ESG Leaders, low carbon emissions and the UN Sustainable Development Goals (SDGs) are three key data and information sources for responsible investing that are clearly distinct but not mutually exclusive. Integrating all three into an investment product may sound like theoretical “nice-to-haves” and some investors remain concerned that “doing good” may not translate into “doing well”. Reasonably, they hope to focus on these issues of sustainability without taking on too much risk relative to the broad equity market and thereby give up returns.

In this whitepaper, we show:

- How portfolios can be built that provide more attractive sustainability characteristics – without taking on too much risk;

- Use the iSTOXX APG World Responsible Index Family to show that layering successive portfolio tilts does not add significant risk along the way;

- Why a financial optimizer is an essential tool in achieving the most efficient portfolio.

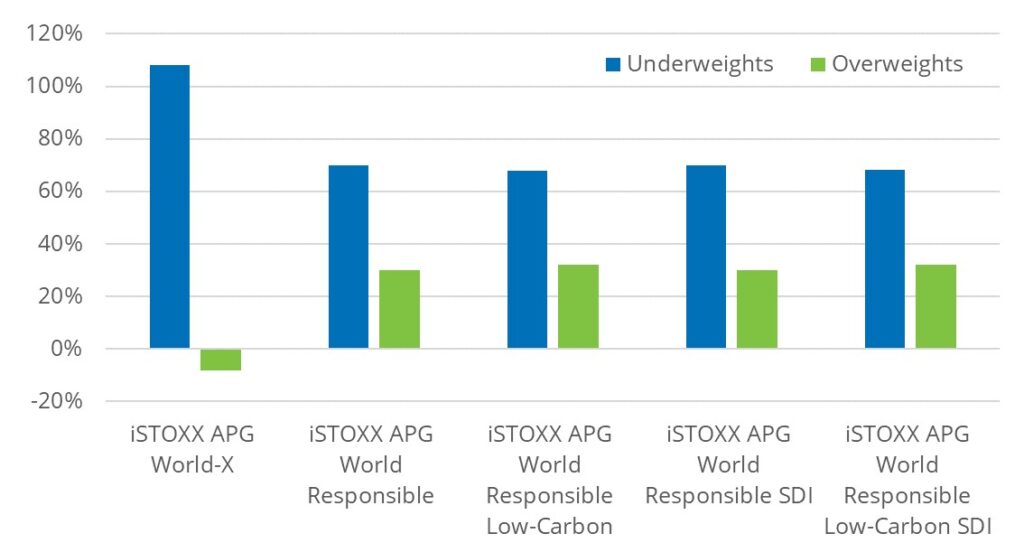

Contribution to Active Risk, Underweights vs. Overweights

Source: Qontigo. APG.

Download Our Whitepaper