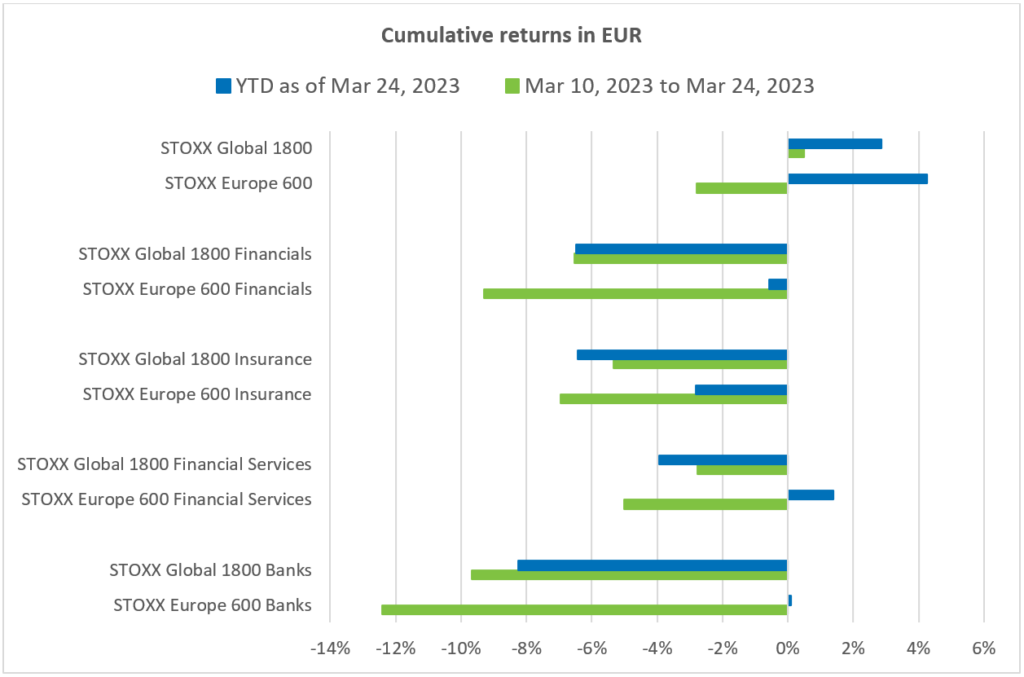

This article will analyze the losses registered by financial stocks around the world between March 10, the day when SVB failed, and March 24. The STOXX® Europe 600 Financials index dropped 9.3% over the period, nearly three percentage points more than the STOXX® Global 1800 Financials index. The former’s decline has wiped out all its gains in 2023 (Figure 1).

European Banks, Financial Services, and Insurance — the three Supersectors within the broader Financials Industry as defined by the ICB classification — each fell more than their global counterparts in the ten business days under consideration. Yet, the Supersectors in Europe still show higher 2023 returns than in the global landscape following strong performances in January and February.

Among the three Supersectors, European Banks were the hardest hit in the recent turmoil, falling more than 12%, followed by Insurance (-7%) and Financial Services (-5%). Insurance has recorded a 3% year-to-date decline as of March 24, while European Banks and Financial Services are still in positive territory.

Global Financials and each of its Supersectors are down for the year, with the STOXX® Global 1800 Banks index underperforming the global market by 11 percentage points.

Figure 1: Cumulative returns in EUR

The rest of the study looks at the reaction of banks, financial services and insurance companies by country and region over the recent turmoil.

Returns by country

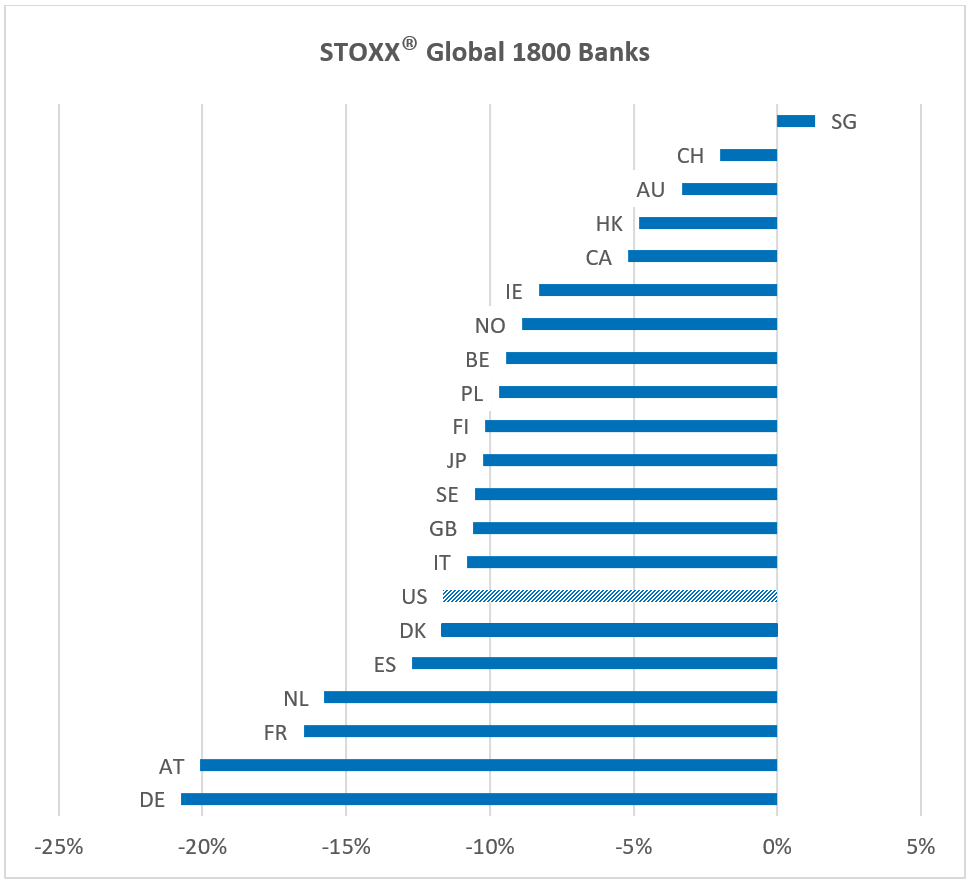

US banks fell 12% in the wake of the industry collapse (Figure 2). Banks in six European countries saw even larger stock declines, led by Germany (21%) and Austria (20%). Only banks in Singapore managed to post gains.

Figure 2: STOXX® Global 1800 Banks index: returns by country

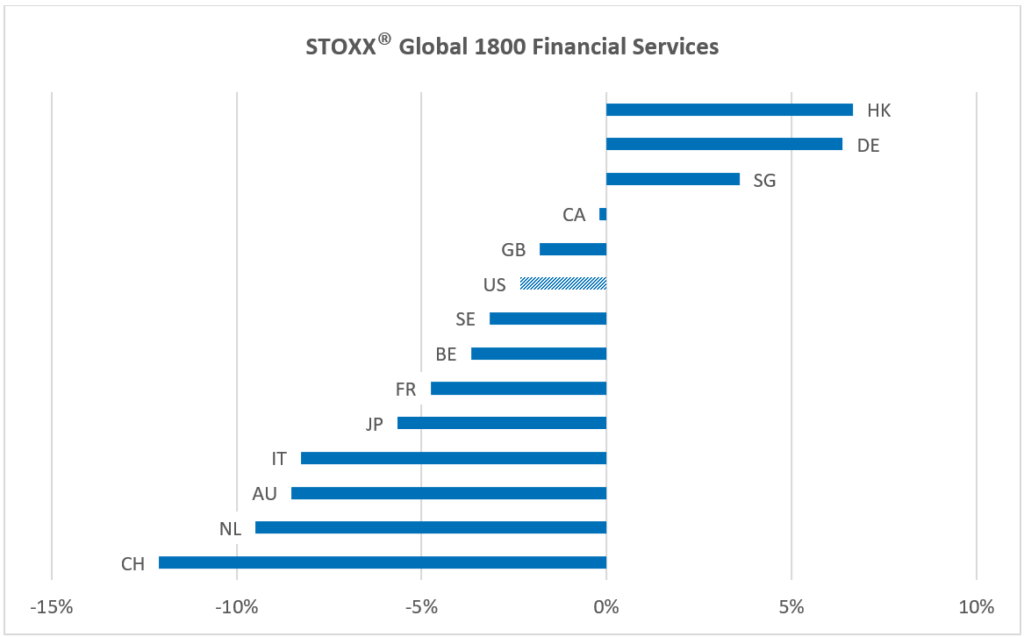

Financial Services companies in Switzerland (which include Credit Suisse and its rescuer, UBS), fell the most (12%) (Figure 3). The US saw one of the smallest losses in this category, of about 2%.

In contrast, Hong Kong, Germany and Singapore posted small gains. This is because Financial Services includes stock exchanges, which benefit from higher trading volumes amid extensive selling.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Figure 3: STOXX® Global 1800 Financial Services index: returns by country

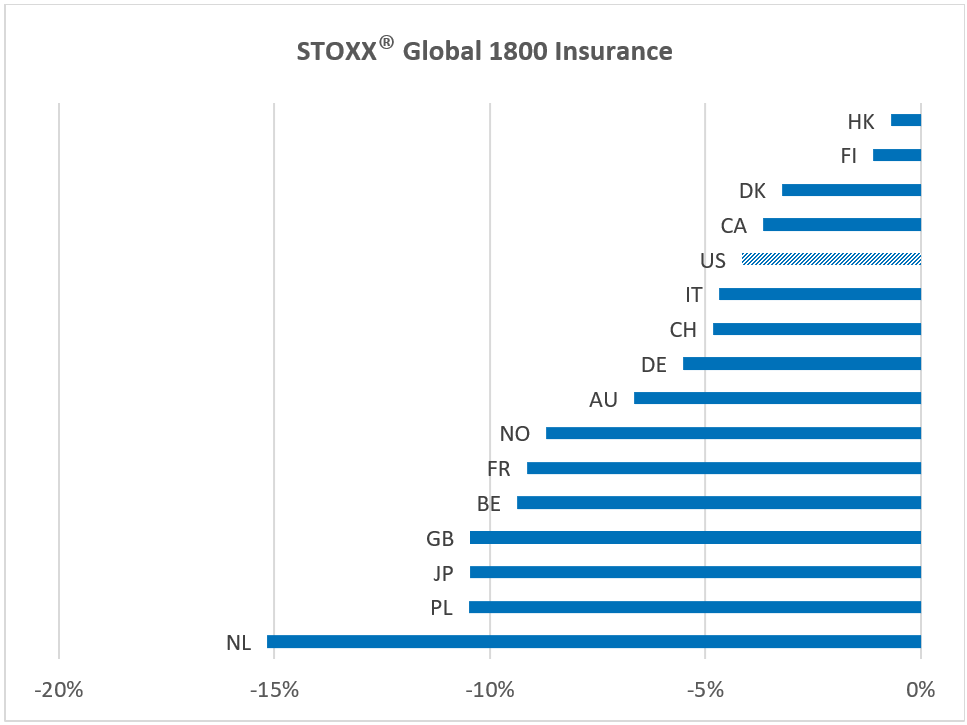

While most eyes were set on Banks, Insurance companies were not left unscathed. This is because systemic risk has increased in the insurance sector, partly as a consequence of its growing ties with banks.

Insurers’ stocks were down in all countries in the STOXX® Global 1800 index (Figure 4). Once again, European countries bore the brunt of selling, with the Netherlands posting losses of 15%. In comparison, US insurers were down only 4%.

Figure 4: STOXX® Global 1800 Insurance index: returns by country

Country contributions to index loss

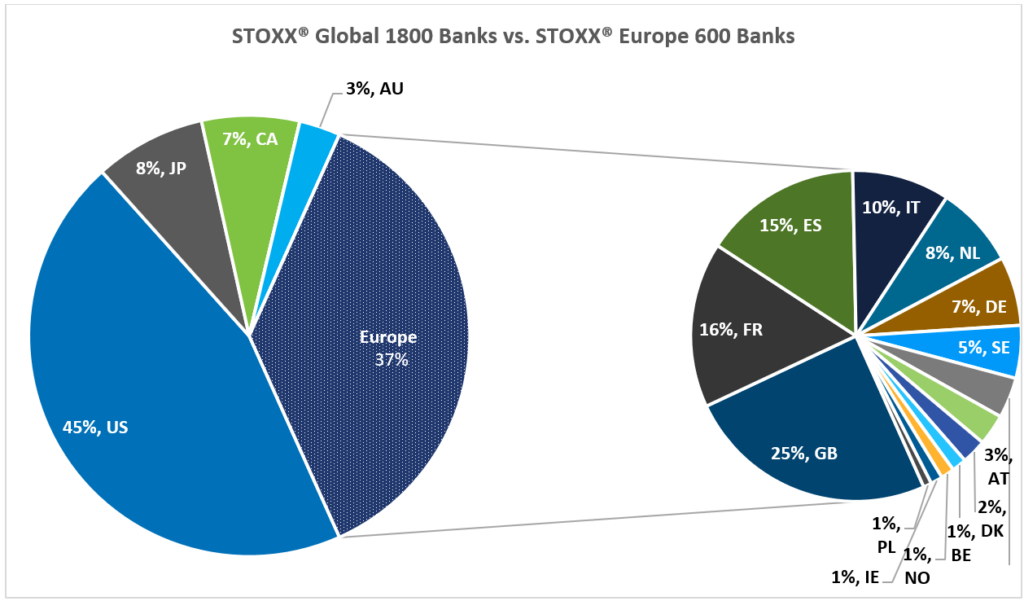

US and European banks were mostly responsible for the 10% decline in the STOXX® Global 1800 Banks index (Figure 5).

UK, Spanish, French and Italian banks were the main culprits for the 12% fall in the STOXX® Europe 600 Banks index. Surprisingly, Swiss banks have a minuscule weight in the index (0.6%); instead, large Swiss financial institutions are categorized under Financial Services, and we will see their impact on that Supersector.

All but one of the 42 stocks in the STOXX® Europe 600 Banks index fell after March 10, with some losing over 20% of their equity.

Figure 5: Contribution to Global and European Bank index returns by country (March 10 to March 24, 2023)

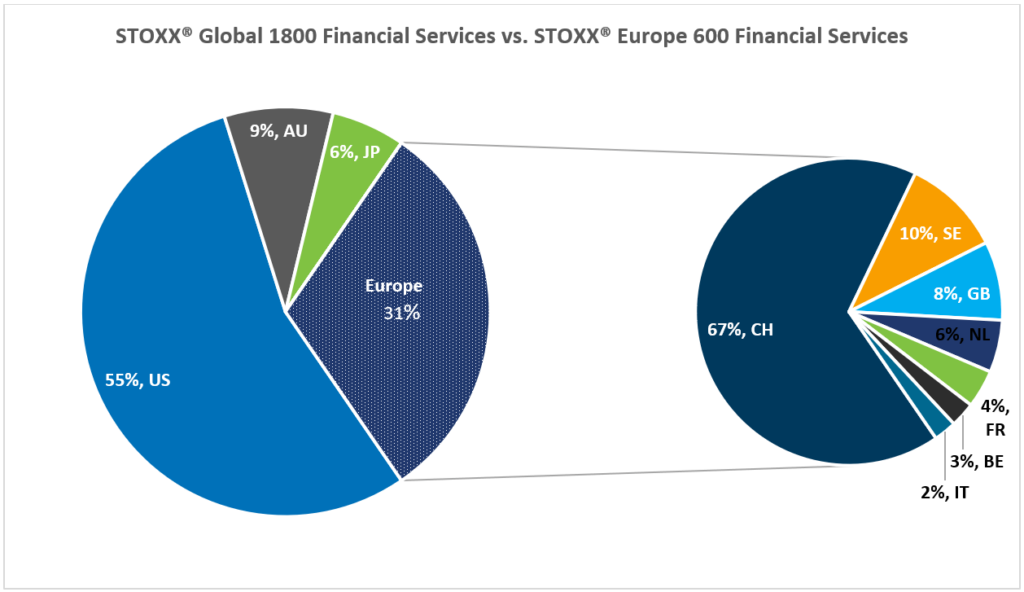

Switzerland was largely responsible for the drop in the European Financial Services Supersector (Figure 6). Except for Credit Suisse, which plunged 70%, there were lower magnitude losses among European Financial Services firms than the ones seen for European banks.

Credit Suisse held a relatively small weight in the STOXX® European 600 Financial Services index but was still the largest contributor to the index’s loss. UBS, which represents nearly 18% of the index, was the second-largest negative contributor.

Two of the largest stocks in the index — Deutsche Börse and London Stock Exchange (each weighing 10% in the index) — offset some of the overall losses.

Figure 6: Contribution to Global and European Financial Services index returns by country (March 10 to March 24, 2023)

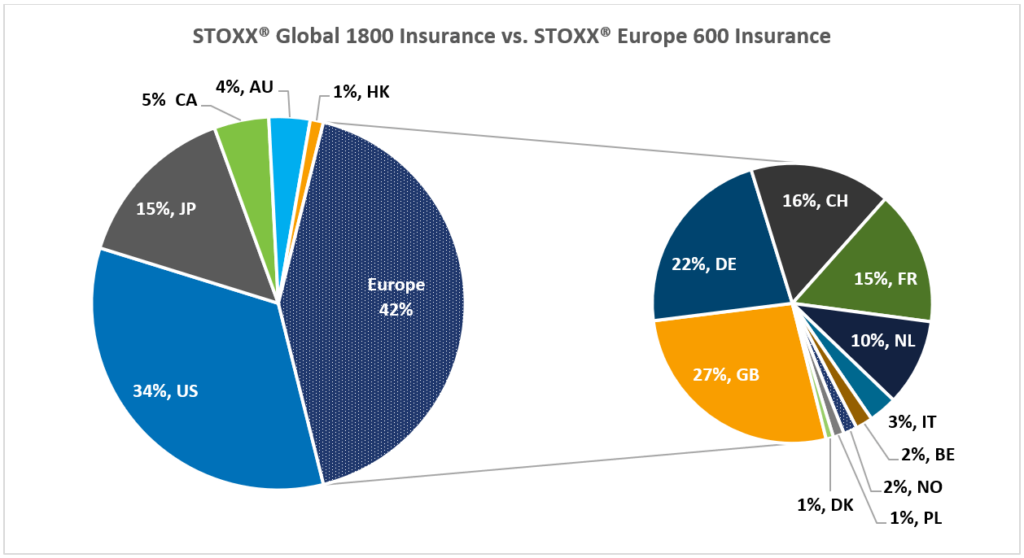

The downfall of insurers in Europe contributed more than 40% to the 5% decline in the STOXX® Global 1800 Insurance index (Figure 7). The US (34%) and Japan (15%) were the other large detractors.

The STOXX® Europe 600 Insurance index fell 7% over the short period, with all but one of its 31 constituents dropping.

Figure 7: Contribution to Global and European Insurance index returns by country (March 10 to March 24, 2023)

Risk forecasts

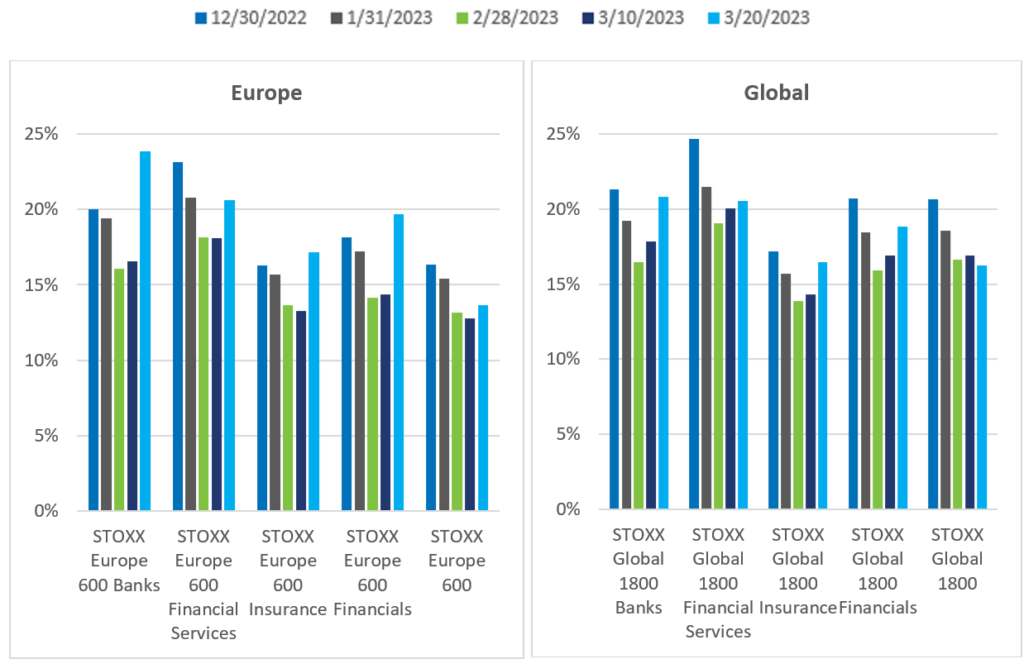

The risk of European banks jumped 44% following SVB’s downfall, much more than it did for Global Banks (Figure 8). By March 24, the risk forecast for the STOXX® Europe 600 Banks index had exceeded that of the STOXX® Global 1800 Banks index, as measured by Axioma fundamental short-horizon models, reverting the situation earlier in the year.

The risk of European Banks, Financial Services and Insurance is now higher than it was at the beginning of the year, while, so far, that is not the case for their global counterparts.

Figure 8 – Risk on Financials Supersectors: Banks, Financial Services, Insurance

Conclusion

Despite regulators’ efforts to limit the damage from the bank upheaval, investors are becoming more and more anxious about a contagion effect among financial institutions and a cascading impact on other industries. For an analysis on the potential effects on stocks of a widening banking crisis, see the blog post ‘Bank Credit spread contagion – how bad can it get?’