The Sustainable Development Investments Asset Owner Platform (SDI AOP) has expanded its analysis of companies’ alignment with the UN’s Sustainable Development Goals (SDGs) with new, forward-looking information based on firms’ patents.

The SDI Innovation Outlook provides a unique picture of companies’ future positioning in 130 technology themes that have been identified to advance the SDGs, from next-generation photovoltaics to precision agriculture. More than 20 million patents from thousands of companies are reviewed regularly through large-scale network analysis and proprietary statistical models. The resulting Innovation Outlook consists of a tabular dataset for quantitative analysis, and reports that provide a detailed company profile for more than 2,500 firms.

“Most ESG metrics are about the past or present, but it is important for investors to determine which areas companies are likely to be active in in the coming years,” said James Leaton, Research Director at the SDI AOP. “The growing community of investors using SDI data benefit from the consistent, objective way in which we have identified and mapped SDGs and technologies across revenues and now patents.”

There is strong scientific evidence that patenting — especially after adjusting for significance and quality — is a leading indicator for product introductions in the respective domains. By using patent analysis, investors get guidance on how a company’s developing technologies and solutions will positively contribute to the UN SDGs through future products and services.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Channeling investments into the SDGs

Investors are increasingly adopting the SDGs as a holistic sustainability framework to understand investment outcomes. An SDG-lens analysis can identify companies’ absolute and relative contribution to improving social and environmental objectives, and can assist in constructing thematic portfolios and indices. For many asset owners and asset managers, investing in companies that offer sustainability solutions is a key factor for improved long-term risk/return.

The SDI AOP was introduced in 2020 by asset owners APG, AustralianSuper, British Columbia Investment Management Corporation and PGGM, to accelerate the market adoption of Sustainable Development Investments (SDIs). Research partner Entis employs artificial intelligence to generate SDI classifications based on a taxonomy developed by the platform’s founding partners. Qontigo is the SDI AOP’s exclusive distribution partner.

Until now, the SDI AOP provided information on companies’ current contribution to the goals based on revenues from products and services.

A deep review of patents’ portfolios

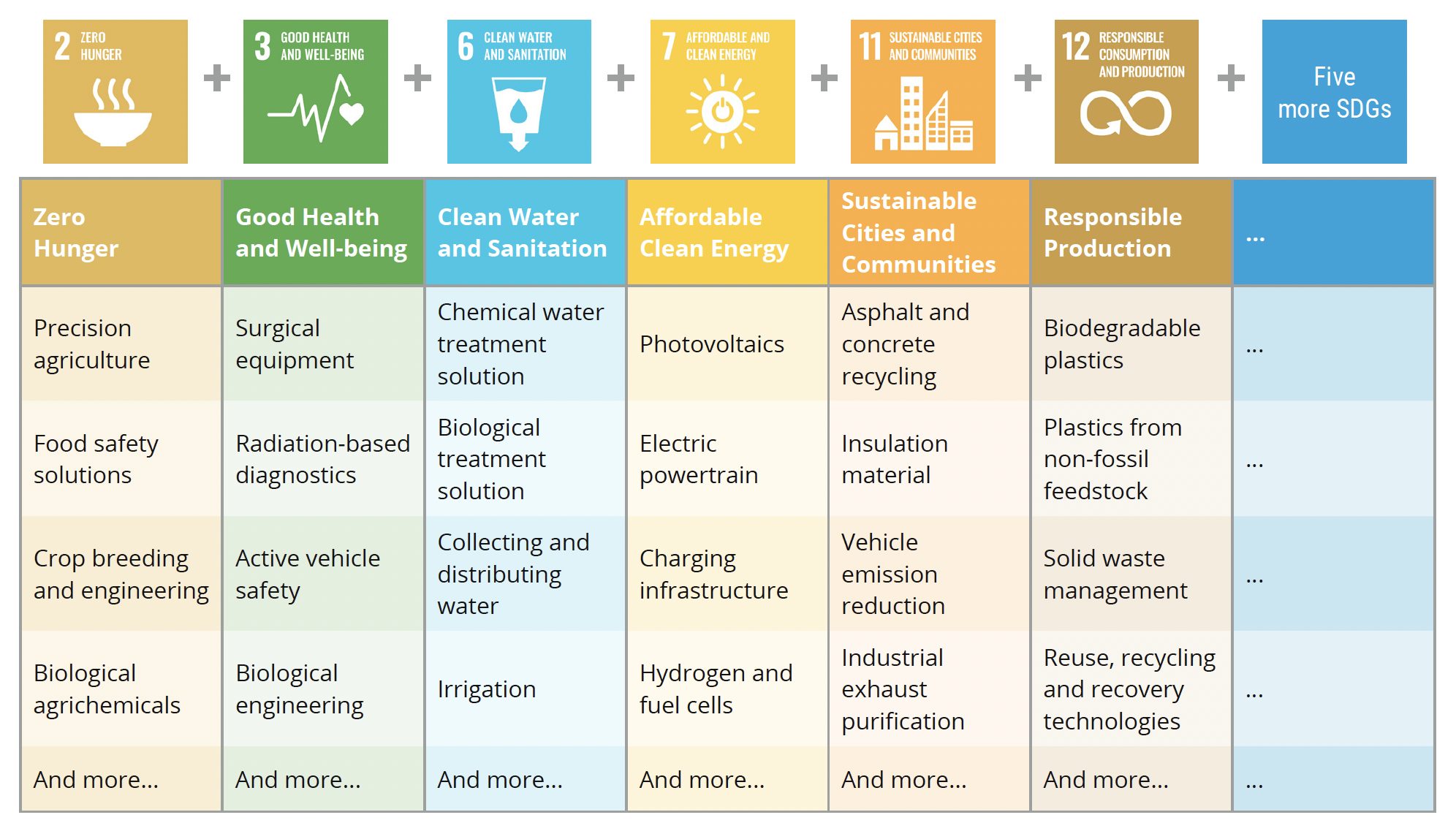

The SDI AOP taxonomy used for the new SDI Innovation Outlook identifies 130 technologies covering 11 of the 17 SDGs (Exhibit 1). For example, patents relating to crop breeding and engineering are relevant for SDG 2: Zero hunger.

Exhibit 1 – Mapping SDGs to technology categories and patents

The SDI Innovation Outlook analysis incorporates the quality and importance of individual patents, takes historical trends into account and provides granular insights for specific themes and technologies. Each company receives an Innovation Outlook score, calculated algorithmically by Entis based on a 10-year history of filings per company. Patents are quality-weighted by the number of citations they receive from later patents over that period. The SDI Innovation Outlook score is calculated as the weight of SDI patents versus the weight of all patents.

“A window of ten years in patents analysis gives us a good insight into the types of products that are currently being introduced,” said Pieter Laurens Baljon, Senior Data Scientist at Entis. “Furthermore, for patents older than three years, the determination of their quality and significance becomes more accurate.”

“Citations, meanwhile, are by far the best measure available to identify patents of significant value,” added Baljon. “Incoming citations of a given patent signify a high degree of innovation that has been built upon by subsequent patents. The fast pace of research in both natural language processing (NLP) and network-analysis-based machine learning is enabling us to determine the quality of patents and their SDG contribution with ever increasing accuracy.”

Companies only receive a score in case their patent portfolio is large enough compared to the company’s size.

Objective assessment of a company’s SDG-related strengths

“The SDI Innovation Outlook helps investors understand companies’ future alignment with SDGs, their specific SDG-related strengths, and potential for increased returns,” said the SDI AOP’s Leaton. “The analysis also allows a comparison of a company’s standing relative to peers, provides an instrument to improve SDG portfolio construction, and offers a tool for engagement over business strategy and investment in sustainable innovation.”

The mapping from the SDI AOP taxonomy to technology categories — a process that determines whether a technology is considered sustainable — is performed in a strictly governed way by the SDI AOP. Because the SDI AOP is asset owner-led and has no commercial or political motivation, the process is objective and neutral.

Conclusion

The SDI AOP is already helping guide and shape impact portfolios for some of the world’s largest investors, offering an objective, granular and transparent taxonomy that is becoming a standard in SDIs. The latest upgrade further widens the possibilities in responsible investing, a field that continues to grow at a significantly fast pace.