Qontigo has introduced versions of the STOXX® Factor Indices, which rely on Axioma’s proven factor models, that keep the same industry allocation as the respective benchmarks. As such, the new indices provide further choices for investors looking to remove unintended industry exposures and access the ‘pure’ return of the factor.

The STOXX® Industry Neutral Ax Factor Indices implement the same methodology of the STOXX Factor Indices while reducing the active industry1 constraint from +/- 5% to near neutral. In all but eliminating the overall industry deviations, the STOXX Industry Neutral Factor Indices may sacrifice some factor exposure, but benefit from targeting lower levels of active industry risk and avoiding potential performance drag from industry returns.

Qontigo introduced its first global family of STOXX factor-based indices in January 2020. The indices are built using commercially accepted and institutionally tested factor definitions and Axioma’s advanced portfolio-construction tools and risk models. The STOXX Factor Indices target high exposures to proven sources of excess returns and, as well, manages liquidity and unintended risk exposures.

Historically above-market returns

Factor-based investing has a long history and has become one of the most popular indexing segments in recent years. These products aim to capture sources of risk premia in a systematic process, relying on equity characteristics to determine index compositions in a transparent and cost-efficient way. While 2020 was a relatively difficult year for factor investors, hurt by the underperformance of the Value factor in particular, the strategy remains a core holding for many institutional and ETF investors alike.

A whitepaper2 published last year describes the key principles behind the indices’ construction and explores the sources of their returns in recent years. The study is available here.

Comprehensive regional coverage

The STOXX Industry Neutral Factor Indices are derived from two market-capitalization regional benchmarks:

The suite consists of five single-factor indices for each region — Value, Momentum, Size, Low Risk, and Quality — and a Multi-Factor index that targets exposure to all five factors. The indices maximize the exposure to the target factor while constraining the exposure to non-targeted factors.3

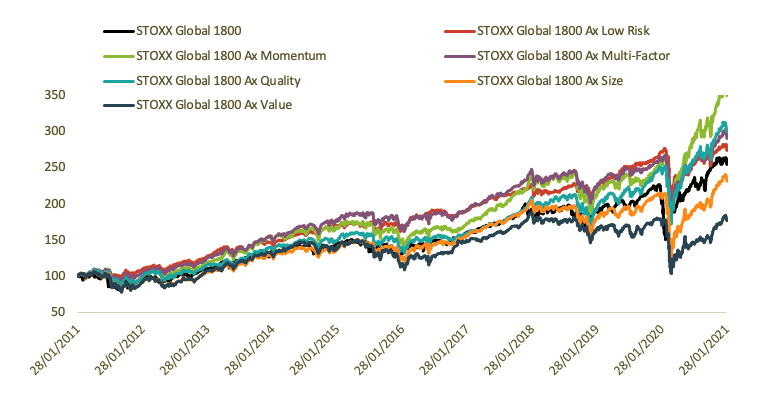

These factor definitions follow the standards found in academic and practitioner literature, and were chosen for their clear economic rationale and empirical outperformance over the long term. In the past ten years, four of the six styles tracked by the STOXX Factor Indices have outperformed the benchmark, which is shown with the black line in Exhibit 1. This suggests that factor-targeted strategies can extract premia but also that certain styles can be out of favor during extended times.

Exhibit 1 – STOXX Factor Index performance since 2011

The indices are constructed to be transparent and robust, and are supported by the use of high-quality data analytics to verify historical exposures.

All STOXX Factor indices have single-stock weight caps and the effective number of constituents is set to represent at least 30% of that of the benchmark to ensure adequate diversification. Besides the industry weighting limitations discussed earlier, they cap the country exposure deviation from the benchmark at 5% and limit the tracking error to a maximum of 5%. Additionally, they employ other liquidity, turnover and tradability thresholds, as well as limits on exposures to untargeted factors.

Return analysis of the Industry Neutral Factor indices

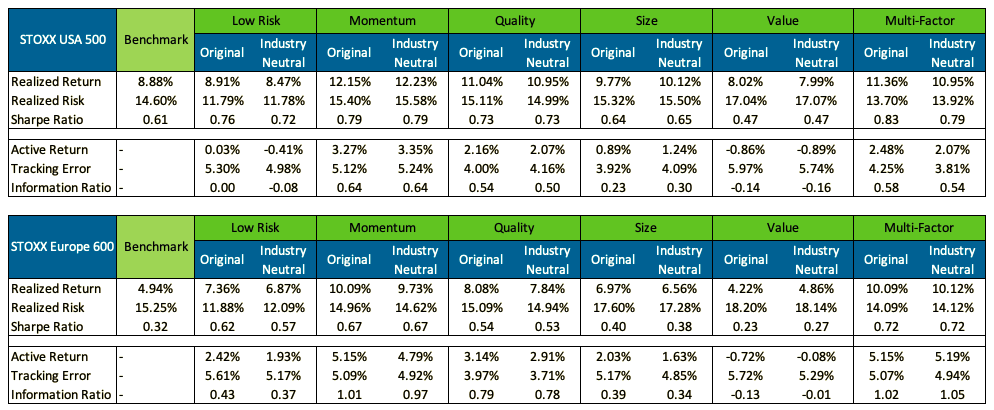

Exhibit 2 displays the returns and realized risk for the standard Factor and new Industry Neutral Factor indices derived from the STOXX Europe 600 and STOXX USA 500 benchmarks.

Exhibit 2 – Annualized risk and return analysis since start of 2002 for STOXX Factor and Industry Neutral Factor indices

In both the STOXX Europe 600 and STOXX USA 500, four of the six standard Factor portfolios outperformed their Industry Neutral versions in the period analyzed. The average difference between the 12 pairs was 11 basis points. The maximum spread, however, was 64 basis points in favor of the STOXX® Europe 600 Industry Neutral Ax Value Index relative to the STOXX® Europe 600 Ax Value Index.

In terms of risk, there is no clear trend. The standard Factor Indices covering the US market appear to have been slightly less volatile on average than the Industry Neutral brethren, while the inverse is true for the European portfolio. One would expect that restricting industry exposures would add an additional layer of active risk management, as it avoids the potential impact of big relative industry moves. This was not always the case, as realized tracking error was lower for just three of the six US industry-neutral indices, and for all the European ones.

It is also interesting to note that the Multi-Factor indices in both the US and Europe produced higher Sharpe ratios than their single-factor peers. In Europe the industry-neutral Multi-Factor index also produced the highest information ratio, although in the US that honor went to both momentum portfolios.

Factor clarity

To help investors visualize factor exposures and target benchmark tracking, Qontigo last year launched Factor iQTM – an online tool designed to illustrate current factor portfolio exposures according to Axioma’s risk models.

Analytic and indexing prowess

By employing well-established factor definitions and transparent index construction rules, the STOXX Factor Indices set a high industry standard. The new industry-constrained versions broaden the opportunity and flexibility for investors to access and exploit factor exposure.

Explore the new indices here:

STOXX® Europe 600 Industry Neutral Ax Value Index

STOXX® Europe 600 Industry Neutral Ax Size Index

STOXX® Europe 600 Industry Neutral Ax Quality Index

STOXX® Europe 600 Industry Neutral Ax Multi-Factor Index

STOXX® Europe 600 Industry Neutral Ax Momentum Index

STOXX® Europe 600 Industry Neutral Ax Low Risk Index

STOXX® USA 500 Industry Neutral Ax Value Index

STOXX® USA 500 Industry Neutral Ax Size Index

STOXX® USA 500 Industry Neutral Ax Quality Index

STOXX® USA 500 Industry Neutral Ax Multi-Factor Index

STOXX® USA 500 Industry Neutral Ax Momentum Index

STOXX® USA 500 Industry Neutral Ax Low Risk Index

1 Industry classification used is ICB level 1.

2 Qontigo Applied Research, ‘STOXX Factor Indices: Targeted Factor Exposures with Managed Liquidity and Risk Profiles,’ January 2020.

3 The STOXX Industry Neutral Ax Factor indices are available in price, net return and gross return versions, in EUR and USD.