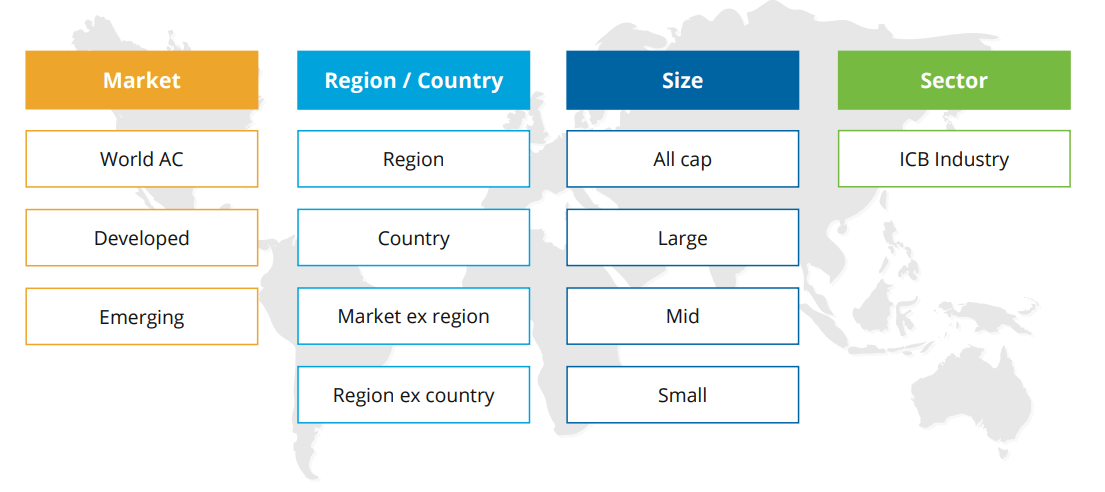

Our global index offering provides investors with building blocks to slice and dice the world’s equity markets along region, country, size and sector while adhering to both consistent methodology and international benchmarking standards – leaving no gaps or overlaps in their coverage.

Key benefits

Representative

Broad yet liquid coverage of global large, mid and small cap companies that supports clients’ investment decisions

Transparent

A consistent and transparent methodology offering our clients flexibility in their preferences while fully embracing global standards of governance

Modular

Our tailored approach ensures the ability to specify markets and their segments to match our clients’ investment views and create highly targeted indices

In this interview, Axel Lomholt highlights that the STOXX World Equity index suite is ideally suited to serve as building blocks for targeted and customized indices. The STOXX World indices allow investors to combine a consistent view of world markets with analytics-enhanced strategies based on desired styles, sustainability factors or themes.

We caught up with Serkan Batir, Global Head of Index Product Development, to find out how asset owners, ETF issuers and investors can use the suite to derive portfolios targeting strategies. This is particularly true of ESG objectives, enabling clients to integrate the best datasets for each case.

Index methodology

The STOXX World AC* All Cap Index aims to provide a broad universe that includes all investable stocks, ADRs and GDRs from all developed and emerging markets worldwide.

Large and mid-cap versions cover approximately 70% and 85% respectively of float-adjusted market capitalization. Numerous derived indices can be created by filtering the STOXX World AC All Cap Index components on geographic region/country, capital markets (developed or emerging), size (large, mid or small), and/or sector. The component weights of the derived indices are market cap weighted unless specified otherwise.

Check out the full Methodology guide >

* AC stands for All Countries

Key STOXX World Equity indices

No Results Found

Try a different search term or browse all our indices