Qontigo has introduced the iSTOXX® Global Blue and Green Economy Select 50 Index, which tracks low-volatility and high-dividend companies that show the highest environmental standards.

These companies have set up policies and practices to minimize harm, control risk and limit their impact on waters (‘blue’), land (‘green’) and the broader ecosystems. Components in the iSTOXX Global Blue and Green Economy Select 50 Index are selected based on ESG key performance indicators (KPIs), while companies involved in activities deemed controversial from a sustainability point of view are excluded.

Protection of the environment has become a top objective within responsible-investing portfolios, and is considered a key campaign to accomplish other principles such as climate action and societal goals. In a recent blog post, we explored why biodiversity is a focus for investors and why efforts to halt nature loss are set to accelerate further this year.

Do no harm to the environment

The initial universe of the iSTOXX Global Blue and Green Economy Select 50 Index is the STOXX® Developed and Emerging Markets Total Market Index. Index components are selected based on 20 ESG KPIs compiled by Sustainalytics that look at if and how companies consider ways to limit their impact on the environment. The KPIs include environmental policy, water intensity, biodiversity programmes, green logistics programmes and eco-design. For a full list, please visit the index rulebook here.

Companies with a score of 0 in at least one of the indicators are excluded. Assessment of these KPIs does not apply for all industries, and for certain companies some of the indicators are not applicable and hence ESG research is not available. Those companies are therefore exempted from analysis in said fields. It is also important to note that companies with high ESG scores are not given selection priority nor a larger weight in the index. The idea is to choose companies with a minimum standard of quality across all KPIs, rather than the leaders.

ESG negative screening

Companies are also excluded if they fail to pass Sustainalytics’ Global Standards Screening (GSS). Additionally, those determined to be involved in the following industries or products are also removed: controversial weapons, weapons including small arms and military contracting, adult entertainment, gambling, unconventional1 and conventional oil & gas, thermal coal, nuclear power2 and tobacco.

Applying the volatility and dividend filters

The final step in the composition list applies two screens that are common to all STOXX Select indices.

Firstly, eligible companies are sorted in ascending order in terms of their volatility and the least volatile stocks are pre-selected. These are then ranked in descending order based on their historical dividend yield. The top 50 stocks in the pre-selection list are picked for inclusion, applying country and industry constraints to foster diversification. Index member weights are calculated based on the inverse of their historical volatility.

These last two screens of price volatility and dividend yield are characteristics that have proved popular with issuers of structured products as they bring down the price of packaging the securities.

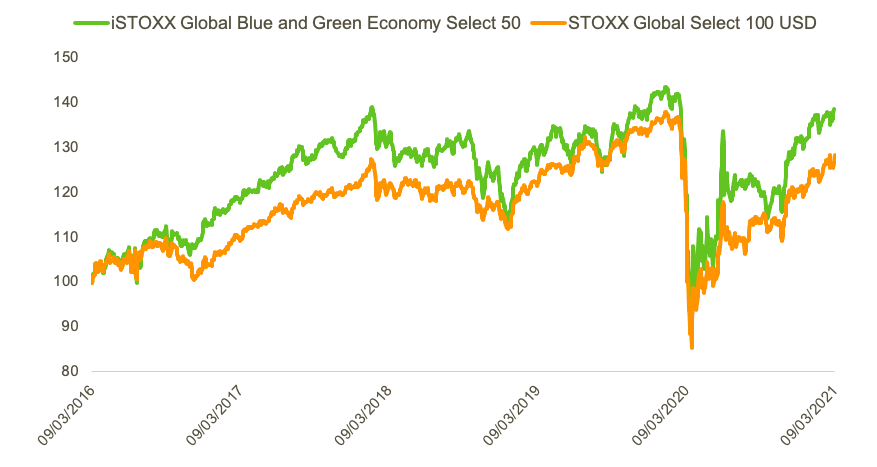

Exhibit 1 displays the performance of the Blue and Green Economy Select index against the STOXX® Global Select 100 USD Index, a benchmark that also follows a low-volatility/ high-dividend-yield strategy. The environment-focused index has returned 10 percentage points more than the Global Select 100 index over the past five years.

Exhibit 1 – 5-year total returns

The power of ESG indices to support change

Passive investing has been at the forefront of ESG methodologies among asset managers. Qontigo has innovated with a series of indices that form its sustainable ecosystem and that help investors construct portfolios in an efficient, clear and rules-based way, while observing their guiding principles. The new iSTOXX Global Blue & Green Economy Select 50 Index adds to that rich offering, allowing investors to align with a theme that is of high priority for our world.

1 Includes Arctic oil and gas exploration, oil sands and shale energy.

2 Thermal coal exclusions cover the following: companies with over 25% of revenue from either nuclear power production, nuclear power supporting products and services, or nuclear power distribution.