BlackRock has launched the iShares Lithium & Battery Producers UCITS ETF (LITM) in EMEA. The underlying index tracks companies with high exposure to the lithium industry through miners, compounds manufacturers and battery makers.

The STOXX® Global Lithium and Battery Producers index inaugurates a dual identification process to selecting stocks, involving revenue and patents. The index employs FactSet’s Revere (RBICS) data for a detailed breakdown of the revenue sources of eligible companies, capturing leading and specialized lithium miners and producers. Additionally, EconSight’s patent data is used to identify innovators in lithium battery technology. This unique dual approach yields diversified exposure to both established and pioneering industry players across the entire lithium value chain.

Companies that are non-compliant with the Global Standards Screening or display a Severe (Category 5) Controversy Rating, as identified by Sustainalytics, are excluded from the index.

The ‘big shovel’: Conductors powering the green revolution[1]

The brown-to-green revolution requires substantial amounts of metals such as lithium, copper, nickel, cobalt and aluminum, which are good conductors of heat and electricity, and are ductile and malleable. The minerals are enabling the structural boom in solar and wind energy and in electric vehicles (EVs) that’s unfolding as nations drop hydrocarbons. Under the International Energy Agency (IEA)’s Net-Zero by 2050 Roadmap, renewables may increase their share of power from 10% currently to 60% in three decades. Fossil fuels would shrink from almost 80% to about 20% over the period.

The race to extract lithium

Labelled the “white gold” because of the current rush to mine it, lithium is seeing exponential demand growth, mainly for its use in EV batteries, although the metal is also employed in renewable energy storage and cell phones. Innovation in battery technology is enabling faster, more efficient and more reliable powering, putting lithium producers and battery makers at the center of climate action efforts.

Lithium-ion batteries show several advantages over the traditional lead-acid batteries. The former typically have up to six times higher energy density, have a higher capacity use, a higher depth of discharge, charge in less than a quarter of the time, and last about five times longer. They also perform better in cold weather, making them more suitable for energy storage solutions.[2]

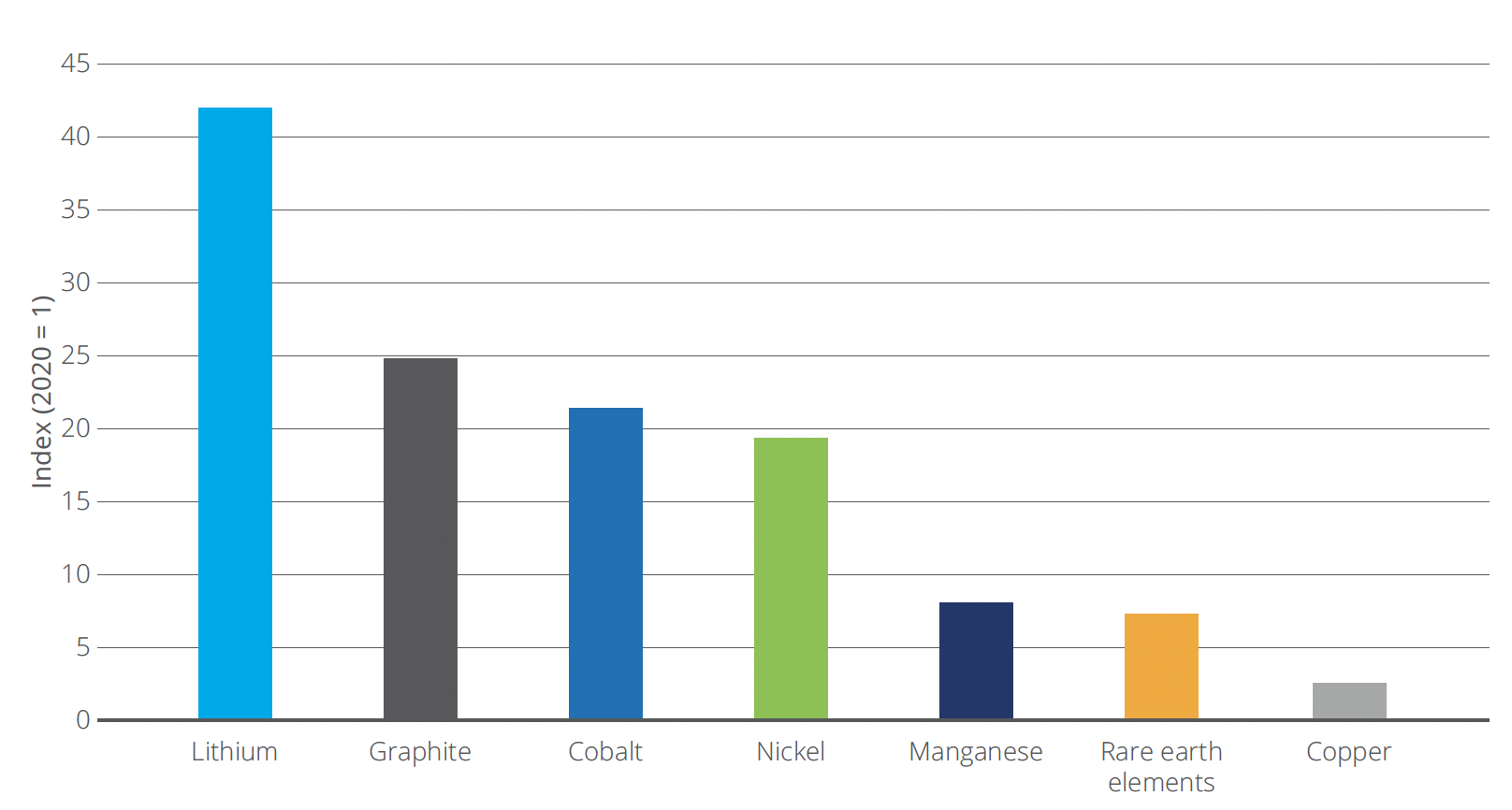

McKinsey estimates that by 2030 about 95% of lithium demand will come from EV batteries, up from 60% in 2022.[3] Sales of EVs (cars and light trucks) rose more than fourfold between 2020 and 2022, to a record 10 million.[4] MIT researchers have estimated that the global EV fleet could surpass 800 million units by 2050 if current Paris Agreement targets are maintained.[5] The IEA expects lithium shipments from clean energy technologies to grow more than 40 times between 2020 and 2040, the fastest increase among all transition metals (Figure 1).[6]

Figure 1: Growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020

However, lithium demand is far outstripping supply. BloombergNEF has estimated that, by 2040, the output shortfall will reach 5.2 million metric tons.[7]

Given the difficulty in starting new mines fast enough, lithium prices jumped tenfold between January 2021 and March 2023.[8] They have dropped in 2023 amid concern of a global recession and as China ended EVs subsidies, but analysts expect a supply shortage to lift prices once again.[9]

Index components

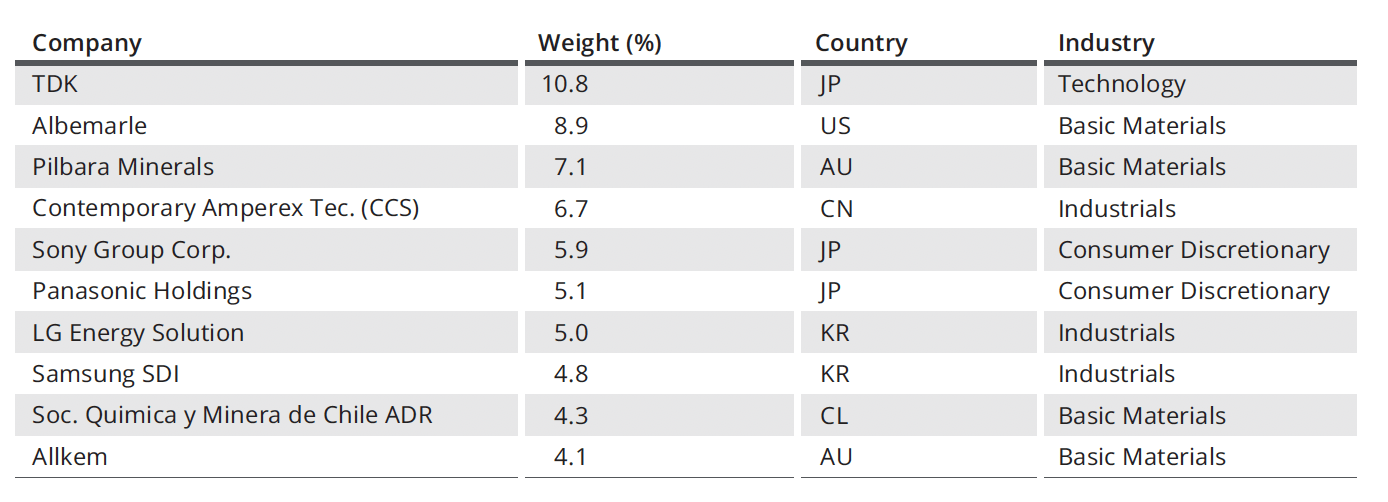

Figure 2 shows the main composition of the STOXX Global Lithium and Battery Producers.

Figure 2: Ten largest components

The patent-based selection in the lithium index captures active patents in the lithium battery sector. It assesses a company’s involvement in the theme through either high-quality patents or patent specialization, rather than a simple patent count.

Performance

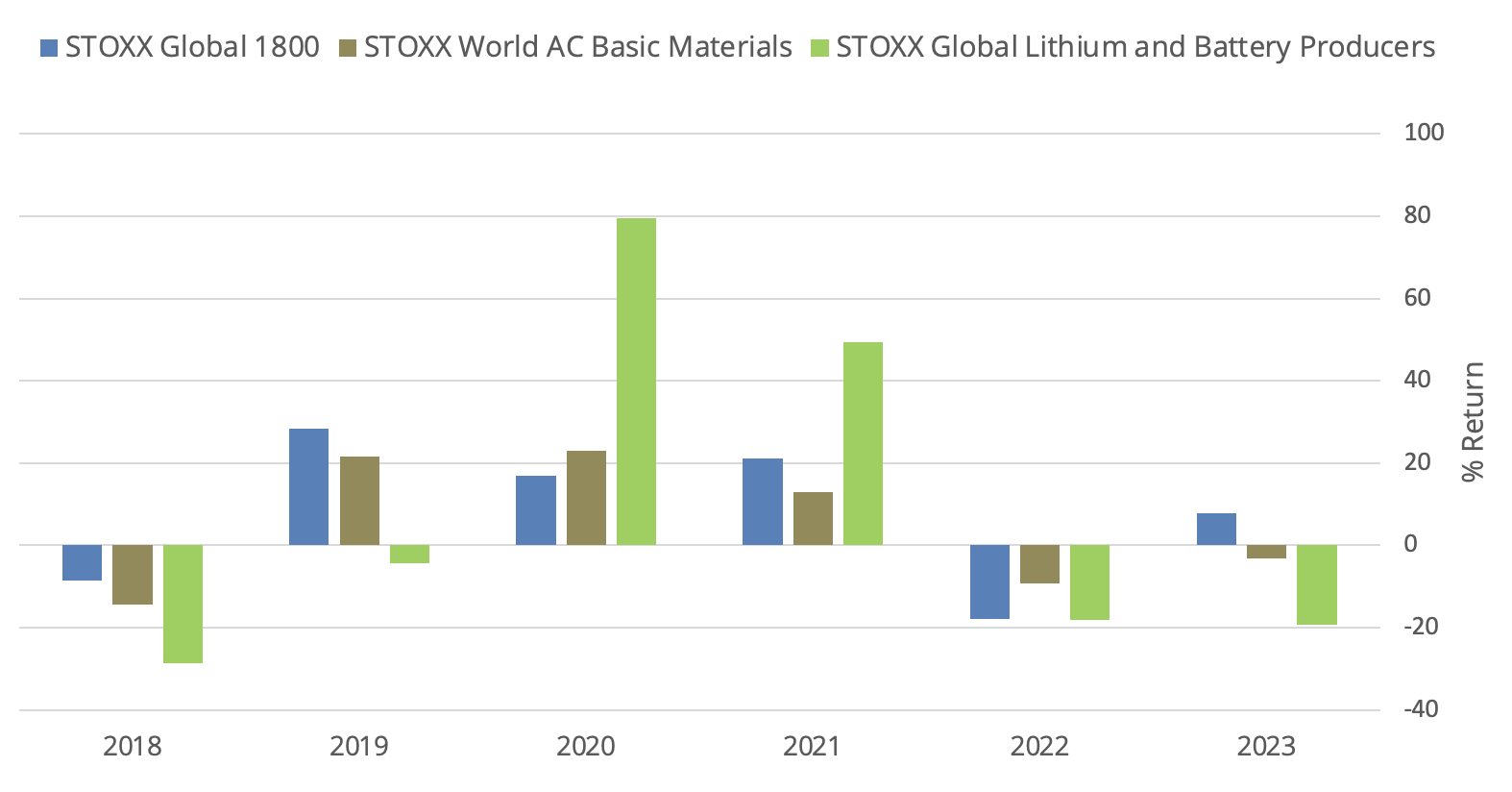

The STOXX Global Lithium and Battery Producers index has outperformed the STOXX® World AC index in backtested data over the past three and five years (Figure 3). The index has also beaten a broader benchmark of mining stocks, the STOXX® World AC Basic Materials, testament to the thematic index’s pure exposure to the energy transition metals growth story. As is intended with most thematic indices, the strategy is designed to capture long-term structural trends.

Figure 3: Index annual returns

Not enough raw materials

With countries across the world pressing ahead with policies to boost brown-to-green assets and meet net-zero goals, demand for climate transition materials and technology will remain exceptional. While the world is consuming more of energy transition metals year after year, the opening of new mines takes over 1.5 decades on average, a long process that will exacerbate current supply shortages. These constraints may well place the metals at the top of national and energy security issues, similar to what happened with oil in the 20th century.

The historical shift in the way the world consumes energy is having a deep impact in the minerals market and constitutes a long-term megatrend that can be captured through a well-designed thematic investment strategy. The STOXX Global Lithium and Battery Producers index covers an area of increasing investor interest, allowing them to tap the energy transition metals theme through the companies that stand to benefit most from growing demand.

[1] The “big shovel” was a phrase used by Daniel Yergin, a renowned energy expert, to describe the mining boom that will result from mining critical energy transition metals to power the shift from a fuel-intensive energy system to a sustainable one.

[2] See AutoZone, “Lead Acid Vs. Lithium-Ion Jump Starters;” energysage, “Lithium-ion vs. lead acid batteries: How do they compare?” and Skill-Lync, “Top 10 Differences between Lead-Acid Batteries and Lithium-Ion Batteries.”

[3] McKinsey & Co., “Battery 2030: Resilient, sustainable, and circular,” Jan. 16, 2023.

[4] IEA, “Global EV outlook 2023.”

[5] MIT, “Electrifying cars and light trucks to meet Paris climate goals,” Aug. 10, 2021.

[6] IEA, “The Role of Critical Minerals in Clean Energy Transitions,” May 2021.

[7] BloombergNEF, “Transition Metals Outlook 2023.”

[8] Source: Benchmark Mineral Intelligence.

[9] See, for example: Morningstar, “Lithium: We Expect Prices During This Decade to Remain Higher Than Market Valuations Imply,” June 1, 2023.