Last Month, Qontigo unveiled its expanded family of sustainability indices, with two new index families specifically designed for the increasing pool of investors who want to maximize their portfolios’ ESG profile while minimizing any deviation from benchmarks.

As the pool of ESG-governed assets continues to grow, many investors are setting an objective of obtaining the highest level of sustainability for a given level of risk or, alternatively, getting the minimum possible risk for a desired level of sustainability. This exercise in portfolio efficiency adds to the traditional tradeoff between the two pillars of risk and returns. Today, ESG impact has become a third, non-financial pillar in portfolio management.

The STOXX and DAX ESG Target Indices form one of two index families designed with that ESG efficient-frontier premise in mind. The indices optimize the tradeoff between ESG score and benchmark tracking error via transparent quantitative techniques.

Exclusions and optimization

The ESG Target indices are derived from benchmarks and firstly apply a set of compliance, product involvement and ESG performance exclusionary screens until only the 80% top ESG-rated constituents from the starting universe remain. From that selection pool, the indices implement an optimization process to maximize the overall ESG score of the portfolio subject to a number of constraints.

Those constraints rely on Axioma’s risk models and include an ex-ante tracking error limit to the benchmark of 1.5%, a maximum cap on quarterly turnover, and limits to active country and industry exposures. This ensures the portfolio’s return will not stray too far from that of the underlying benchmark.1

DAX ESG Target Index

Part of this family, the DAX® ESG Target Index aims to provide an optimized ESG alternative to Germany’s flagship DAX® that additionally reduces the portfolio’s carbon intensity by at least 30% relative to the benchmark. The index underlies since May 20 an exchange-traded fund managed by BlackRock.

The DAX ESG Target Index first undergoes a series of exclusionary screens for global standards, controversial weapons, tobacco, thermal coal, military contracting, small arms, nuclear power and oil sands.2 Removed stocks are replaced by the largest stocks in the broader HDAX® index that also have the highest ESG scores.3 Unlike other ESG Target indices, there is no removal of companies based solely on low ESG scores. The optimization weighting process is then applied.

A new whitepaper4 from Melissa Brown, Managing Director, Applied Research at Qontigo, examines the performance and characteristics of the DAX ESG Target Index in terms of risk, return and impact.

In backtested data since 2012, the DAX ESG Target has, by design, produced a higher ESG score than the DAX and has reduced the portfolio’s carbon emissions by a margin that surpasses the 30% aimed for. Until here, the results are in line with what one may expect. However, as Brown writes, any ESG Target index “is also a portfolio for which the optimizer has effectively traded off industry and style factor risks, taking into account their individual volatilities and the correlations between them.”

Optimization is widely used by professional investors to construct portfolios that maximize efficiency, Brown writes. “Optimization is a fancy word for a methodology that allows us to consider virtually all combinations of assets and discover which one will give us the highest level of sustainability for our desired level of risk or, alternately, minimize the risk for our desired level of sustainability,” she says. “It assures us there is no ‘better’ possible portfolio that will attain these goals. By taking into account the return expectations for and volatility of each asset, plus the correlation between them, optimization can very quickly determine the outcome of thousands (or millions) of combinations of assets.”

Study results

In the DAX ESG Target’s case, the optimization has led to the index taking very small bets on individual style factors, Brown’s study found. There are a few industry exposure differences to the benchmark, a result of the deletions/additions and under/overweighting.

Overall, during the study’s period the optimizer achieved its main goal of improving the portfolio’s ESG profile and reducing the carbon emission, all while limiting the active risk. Importantly, the portfolio has also outperformed the benchmark.

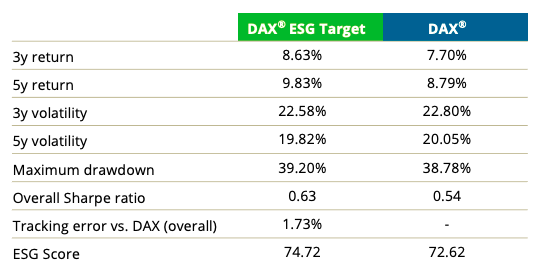

In backtested data for the past five years, the DAX ESG Target Index has produced an annualized return of 9.83%, 104 basis points more than the benchmark DAX (Figure 1). Over rolling one-year periods, realized tracking error has hovered between 1% and 2% most of the time, and over rolling three-year periods active risk has been consistently very close to target.4

Figure 1 – Risk and return characteristics

Risk exposures

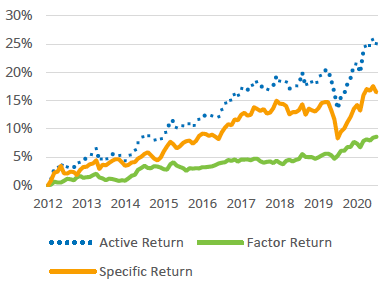

The DAX ESG Target’s outperformance has been consistent, too, with the notable exception of the COVID-19-induced sell-off in early 2020. Figure 2 shows the DAX ESG Target’s active return in a dotted line. ‘Specific returns’ refers to the idiosyncratic component from each stock’s return that can’t be explained by a style factor. The study shows that the DAX ESG Target’s exposure to specific risks consistently outweighs its exposure to factor risks.

Figure 2 – Portfolio’s active return and major drivers

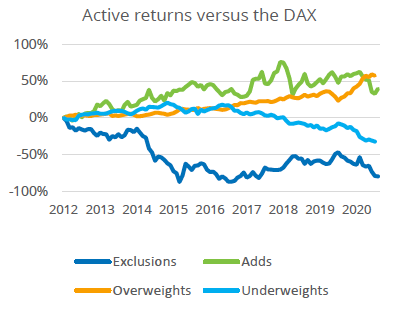

Brown’s analysis also uncovers the accretive impact of replacing portfolio constituents through an ESG lens, supporting the idea that companies with more sustainable profiles and operations tend to outperform.

Added and overweighted stocks in the DAX ESG Target Index have, as a group, outperformed the flagship DAX index since 2012 (Figure 3). Underweighted stocks slightly outperformed during the first five years but reversed the outperformance in the ensuing years. Over the full period, the stocks excluded from the index underperformed, but that underperformance was concentrated in the first three years of the test period.

Figure 3 – Returns by strategies in DAX ESG Target relative to DAX

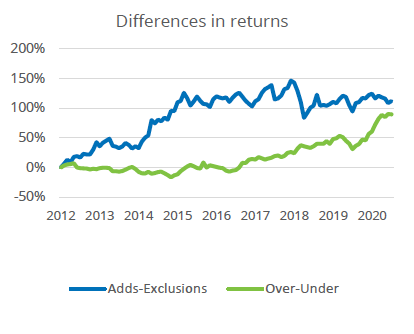

Next, Figure 4 shows the difference in returns between the additions and the exclusions in the DAX ESG target relative to the DAX, and between the overweights and underweights. Here, the additions-vs.-exclusions pair also performed well in the first three years of the test period, but performance has since been flat. On the other hand, the reweighting of portfolio constituents (the result of the optimization) has produced more consistent results since 2015.

Figure 4 – Performance of additions and overweights vs. exclusions and underweights

Managing the path to optimal results

The optimization of ESG portfolios appears as an effective mechanism for investors to maximize impact and avoid material risk deviations from benchmarks. Additionally, data show that enhancing the ESG profile of the portfolio can also generate higher returns. In controlling the three pillars of risk, returns and sustainability impact, investors can better manage their trajectory to optimal results.

1 Qontigo has also introduced the STOXX ESG Target TE (Tracking Error) Indices, which follow a similar overall approach to the ESG target Indices, but the optimization’s objective function is to minimize tracking error to the benchmark, while imposing a constraint on ESG profile improvement.

2 Baseline exclusions for the DAX ESG Target Index include the Global Standards Screening and controversial weapons. Product Involvement exclusions include tobacco production (0%), tobacco suppliers/distributors (5%), thermal coal extraction (5%), thermal coal power generation (5%), military contracting weapons (5%), weapons-related products and services (5%), small arms (0%), small arms retail/distribution (5%), nuclear power generation and distribution (5%), nuclear power supporting products and services (5%) and oil sands extraction (5%).

3 Starting with the largest HDAX companies in terms of free float market capitalization, a company is included in the DAX ESG Target index if it has the same or better ESG rank than the DAX Regular Exit ‘candidate rank’ for free float market capitalization (see Section 4.1.1.3 of the Guide to the DAX Equity Indices).

4 Brown, M., ‘Risk, Return and Sustainability: Qontigo ESG Target Indices Provide an Optimal Solution,’ Qontigo, May 2021.