Qontigo and Mitsubishi UFJ Trust and Banking Corporation (MUTB) have jointly designed the iSTOXX® MUTB Japan Low Carbon Risk 30 to help investors align portfolios with Japan’s ambitious plan to decarbonize its economy by 2050.

The iSTOXX MUTB Japan Low Carbon Risk 30 Index tracks the performance of 30 Japanese securities from the iSTOXX® MUTB Japan Quality 150 Index that have the best profile in terms of carbon emissions exposure and carbon risk management, as measured by Sustainalytics. The Low Carbon index will underlie an ETN to be listed by Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. (MUMSS) on the Tokyo Stock Exchange on March 22. Mitsubishi UFJ Securities Holdings Co., Ltd. (MUSHD) is the issuer of the note.

Selection process

The composition of the iSTOXX MUTB Japan Low Carbon Risk 30 Index starts with the iSTOXX MUTB Japan Quality 150 Index, a six-year-old index that provides exposure to Japanese companies with high profitability, low leverage and sustainable cash flows. Companies that are non-compliant with the Global Standards Screening (GSS) or are involved with Controversial Weapons, as identified by Sustainalytics, are removed. From there, the 30 securities with the best (lowest) Carbon Risk Rating scores are selected, with a maximum of ten companies from each one of the eleven ICB Industries.1 Securities are equally weighted.

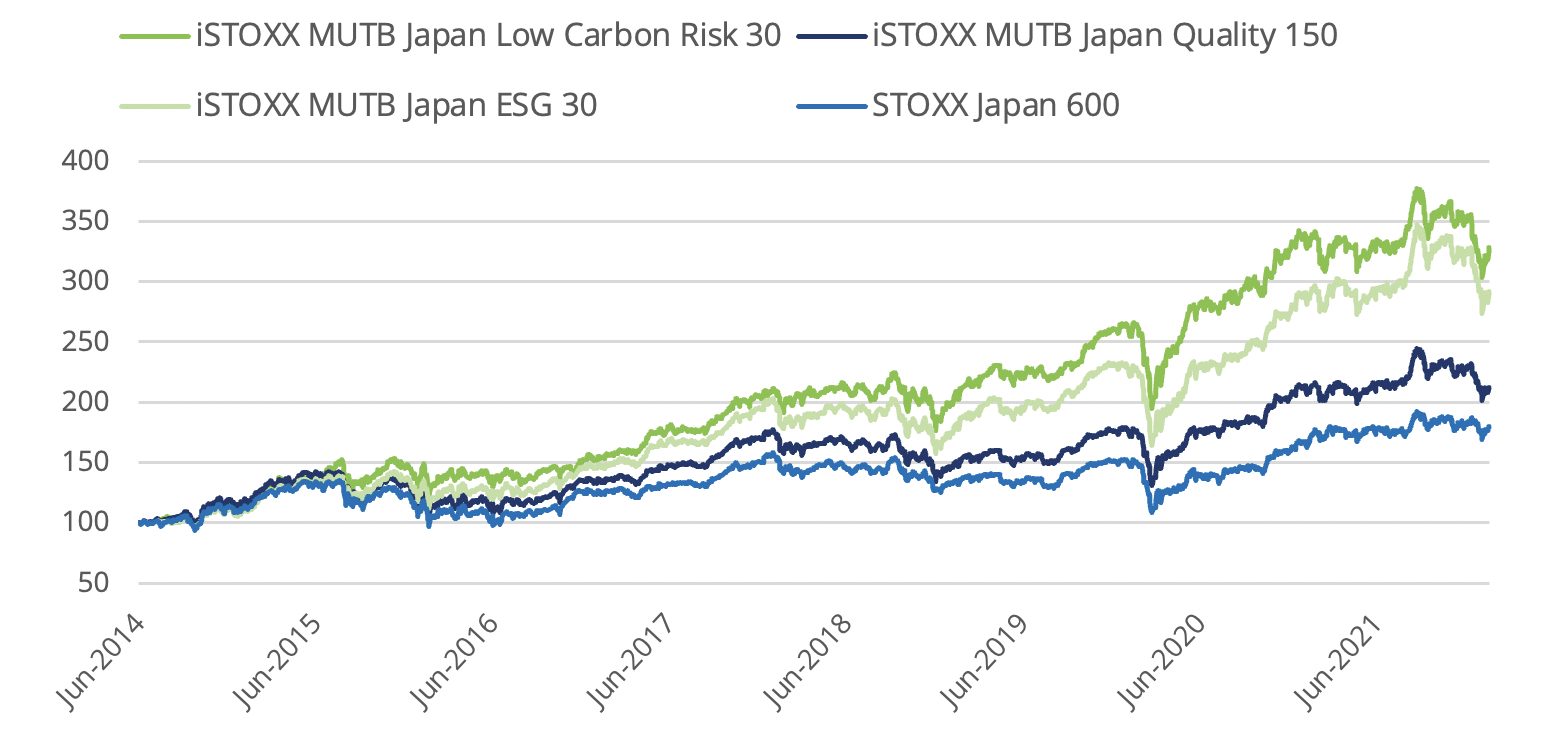

The combination of a quality factor and a low-carbon filter has proved to be a powerful driver of performance. Figure 1 compares the returns since June 2014 of the iSTOXX MUTB Japan Low Carbon Risk 30 Index against those of its parent universe and of the iSTOXX® MUTB Japan ESG 30 Index, which has a quality and sustainability focus but no low-carbon screening. Also featured in the chart is the market-cap-weighted benchmark STOXX® Japan 600 Index.

Figure 1: Comparison of strategies

Carbon neutral by 2050

Former Prime Minister Suga Yoshihide presented in October 2020 the government’s objective to reach net-zero emissions by 2050 and to achieve a carbon-neutral economy. The government has kickstarted a long-term, multi-policy plan at the national and municipal levels, and across ministries, to transform energy consumption and decarbonize the industrial, business, household and transportation sectors. McKinsey has estimated that the transition to net zero in Japan will require a total investment of $10 trillion by 2050.2

Investors are adopting low-carbon strategies to manage portfolio risks and opportunities from a world on a decarbonization path. While some companies will benefit from the transition to carbon neutrality, many others face liabilities, including carbon taxes, decommissioning of plants, repricing of assets and prohibition of certain products. Sustainalytics’ Carbon Risk Ratings reflect these issues and how companies are managing them.

Growing collaboration for the Japanese market

Founded in 2010 as a joint venture between Mitsubishi UFJ Financial Group (MUFG) and Morgan Stanley, MUMSS offers investment banking and securities services. MUFG, a leading global financial services group and one of the largest banking institutions in Japan, is the parent company of MUTB, MUMSS and MUSHD.

The collaboration between STOXX and MUTB goes back to 2015, when the iSTOXX MUTB Japan Quality 150 Index was introduced. The index was conceived following then-Prime Minister Shinzo Abe’s push to enhance the corporate governance and shareholder returns of the country’s companies.

The partnership with MUTB has produced a comprehensive family of innovative indices that incorporate smart-beta and, increasingly, sustainability criteria. We look forward to deepening this collaboration and to designing solutions that help investors support action for a better, more responsible world.

1 In cases where more than one company has the same Carbon Risk Rating score at the 30th threshold preference is given to the company with the highest composite quality score as calculated for the iSTOXX MUTB Japan Quality 150 Index constituents.

2 McKinsey Sustainability, ‘How Japan could reach carbon neutrality by 2050,’ Aug. 4, 2021.