A recent white paper1 from Qontigo’s Applied Research team investigated just how efficient an inflation hedge real estate is, by looking at the relationship between an industry index and inflation expectations in the US, UK and Europe.

In a new study2, the team has now turned its focus to the relationship between real-estate stocks and bond term spreads, which have widened in the past three years as long-term sovereign yields soared amid accelerating inflation while central banks were slower in raising short-term interest rates.

The study, again, focuses on the iSTOXX® Developed and Emerging Markets ex USA PK VN (‘Intl.’ Real Estate Index’)3. Authors Diana R. Baechle and Christoph Schon use Axioma’s Macroeconomic Projection Model to unpick term spreads as a risk factor and its contribution to index returns.4

A key finding is that the Intl.’ Real Estate Index has not been equally exposed to all regions’ term-spread factors, and even within one region that exposure can vary over a given period. For example, the index has mostly had a negative exposure to term spreads in Europe since 2019 (a widening of the term spread in that region would negatively impact the index’s returns), although that changed in 2021. Throughout the entire period (2019-2022), the index has largely had a positive exposure to the US term spread, as the US yield curve steepened.

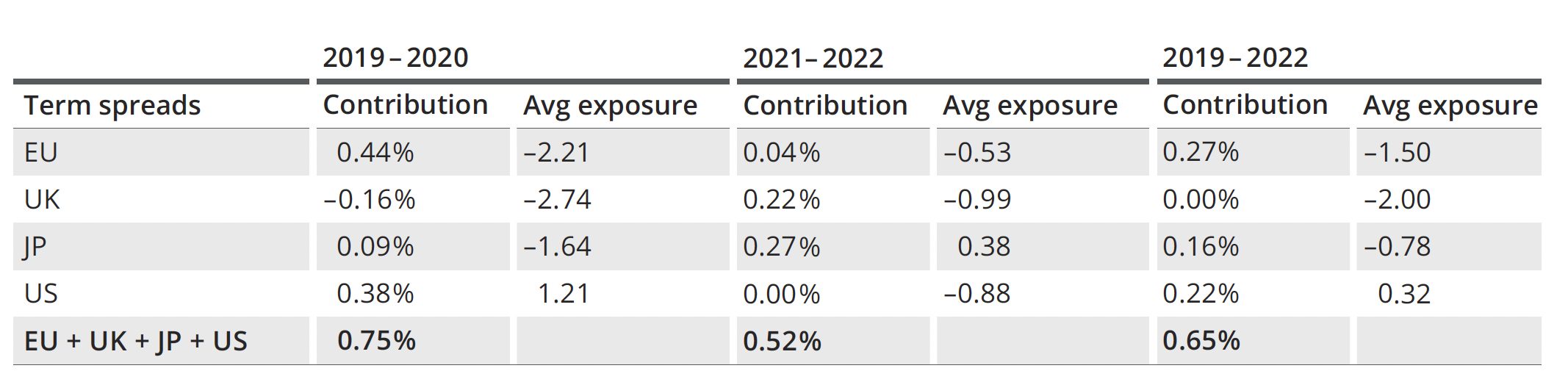

The exposures to the US, European, UK and Japanese term-spread factors, combined with the performance of these factors, give us the contribution of each factor to the index’s return.

Overall, the upward trend in term spreads globally over the past few years has positively impacted the real-estate index’s returns thanks to the ‘right’ exposures to the term-spread factor, as Figure 1 shows. The table also makes it clear that in some regions the factor detracted from returns. It also shows how moves in bond yields significantly changed the yield-curve backdrop when comparing the 2019-2020 period to 2021-2022.

Figure 1: Average Intl.’ Real Estate Index’s exposures to regional term-spread factors and their contribution to index returns

The white paper explains in detail the various drivers behind the move in term spreads in each period and region.

2022 regime

The study may prove of interest at a time when short-term rates are rising in some regions as central banks step up their fight against inflation, while long-term rates drop on concern that the various economies may fall into a recession. A portfolio’s exposures to these yield curve dynamics may inform investors what to anticipate in such an environment of tightening term spreads.

“Given the current negative exposures of the Int’l Real Estate Index to EU, UK and US term spreads, further declines in the corresponding factors should continue to have a positive impact on returns,” write the study’s authors. “We think this is likely since Western central banks will continue to raise rates aggressively, whereas further rises in long-term yields will be curbed by geopolitical concerns and worries about the impact of higher rates on economic growth.”

Of course, term spreads are just one factor affecting index performance, as the authors note. The prospects for real-estate stocks will also be influenced by other macroeconomic considerations (including economic growth and inflation), as well as by country, industry and currency effects.

We invite you to download the white paper and read more about its findings.

1 Baechle D., ‘The International Real Estate Index — A hedge against expected inflation,’ Qontigo, June 2022.

2 Baechle D., Schon, C. ‘Term spread effects on the International Real Estate Index,’ Qontigo, June 2022.

3 The iSTOXX® Developed and Emerging Markets ex USA PK VN Real Estate Index represents the real-estate sector in developed and emerging markets excluding Pakistan, the US and Vietnam.

4 The term-spread factor in the Macroeconomic Projection Model captures the sensitivity to daily changes in the differential between 10-year and 6-month government bond yields, available for four regions.