Last March, STOXX indices from Qontigo became the underlying for single-stock short and leveraged exchange-traded products (ETPs) issued by Leverage Shares. The ETPs provide an efficient and low-cost way to pursue leveraged strategies.

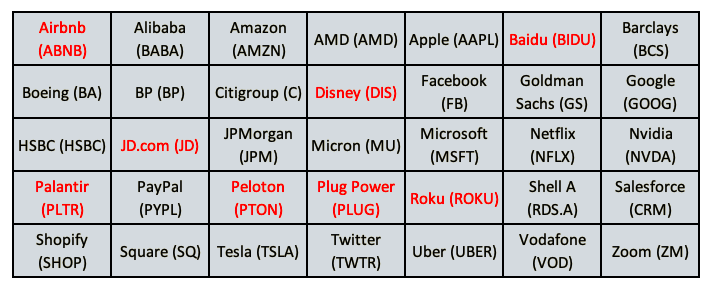

Leverage Shares has just listed a new batch of single-stock short and leveraged ETPs, expanding the strategies to additional stocks such as Airbnb, Baidu, Disney and Palantir (Figure 1). To find out more about the products and how investors use them, we caught up with Oktay Kavrak, responsible for Product Strategy at the ETP issuer.

Oktay, what are some key characteristics of leveraged ETPs?

“First of all, they are simple. They trade like a normal stock or ETF through a brokerage account so you can trade in and out during the entire session. The ETPs are designed to multiply the daily returns of single stocks like Tesla, Boeing and PayPal. We offer leverage factors of up to 3 times on the long side and -3 times on the inverse side.

“One important advantage is that investors do not need a margin account to trade the ETPs; there are no operational complexities around them. We have made the ETPs available in sterling, dollars and euros, to the benefit of traders handling different currencies.”

How do Leverage Shares ETPs differ from other products offering leverage?

“There are various ways in which people can trade with leverage or go short, and our ETPs offer several advantages as an alternative to existing products. First off, the ETPs use independent market-making and are exchange-traded, unlike Contracts for Difference (CFDs). This provides the safety and transparency of having a central clearing counterparty that enhances risk management and collateral protection.

“Secondly, losses cannot exceed the amount invested — also unlike CFDs or futures contracts. The most an investor can lose in a Leverage Shares ETP is the entire value of their initial investment plus any reinvested dividends.

“ETPs are cost efficient. Because our ETPs have access to institutional pricing for margin borrowing, their leveraged exposure is obtained at a fraction of the cost of products such as CFDs, structured products and competing leveraged ETPs.

“Our ETPs are physically backed by the underlying assets, so there is no credit risk.

“Finally, ETPs avoid the operational complexities around expiration dates such as roll-overs that come with instruments like options and futures. Not to mention that you need a margin/futures account to trade those derivatives.”

What are some common misconceptions about leveraged ETPs?

“Firstly, many people think leveraged ETPs are a new concept. In fact, the first such products were introduced back in 2006.

“Secondly, it is usually assumed that leveraged ETP issuers use swaps to offer leveraged exposure. Our products do not use derivatives. Rather, we employ the proceeds from the issuance of ETPs and a margin loan to invest in the underlying securities — making the ETPs, as mentioned, physically backed and fully collateralized.

“It may also be inferred that ETPs have low trading volume simply because there is not too much capital tracking the products. This is not the case. Liquidity is primarily sourced from the underlying shares, and our ETPs track some of the most liquid names in the world. Thanks to market-making agreements in place, a trader will always be able to buy and sell Leverage Shares ETPs regardless of the trading volume.”

Where do leveraged ETPs fit in in a typical core-satellite portfolio?

“We have seen sophisticated investors use our ETPs in the satellite part of their core-satellite portfolios. This simply means that they may preserve capital by allocating less cash to an investment yet receive the same exposure. We have also seen some institutional players manage downside risk by using our inverse ETPs to hedge exposures to so-called FAANG1 stocks in their portfolios.”

What is the role and objective of an index as an underlying for these ETPs?

“The index embodies the investment strategy offered to investors — a clear, rules-based and systematic methodology that is independent from the ETP’s management. This further ensures transparency, robustness and neutrality, as investors can gauge each ETP’s performance against that of the index it aims to track. This is one of the biggest benefits of Leverage Shares ETPs versus certain alternatives like CFDs and spread betting.”

Figure 1 – Listed Leverage Shares ETPs tracking STOXX indices

1 FAANG refers to Facebook, Amazon, Alphabet, Netflix and Apple shares.