Neal Pawar, Chief Operating Officer at Qontigo, addressed the Qontigo Investment Intelligence Summits1 to give a practitioner’s perspective on how to improve efficiency at investment firms, specifically asset managers. He focused on the considerations around whether to buy or build components in a radically changing technological ecosystem.

Many financial institutions are running on legacy technology – decades-old and tightly coupled systems that are hard to customize, slow to operate and expensive to maintain. In many respects they are paying the price for being early adopters of digitalization, and their technology has not easily kept up with changes over the past few decades.

To the industry’s advantage, however, the world of third-party software, components and data has evolved in the past two decades thanks to increased specialization, competition, open standards and, more recently, cloud computing. The menu of tools that managers can buy out-of-the-box to replace expensive home-built capabilities can untangle the old Rube Goldberg-like technology stacks and lead to economic efficiencies and scalability.

“The building blocks have changed,” said Pawar, who previously led technology divisions at buy-side firms including D. E. Shaw & Co., UBS Wealth Management and AQR Capital Management. “We used to think of buy-versus-build as a very deep technology problem. These days, however, clients can assemble the workflows and applications needed to operate front-to-back value chains very differently from the legacy ways.”

The path towards a solution: proprietary or commodity?

The technological transformation of recent years has seen the commoditization of services including accounting, trade order management and execution, risk calculations and complex analytics. They have moved from internal, built-from-scratch capabilities to off-the-shelf solutions.

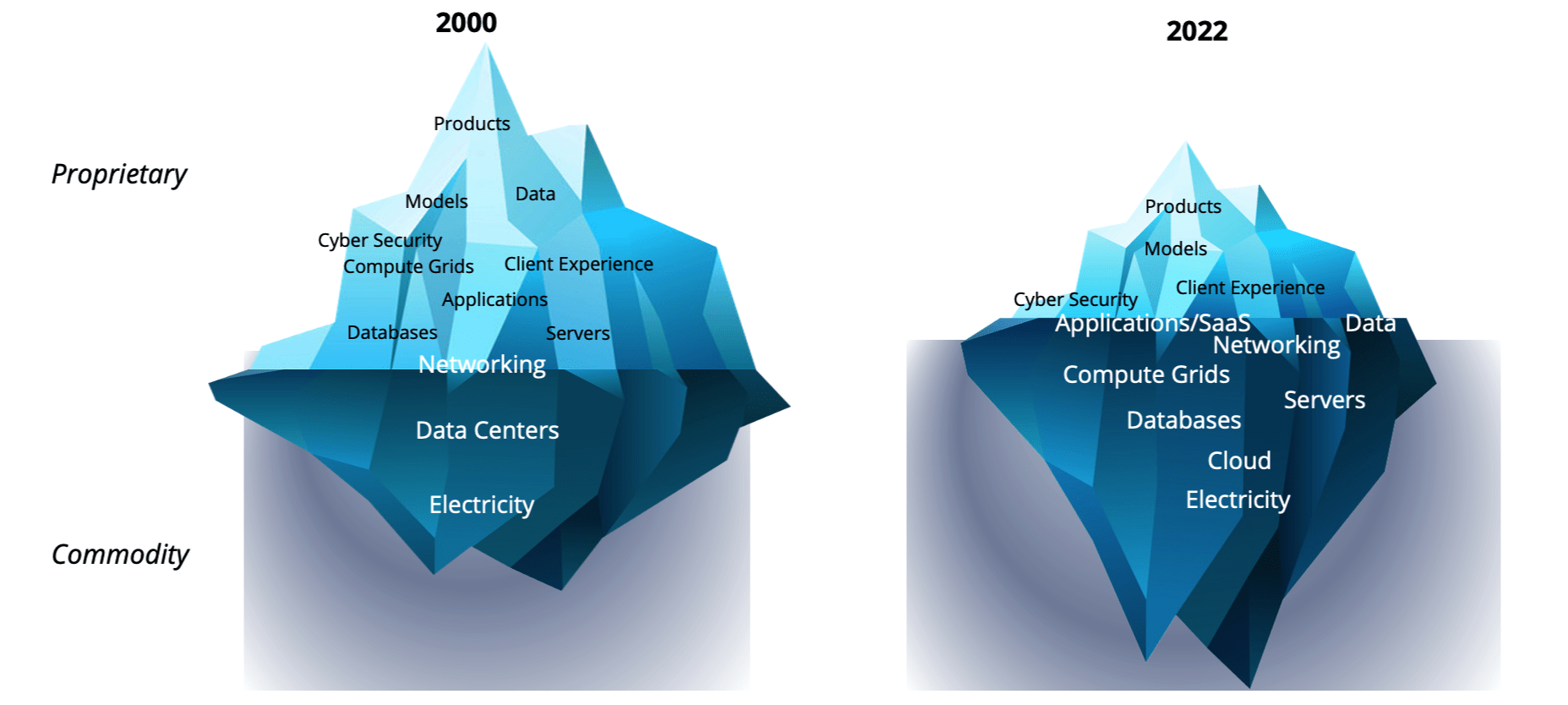

Pawar likened the tech stack of an asset manager to an iceberg, as featured in Figure 1. Activities above the waterline are those designed and fully operated in-house, while those underwater are commoditized services that can be bought or contracted out. Comparing 2000 with 2022, it can clearly be seen which technical domains no longer need to be developed by internal staff but can be replaced with commoditized solutions.

Figure 1: The evolution of buy vs. build in asset management

“About 20 years ago, pretty much the only things that you could truly rely on to buy were electricity, data centers and networking,” said Pawar. “Now, many of the proprietary technical components have gotten more commoditized.”

The invent-to-utility map

From the tip to the base of the iceberg, services can be clustered into four groups, according to Pawar. These are:

- ‘Invent’ (top): areas where the manager creates proprietary services to generate alpha and gain a competitive edge.

- ‘Co-create’ (higher middle range): services where the client keeps control but uses a ‘mix and match’ of outside components.

- ‘Buy and Integrate’ (lower middle range): external services that can fit into a client’s own systems.

- ‘Utilities’ (bottom): services that should be outsourced.

This classification can help guide managers on development methodologies (e.g., agile vs. lean vs. outsource) and to decide where to devote capital, time and effort, Pawar explained.

“With utilities, the goal is to lower costs,” he said. “The things in the middle, you want them to be lean, you want to reduce your waste and to learn from your mistakes so you can improve in that area. All the way to the top — that is where you want to reduce the cost of change. You want to test new ideas and get them into production really quickly.”

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >The case with data

Data services are emblematic of the technology evolution, with information storage and processing moving from company servers to the cloud.

These days, a manager can access terabytes of information from a data vendor via a cloud-based marketplace or exchange at the click of a button, format it, process it, integrate it into their systems and leverage it from their cloud environment. This step-change has eliminated the need for internal resources building feed handlers, parsers and the like.

“We used to buy machines – hardware – and appreciate their capabilities and refresh them over time,” said Pawar. “We don’t care about that anymore now. We buy computing as a service, and we pay for the units of compute that we use. We are replacing our data centers with the cloud.”

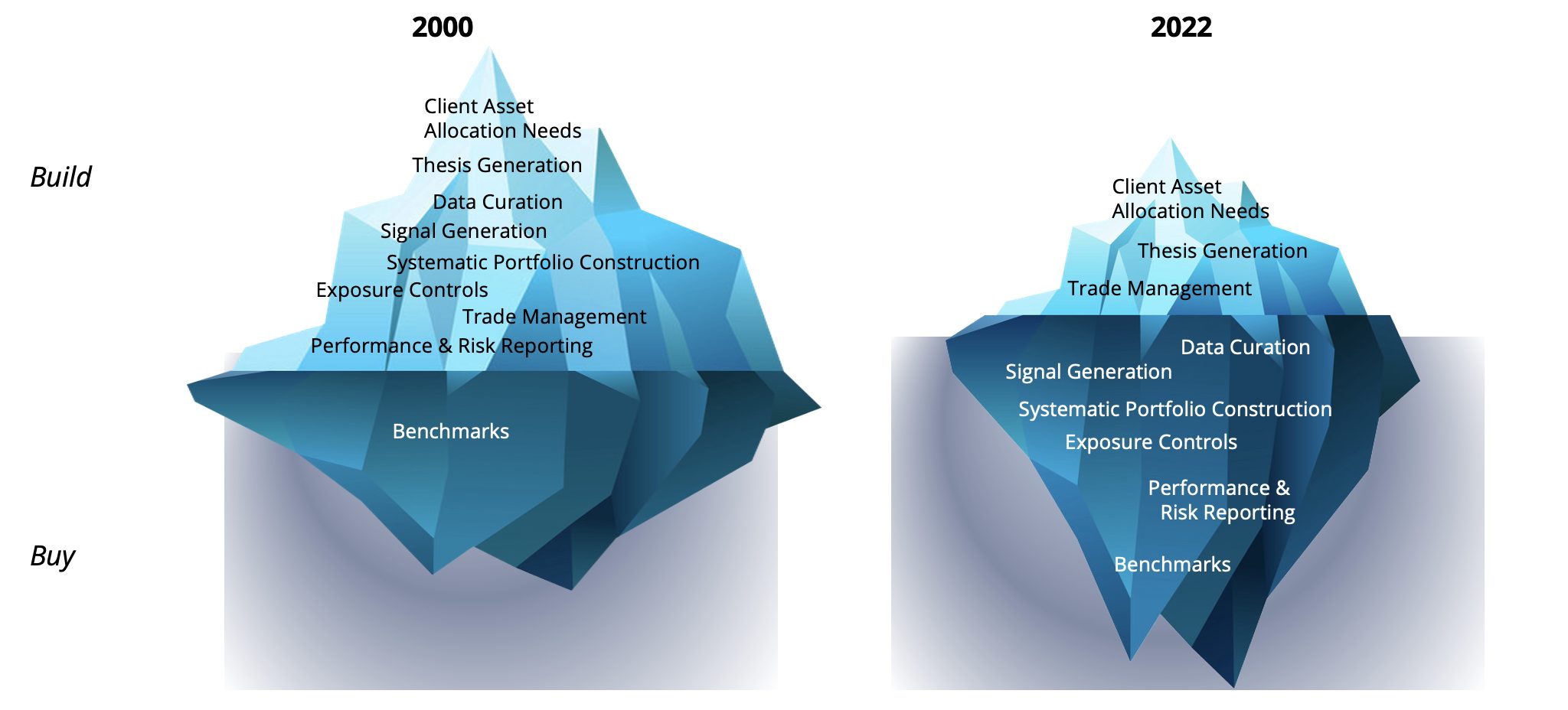

The evolution of the index

Commoditization has also impacted financial products, with indices being a good case study. Index fund managers have gotten more sophisticated over the years, as have the index products they track. Benchmarks will always have their place, but as the industry moves to more complex portfolio construction and alternative sources of beta, clients are looking to take a thesis and build it with their own data and models, while leveraging the index provider partner to pull it all together in a compliant and transparent manner.

STOXX and DAX are able to do this today using the same analytics and portfolio construction tools that Axioma makes available to its hedge fund, asset manager and asset owner clients. Qontigo combines the STOXX and DAX index offering with Axioma’s risk and analytics solutions.

“You can go all the way and buy an ETF which is based on one of our indices,” said Pawar. “Or you can customize your goals, buy an optimizer and factors and put them inside your engine. And make all that in a very short time-to-market.”

Using the iceberg analogy again, Figure 2 shows the activities a fund manager can purchase as a service from index providers in 2022, compared to the world in 2000.

Figure 2: The evolution of buy vs. build for fund managers

The new framework

This new services ecosystem is made of products that are connected yet loosely coupled, Pawar explained. It works best with cloud-native vendors that are API-first, meaning their infrastructure is accessible and extensible, and that run an open architecture through which the client can obtain and integrate the third-party data of their choice.

Loosely coupled systems lead to more competitive products and services, but more importantly, they allow for changes, improvements and upgrades in a far more efficient manner as opposed to homegrown, monolithic application architectures.

“You can bring new datasets in and play around with them without having to worry,” said Pawar. “For asset managers, a more flexible ecosystem means they can develop cheaper products and services faster, and more efficiently.”

Pawar concluded by recommending that his listeners think about what is already commoditized in what they are doing — and then to buy more of those products, while focusing on building proprietary capabilities in areas where they can make a difference.

“What are your differentiators?” he said. “That’s really where you want to put your firepower.”

1 Qontigo’s Investment Intelligence Summits took place in London on May 5 and in New York on May 19.