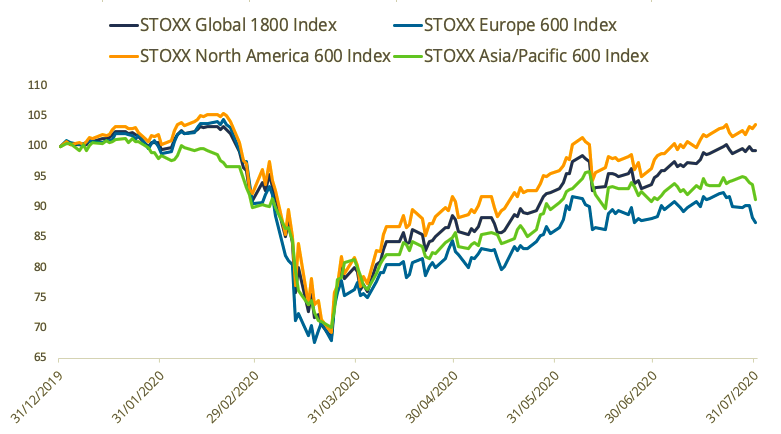

The STOXX® Global 1800 Index rose for a fourth straight month in July, even as COVID-19 contagions crept up in many geographies and European stocks faltered.

The global index rose 4.7% in dollar terms1 during the month but dropped 0.5% in euros as the greenback slumped 5% against the common currency. The index is still down 0.7% for the year in dollars and 3.9% below a Feb. 12 high, as economies have suffered from lockdowns aimed at limiting the spread of the novel coronavirus.

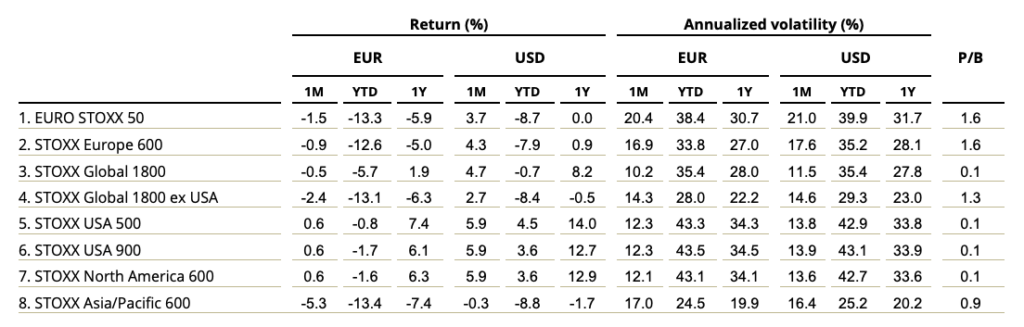

Gains were underpinned by continuing strength in US shares, driven in turn by a weak dollar and by better-than-expected second-quarter earnings. The STOXX® North America 600 Index climbed 5.9% in dollars. The pan-European STOXX® Europe 600 Index, however, fell 0.9% when measured in euros, while the Eurozone’s EURO STOXX 50® Index slid 1.5%. The STOXX® Asia/Pacific 600 Index decreased 0.3% in dollars.

July brought a gauge of just how much economies have suffered this year. The US reported its economy contracted 9.5% in the second quarter from the first quarter, while the Eurozone’s economy tumbled 12.1%. Still, investors have continued to bet on a post-pandemic recovery and have been encouraged by extraordinary government and monetary policy stimulus, and by business indicators pointing to a rebound in activity.

Exhibit 1 – Returns since start of 2020

Exhibit 2 – Benchmark Indices’ risk and return characteristics

Emerging markets and developed nations

All but one of 25 developed markets tracked by STOXX climbed during July when measured in dollars.2 The STOXX® Japan Total Market Index was the exception, as it dropped 2%. The STOXX® Developed Markets 2400 Index rose 4.8% in dollars and slid 0.5% in euro terms.

The STOXX® Emerging Markets 1500 Index advanced 7.7% in dollars. All but four of 21 national developing markets climbed during the month.

Seventeen of 19 supersectors in the STOXX Global 1800 Index rose in the month. The STOXX® Global 1800 Basic Resources Index led gains with a 9.3% advance, as a softer dollar helped the price of metals.3 The STOXX® Global 1800 Oil & Gas Index came out last, losing 3%.

Minimum variance provides shelter in Europe

Minimum variance strategies helped provide refuge in markets where benchmarks suffered losses but underperformed in rallying markets such as the US.

The STOXX® Global 1800 Minimum Variance Index rose 4.1% during the month, while the STOXX® Global 1800 Minimum Variance Unconstrained Index gained 4.9%. The STOXX® USA 900 Minimum Variance Index climbed 4.6% and the STOXX® USA 900 Minimum Variance Unconstrained Index added 5.8%.

The STOXX® Europe 600 Minimum Variance Index gained 0.4% and its unconstrained version climbed 1.2%, both significantly beating their benchmark.

The STOXX® Minimum Variance Indices come in two versions. A constrained version has a similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

Momentum rules in factor space

Investors continued to favor momentum stocks during July, according to the STOXX® Factor Indices, which seek to capture proven sources of equity risk and returns.

The STOXX® Global 1800 Ax Momentum Index, which tracks shares with the highest cumulative return over the last year excluding the most recent month, added 7.3%. All style indices in the global Factor family had positive returns during July. The STOXX® Global 1800 Ax Value Index, came out last, with a 2.6% advance. On a regional basis, momentum also paced gains in Asia, the US and Europe.

The STOXX® Global 1800 ESG-X Ax Momentum Index added 7.4%. The STOXX® ESG-X Factor Indices were introduced in May and cover major regions and countries. They implement the same factor-based methodology of the STOXX Factor Indices, seeking exposure to five style signals, but do so on slightly smaller universes that exclude stocks based on the responsible polices of leading asset owners.

Market neutral

For their part, all but one of seven iSTOXX® Europe Factor Market Neutral Indices, which hold a short position in STOXX Europe 600 futures to help investors neutralize systematic risk, had a positive return. The exception was the iSTOXX® Europe Value Factor Market Neutral Index, which lost 1.6%. The iSTOXX® Europe Momentum Factor Market Neutral Index posted the widest gain, at 1.9%.

Six of eight EURO STOXX® Multi Premia® and Single Premium Indices, which are exposed to the market’s systematic risk, recorded gains in the month that ended. Those six also beat their benchmark, the EURO STOXX® Index, which fell 0.9%. As in other cases, the EURO STOXX® Momentum Premium Index was the group’s winning style in July.

Sustainability strategies

The STOXX® ESG-X Indices performed broadly in line with their benchmarks during July, allowing investors to generate market-type returns while complying with sustainable policies.

The EURO STOXX 50® ESG Index topped its benchmark by 45 basis points during July, a sixth consecutive monthly outperformance. The environmental, social and governance (ESG) index, which is derived from the EURO STOXX 50 Index and incorporates negative exclusions and ESG scoring into stock selection, has outperformed its benchmark by almost 4 percentage points in 2020.

The DAX® 50 ESG Index, which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, was flat for the month, as was the flagship DAX®.

New Climate Benchmarks

The STOXX® Paris-Aligned Benchmark Indices (PABs), which were introduced in June, came up broadly in line with their benchmarks during July. The PAB indices are based on liquid securities from a selection of STOXX benchmark indices and follow the EU Paris-aligned Benchmark (EU PAB) requirements outlined by the European Commission’s Technical Expert Group (TEG) on climate benchmarks.

Among the STOXX® Climate Transition Benchmark Indices (CTBs), the STOXX® Europe 600 Climate Transition Benchmark Index returned 26 basis points more than its benchmark during July. The CTBs, which also follow the requirements outlined by the European Commission’s TEG, form portfolios that are on a decarbonization trajectory.

Thematic indices

The STOXX® Thematic Indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based and artificial-intelligence-driven. All 22 STOXX revenue-based thematic indices had positive returns during July, and 14 of them outperformed the STOXX Global 1800 Index. Two of three STOXX artificial-intelligence-driven thematic indices, the STOXX® AI Global Artificial Intelligence Index and its ADTV5 version, continued their streak of outsized relative returns during July.

The STOXX® Global Pet Care Index, one of the most recent additions to the thematics family, was the month’s top performer, with a 10% jump. The index is comprised of companies that stand to benefit from the continuously growing trend of pet ownership.

Featured indices

STOXX® Global 1800 Index

EURO STOXX 50® Index

STOXX® Europe 600 Index

STOXX® North America 600 Index

STOXX® Asia/Pacific 600 Index

STOXX® Developed Markets 2400 Index

STOXX® Emerging Markets 1500 Index

STOXX® Global 1800 Minimum Variance Index

STOXX® Europe 600 Minimum Variance Index

STOXX® Factor Indices

STOXX® ESG-X Factor Indices

EURO STOXX® Multi Premia® and Single Premium Indices

iSTOXX® Europe Factor Market Neutral Indices

EURO STOXX 50® ESG Index

DAX® 50 ESG Index

STOXX® Paris-Aligned Benchmark Indices

STOXX® Climate Transition Benchmark Indices

STOXX Thematic Indices

1 All results are total returns before taxes unless specified.

2, 3 Returns net of taxes.