The European Union’s Sustainable Finance Disclosure Regulation (SFDR) is one of the landmark frameworks steering sustainable investments, but it has also created confusion when it comes to interpreting the rules

Antonio Celeste is Director for Sustainability Product Management at Qontigo. Saumya Mehrotra is Associate Principal, Index Product Management.

In particular, the SFDR’s definition of Sustainable Investment (SI) is key for funds seeking to comply with the regulation and meet client expectations. In Article 2 (17), the legislative package provides broad principles of what an SI should be (*), but it does not set specific criteria or quantifiable metrics to define it.

(*) SFDR definition of SI:

1. It follows good governance practices

2. It does no significant harm (“DNSH”) to environmental and social objectives

3. Investee companies deliver a positive contribution through an economic activity that supports either environmental or social objectives, or both.

To help investors in the construction of portfolios, Qontigo has published a methodology guide for reporting the SI percentage of STOXX and DAX indices. The methodology follows the SFDR definitions, and is based on fundamental choices to identify pragmatic answers, build solutions and maximize robustness in an evolving context.

Methodology choices based on available information

The document highlights some key background elements to understand how the concept of SI is considered under the European regulation. It contains an overview of Qontigo’s methodological approach that allows investments to be classified as sustainable or not, and a more detailed presentation of the individual steps within it. Additionally, it shows how portfolio aggregation of the SI percentage is calculated.

This methodology was developed using a “best efforts” stance. Given the room for interpreting the rules and official guidance, Qontigo has used the most selective criteria and a pragmatic approach in integrating the rules, and our team constantly monitors legislative developments in the field.

Why a clear definition of SI is important

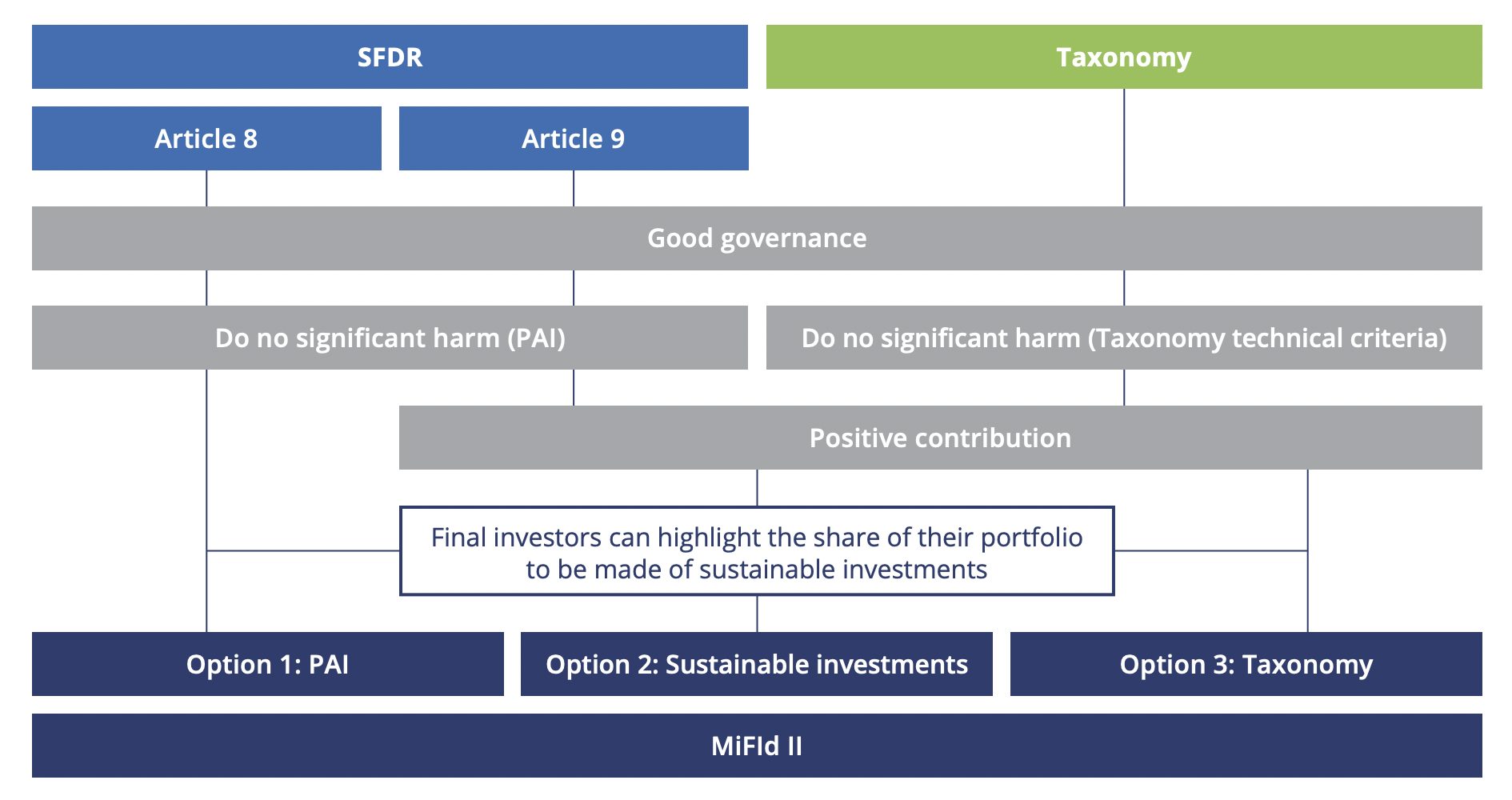

SI, as defined in the SFDR, is a cornerstone of the EU’s sustainable finance regulatory agenda:

- It determines the eligibility of securities to be included in SFDR Art. 9 products.[1]

- It entails a concept of good governance and DNSH that are part of the exclusion base layer for SFDR Arts. 8 and 9.

- It overlaps with the EU Taxonomy[2] under development.

- It represents one of three ways in which end investors can express their sustainability preferences under MiFID II.

Figure 1: Common requirements under SFDR, MiFID II and the EU Taxonomy.

Binary approach

Importantly, Qontigo has taken a “binary approach”[3] to considering a company as an SI, taking a 20% sustainable revenue alignment threshold at the company level as the determinant factor. The company’s positive contribution will be measured using the United Nations’ Sustainable Development Goals (SDGs) until the Taxonomy is fully developed.

Guiding principles in our methodology

Qontigo used the following guiding principles when developing the SI methodology presented in the document:

- Consistency with the existing reference frameworks for the EU’s SI regulations

- Specificity, so as to reflect the current recommendations in the SFDR as far as possible

- Integrity, to avoid any risk of greenwashing

- Cohesiveness across all indices

- Flexibility, to account for different approaches and evolving regulation.

Qontigo is committed to updating its methodology as the regulatory environment develops and more data becomes available. We invite you to download the document and share any comments and questions with us.

[1] For example, SFDR states that Art. 9 financial products “may invest in a wide range of underlying assets, provided these underlying assets qualify as ‘sustainable investments.’”

[2] The European Commission has defined the Taxonomy as “a classification system, establishing a list of environmentally sustainable economic activities.”

[3] A binary approach means a company is (100%) or is not (0%) an SI based on a particular threshold of sustainable economic activity that qualifies it as such. The alternative is to take an “in-part approach,” reflecting the exact share of a company’s economic activity that can be considered as is sustainable.