Factor investing has gained enormous traction in recent years as a transparent and low-cost way to exploit widely-acknowledged sources of market-excess returns, so-called risk premia.

To complement our continuous effort in that space we have launched the EURO STOXX® Multi Premia® and Single Premium Indices, which integrate the academic research-based Multi Premia® methodology developed by Finreon, a spin-off from University of St. Gallen in Switzerland.

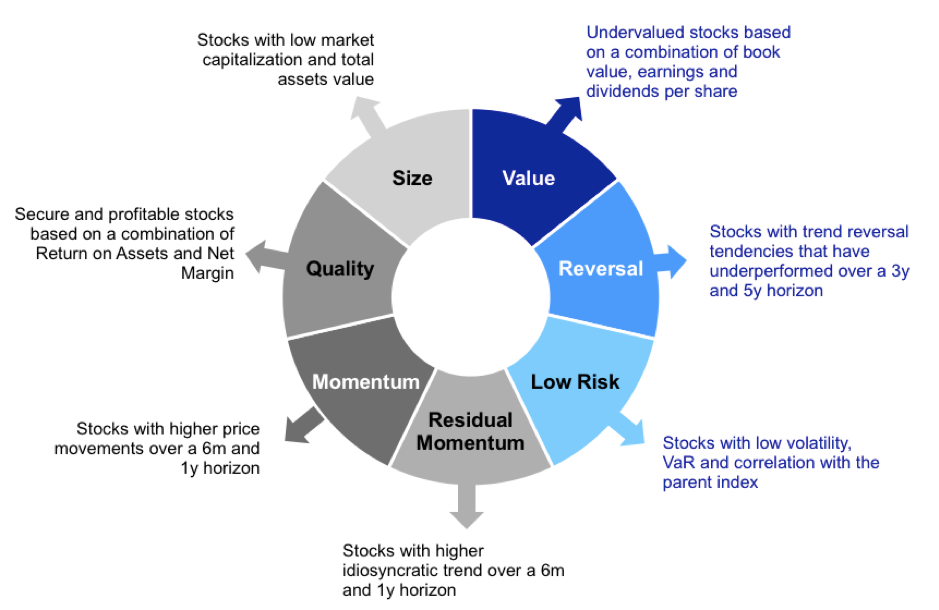

The indices track seven distinctive sources of equity risk and returns: value, reversal, low risk, residual momentum, momentum, quality and size (Graph 1), on the broad and liquid universe of Eurozone equities that is the EURO STOXX® Index.

Proven track record

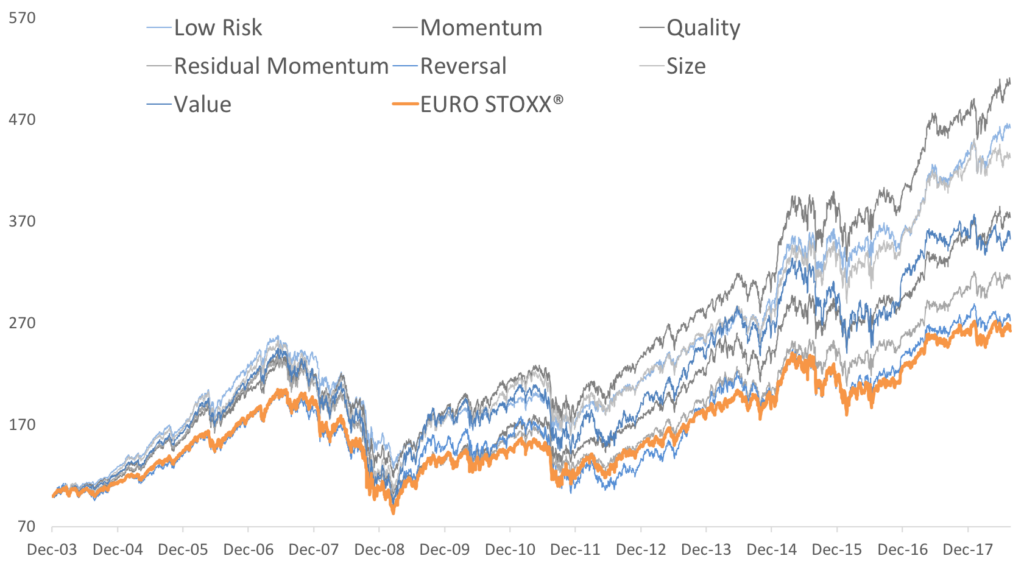

Testament to their well-researched drivers, all single risk premia have demonstrated their prowess in producing market-beating returns. Chart 1 shows the performance of the seven single premium indices since their data starts in 2003, against the EURO STOXX® Index, which is trailing all factor strategies in the period.

Chart 1 – Single Premium Indices and EURO STOXX®.

Uncorrelated premia help overall returns

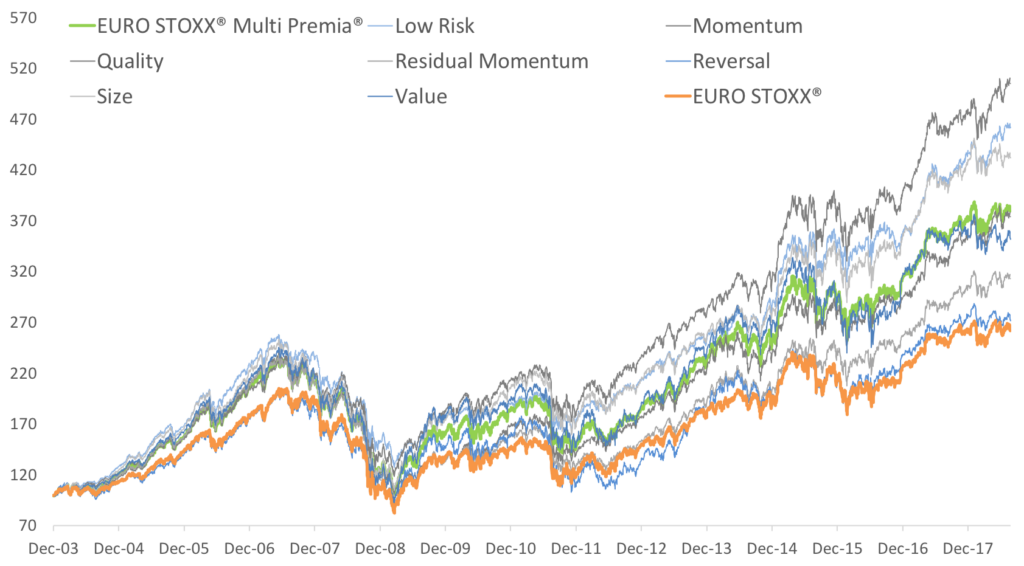

Because risk premia fluctuate significantly over time, their performance varies and there can be periods of underperformance. This problem can be addressed by combining the individual sources of returns, exploiting their low correlation and the power of diversification.

For that purpose, the Single Premium Indices suite is complemented by the EURO STOXX® Multi Premia® Index, a cutting-edge multi-factor strategy that provides a blend of risk premia sources that leads to consistent outperformance of the benchmark throughout market cycles. The portfolio is constructed with a focus on relative and absolute risk, and on tradability.

A diversified investment in a balanced set of factors allows the EURO STOXX® Multi Premia® Index to harvest the average factor return at significantly reduced risk. The resulting average tracking error is significantly lower than the average of the individual EURO STOXX® Single Premium Indices.

Chart 2– Expanding Chart 1 by adding the EURO STOXX® Multi Premia® Index.

A construction process that minds tracking error

A systematic, three-step portfolio construction process is used to create the EURO STOXX® Multi Premia® Index.

Firstly, for each of the seven risk premia, stocks are selected using academically founded and widely recognized criteria. An aggregated score is calculated for each factor, and is used as the basis to select the top third of stocks to be included in each individual risk-premium portfolio.

The weighting of the stocks is determined by a risk-parity approach, whereby each constituent contributes equally to the overall risk of the portfolio. There are weighting caps in place for individual stocks, as well as country and sector constraints to avoid cluster risks.

Finally, the seven individual portfolios are aggregated using an ‘equal contribution to tracking error’ optimization to ensure broad diversification. Thus, each individual factor contributes equally to the overall risk.

Transparent and low cost

With smart beta gaining ground among investors, the EURO STOXX® Single Premium and Multi Premia® indices stand out for their academic-based multi-premia methodology within the European universe. They are part of the broad move towards passive investments, which have gathered assets seeking transparency and low cost.

Credit Suisse Asset Management (Switzerland) Ltd. is first to launch an index fund tracking the EURO STOXX® Multi Premia® Index.

With the most current research tools to extract risk premia returns, the EURO STOXX® Single Premium and Multi Premia® Indices lay a powerful foundation for potential stable outperformance in the long term.

Featured indices