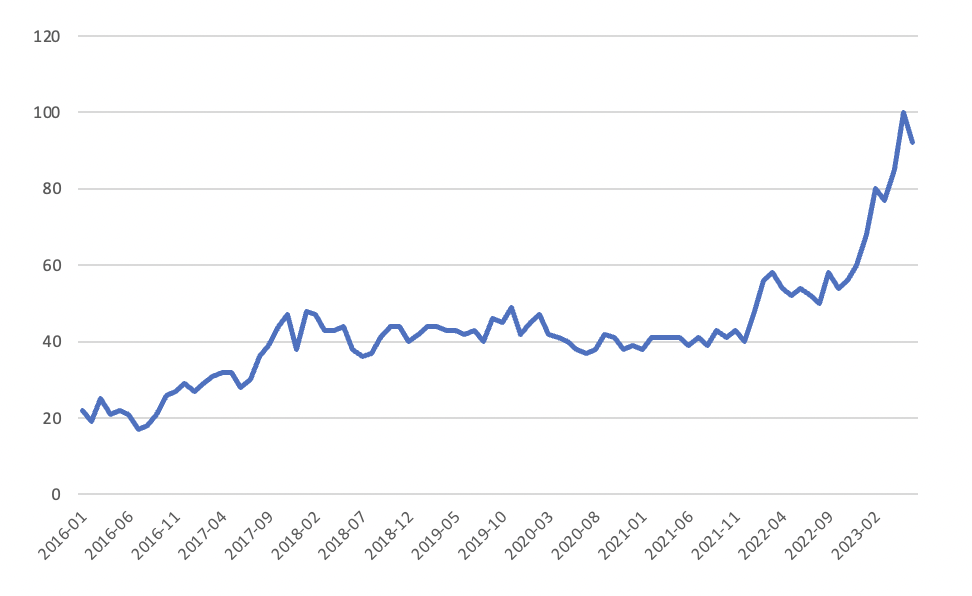

The debate about artificial intelligence (AI) and its potential to transform our world seems to be everywhere in 2023. But AI feels like more than just hype. We are experiencing an enlightening moment about the power of data, machine learning and accelerated computing — with concrete revenue stories to prove the AI revolution is taking place today.

Investors have also embraced AI’s momentum. The STOXX® Global Artificial Intelligence index has gained 49% this year[1], the most among 29 STOXX Thematic indices and more than twice the average return for the group. The index selects companies with the highest revenue exposure to sectors involved in the deployment of AI.

In this post, we will look into what makes up the STOXX Global Artificial Intelligence index.

2023 – the year of AI?

While AI has been developing for decades, 2023 has brought the technology emphatically to the forefront. Open AI’s ChatGPT, the first widely used text-generating AI product,[2] reached 1 million users in just five days after its launch in November 2022. Such pace of adoption and the widespread reporting of generative AI’s capabilities highlighted the potential of computer intelligence and created an “iPhone moment” for AI.[3]

The excitement quickly cascaded onto the corporate world, and soon many companies were touting on conference calls what AI could do for them.

Investors also got a seminal moment on May 24 this year, when NVIDIA, whose systems help run AI worldwide, forecast second-quarter sales would reach USD 11 billion, 50% more than analysts had expected, thanks to growth in accelerated computing and generative AI.[4] Jensen Huang, NVIDIA’s CEO, said there is a spike in demand for fast data-processing infrastructure as “companies race to apply generative AI into every product, service and business process.”[5]

Figure 1: Worldwide Google search for “Artificial Intelligence”

The International Data Corporation (IDC) has forecast that global spending on AI, including software, hardware and services, will rise 27% this year to USD 154 billion from a year earlier.[6] IDC analysts see that expenditure exceeding USD 300 billion in 2026 — a compound annual growth rate of 27% over the 2022-2026 period.

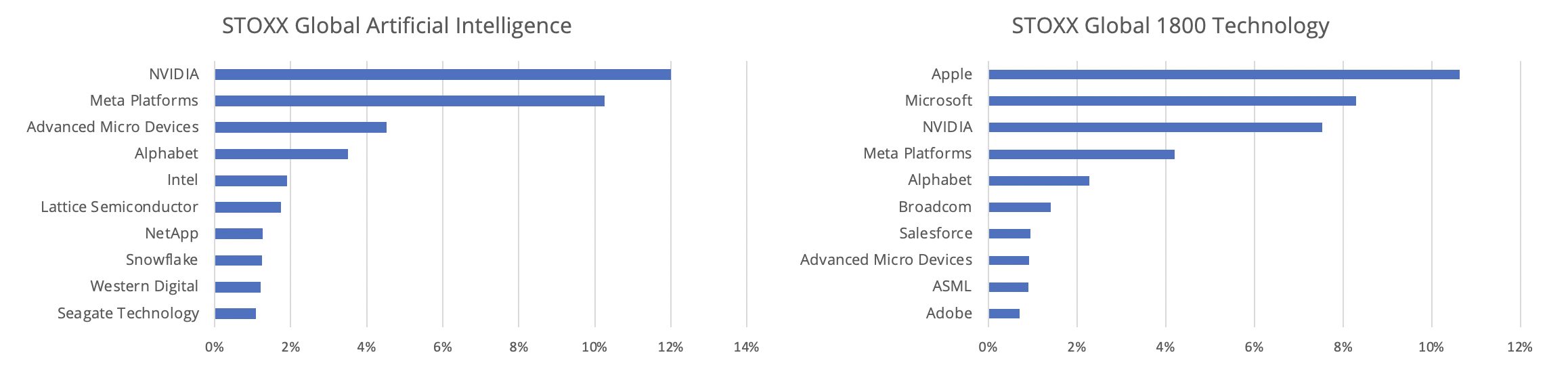

Broader technology boom

To be sure, investor enthusiasm for breakthrough scientific applications is not limited to AI — the broader technology sector has done equally well. The STOXX® Global 1800 Technology has advanced 48% in 2023, helped by a 49% gain in its largest constituent, Apple. The maker of the iPhone, plus Microsoft and NVIDIA, have accounted for more than half (56%) of the Technology index’s returns this year. NVIDIA and Meta Platforms are responsible for almost half (45%) of the gains in the STOXX Global Artificial Intelligence index (Figure 2).

Figure 2: Top ten stock contributions to index returns

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Inside the portfolio

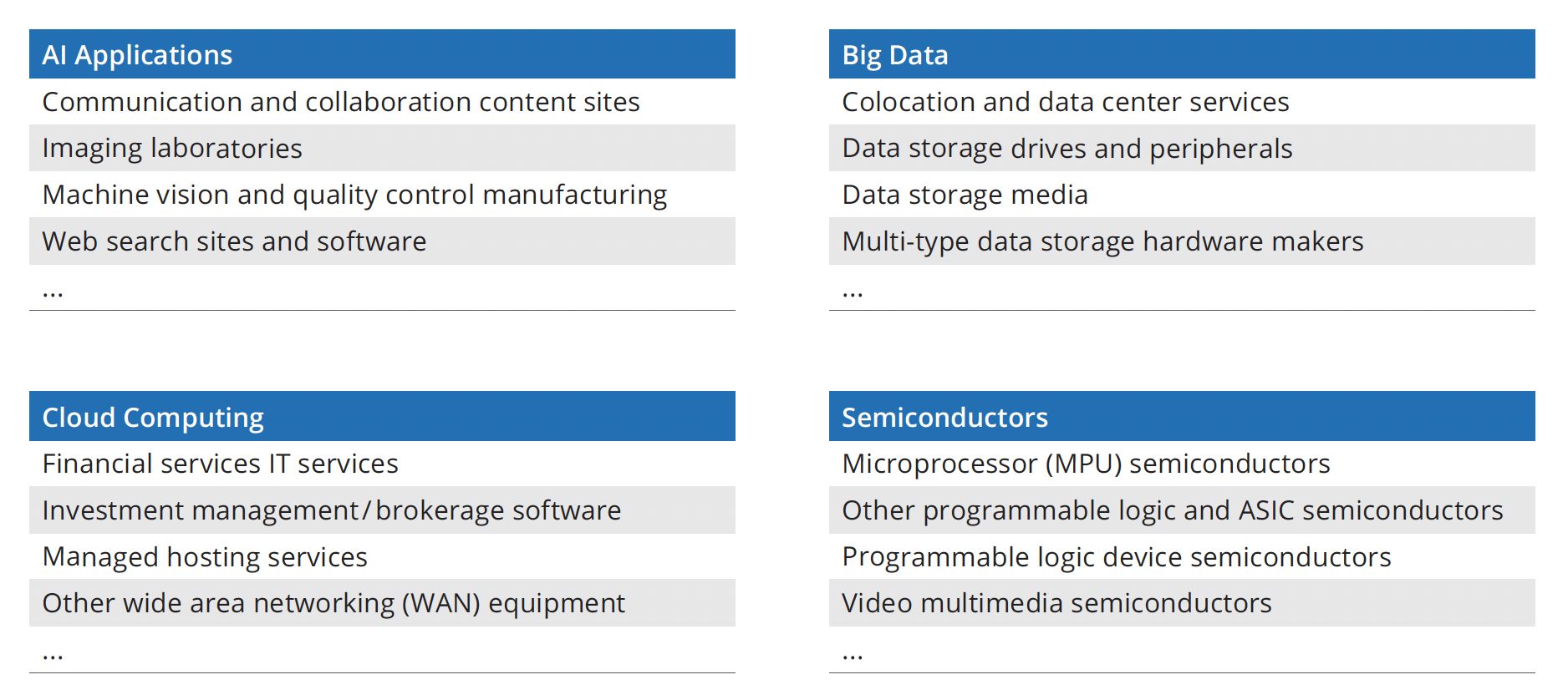

The STOXX Global Artificial Intelligence index selects components that are active in the following four sub-categories identified within the AI theme:

- AI applications

- Big data

- Cloud computing

- Semiconductors

From there, 44 business sectors have been associated with those categories or sub-themes. Companies that derive at least 50% of their revenues from those sectors are eligible for index inclusion. Figure 3 shows some sector examples per category. For a full list, visit the index methodology.

Figure 3: Mapping the AI segment classification

The STOXX Global Artificial Intelligence index is weighted according to the free-float market capitalization of selected stocks multiplied by the aggregate revenue exposure of each stock to the targeted sectors.

Cloud, chipmakers, data centers

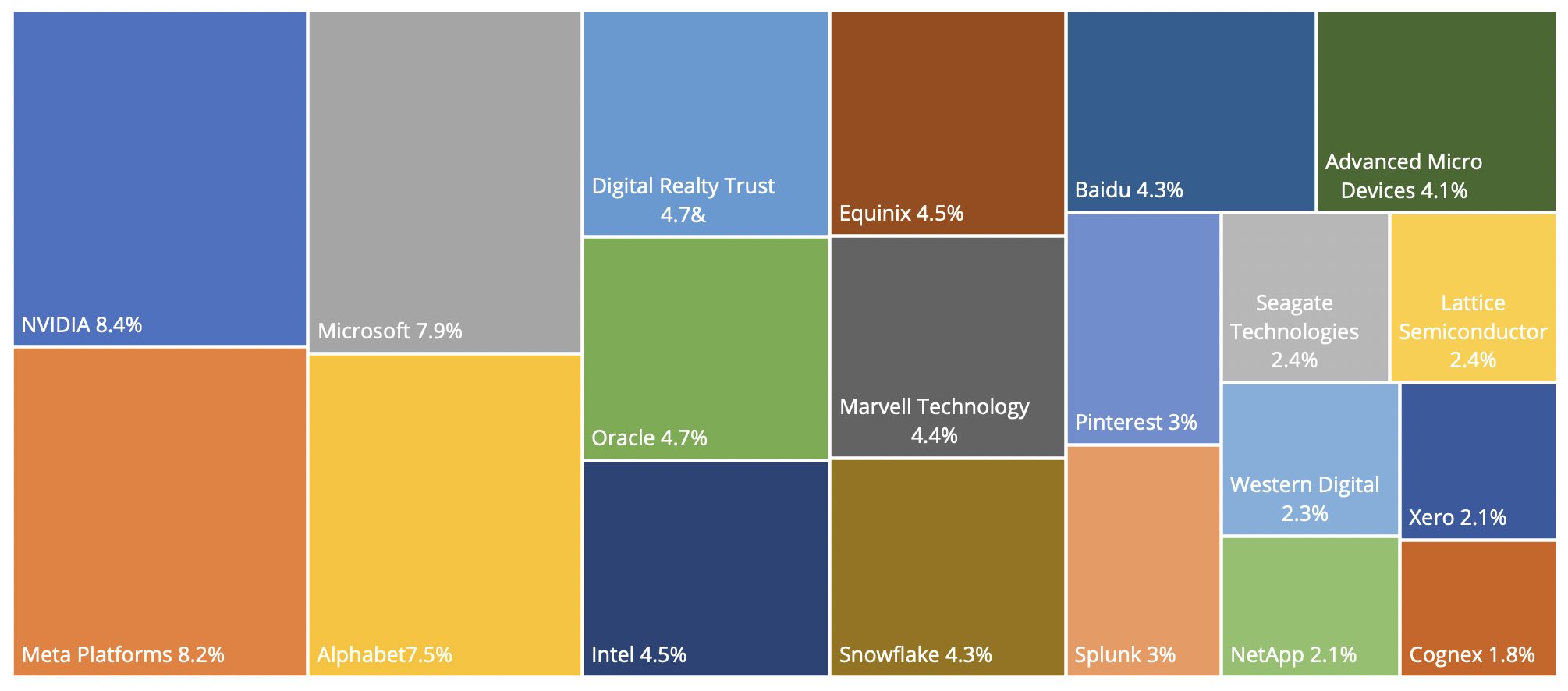

Most index constituents (Figure 4) have been at the center of the AI conversation this year, with analysts predicting rising demand for their products and services. Figure 4 shows the largest 20 of a current total of 50 stocks in the index.

Figure 4: STOXX Global Artificial Intelligence’s top 20 holdings

Meta (YTD +138%) has deployed AI to boost engagement on its platforms and make advertising more efficient.[7] Microsoft (YTD +42%) is an investor in Open AI and is seeing strong demand for Azure cloud services. Alphabet (YTD +36%) in February said that its Google Cloud unit reported a 32% annual jump in revenue in the fourth quarter.

Digital Realty Trust (YTD +13%) and Equinix (YTD +19%), which run data centers, both reported first-quarter sales rose at least 15% in 2023 from a year earlier.

Snowflake (YTD +23%) in June announced a partnership with NVIDIA (YTD +189%) to allow clients to create customized generative AI applications using their own proprietary data within the Snowflake Data Cloud.

Advanced Micro Devices (YTD +76%) is an example of how makers of computer processors and semiconductors are benefiting from faster-computing demand. Analysts have said the stock’s gains are likely to continue, pointing to strong demand in the company’s data-center graphics processing unit (GPU) business.[8]

Sector allocation

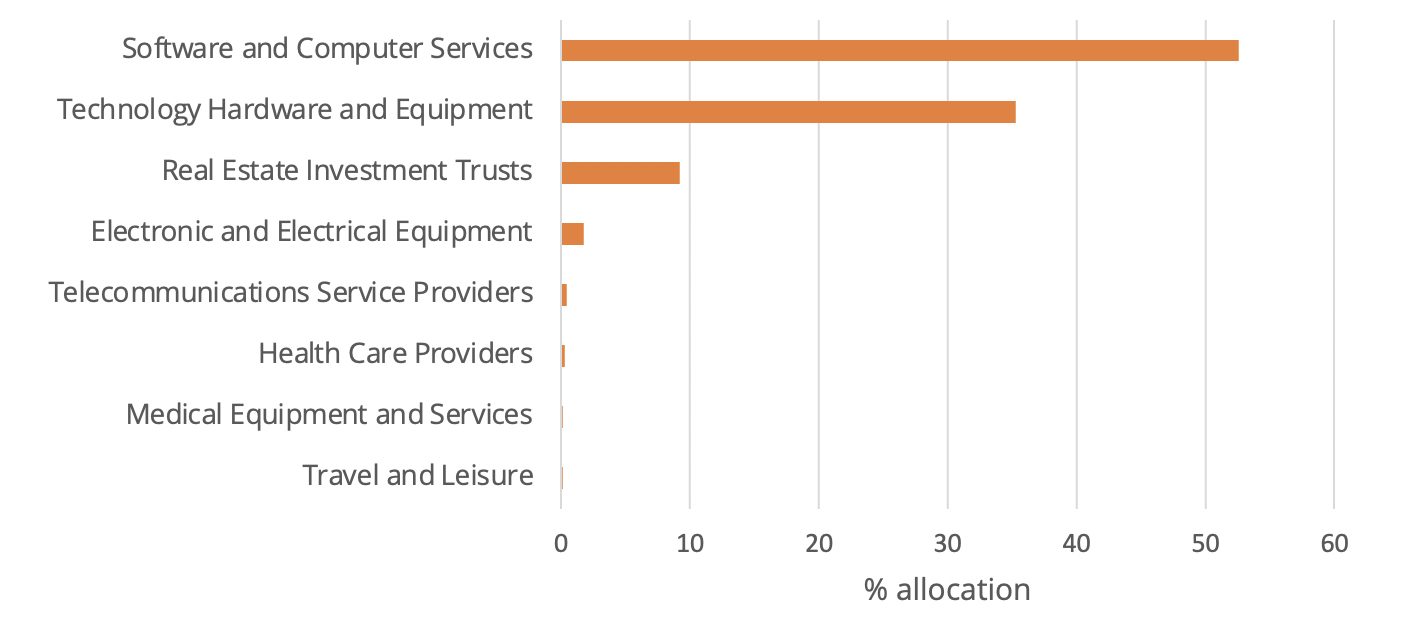

Two ICB sectors dominate the STOXX Global Artificial Intelligence index: Software and Computer Services (53% of total weight), and Technology Hardware and Equipment (35%).

Figure 5: Sector exposures

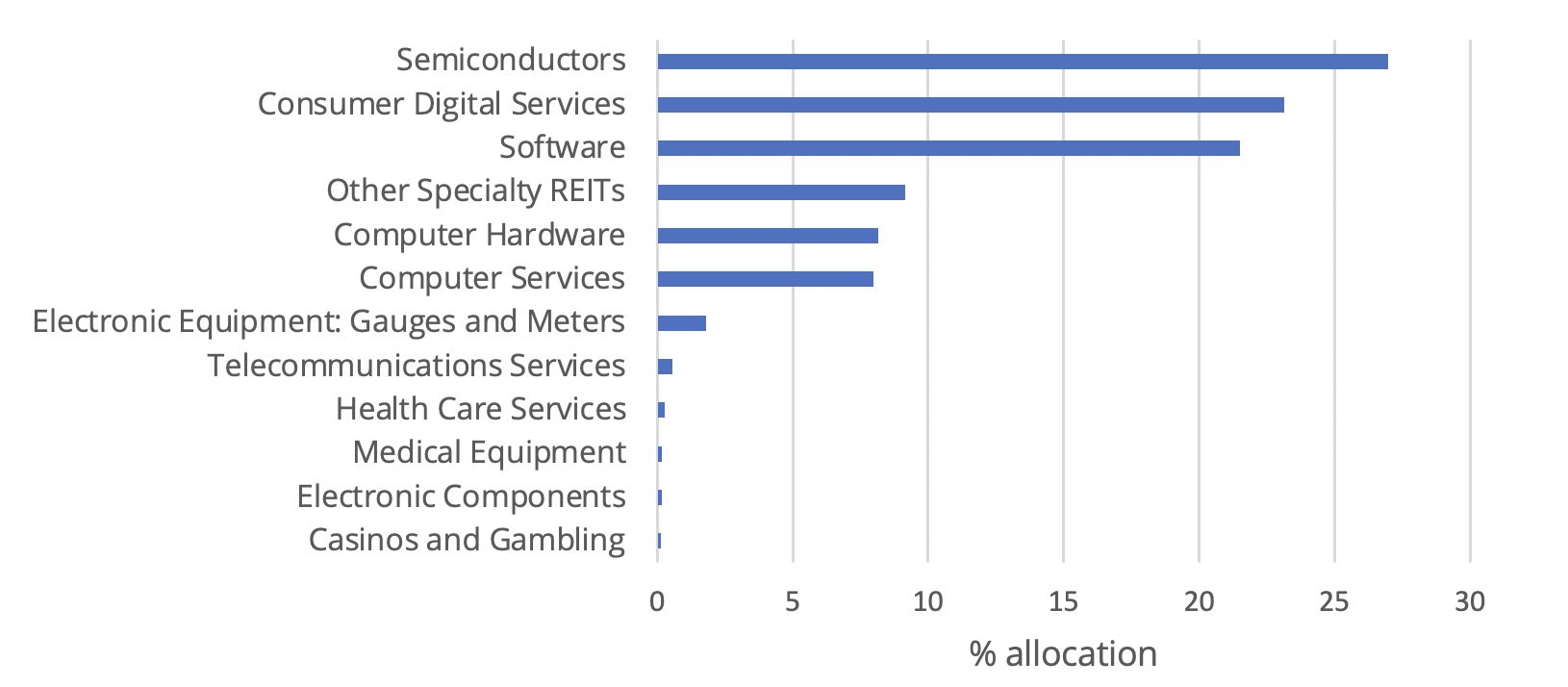

Digging one level lower to ICB subsectors, Semiconductors (27%), Consumer Digital Services (23%), Software (22%) and Other Specialty REITs (9.2%) represent the biggest weights.

Figure 6: Subsector exposures

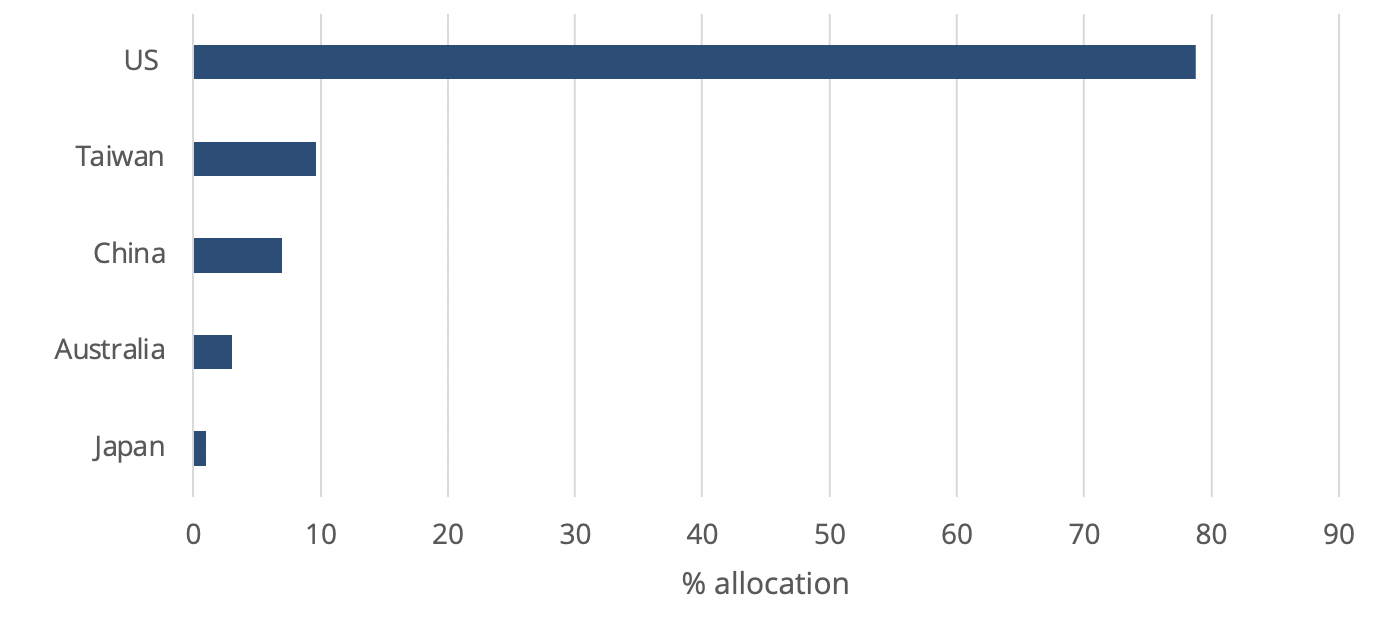

Finally, the US accounts for the largest country exposure in the index, followed by Taiwan and China.

Figure 7: Country exposures

Market Sensitivity, Volatility

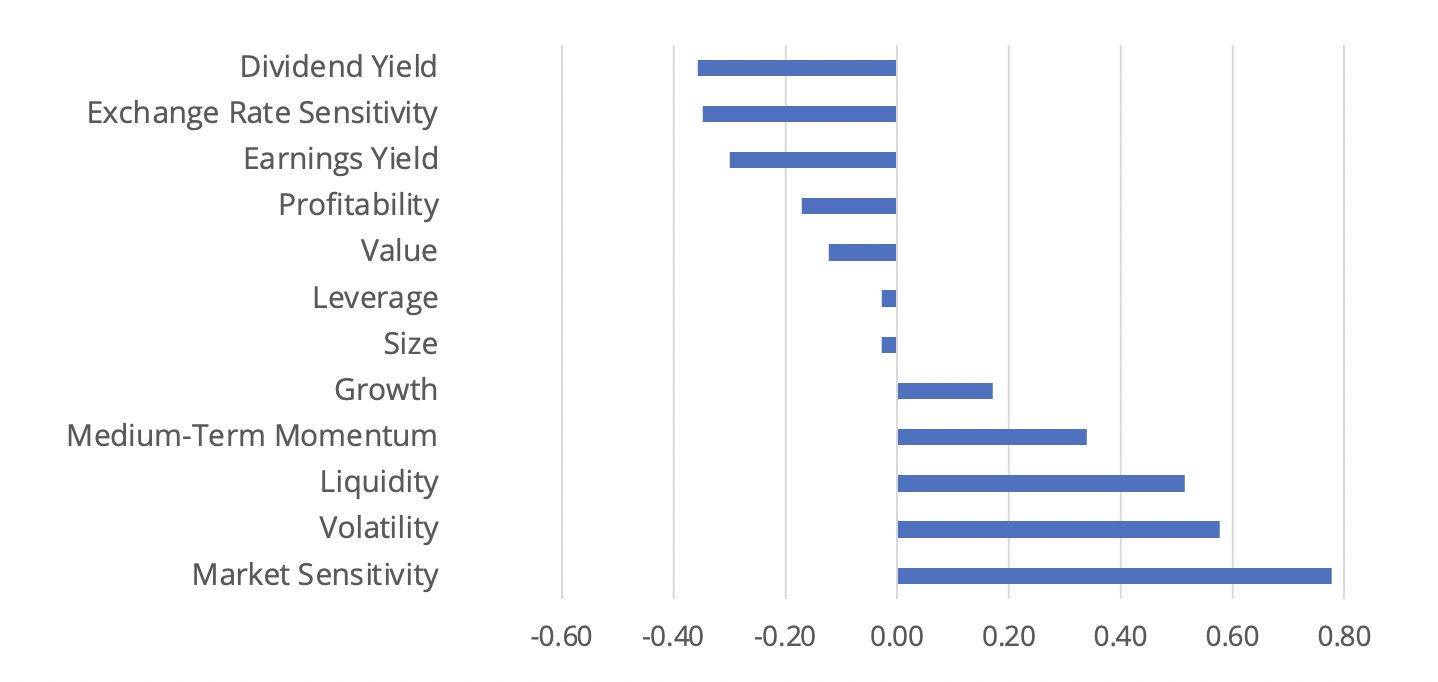

Figure 8 shows the active style-factor exposures of the AI index relative to the parent universe of the STOXX® World AC. The AI index has its largest positive active exposures in the Market Sensitivity, Volatility and Liquidity factors, while also being more exposed to the Medium-Term Momentum and Growth factors. Negative active exposures include those to the Dividend Yield, Exchange Rate Sensitivity and Earnings Yield factors.

Figure 8: Active style-factor exposures

Conclusion

The STOXX Global Artificial Intelligence index helps investors track a specific thematic segment of the broader technology space, offering exposure to pure-play thematic stocks and to smaller companies that may be early on in their life cycle. It is important to note that the STOXX thematic indices are chosen for the long-term outlook of the targeted theme. This includes not just considering the economic growth potential, but its viability as a multi-year structural story. Having a revenue-based selection methodology appears as an appropriate strategy for an industry where earnings growth is happening now, rather than in the future.

Investors targeting a technologically disruptive theme such as AI must be aware of the sector and factor exposures involved in such a strategy. As with many other technology-focused themes, investing in AI can benefit from rising markets (high “beta”), but be more susceptible than other sectors to spikes in market volatility.

[1] Total returns in dollars through June 30, 2023.

[2] See McKinsey, ‘What every CEO should know about generative AI,’ May 12, 2023, for this reference.

[3] The phrase was used by NVIDIA.

[4] Reuters, “Nvidia shares soar nearly 30% as sales forecast jumps and AI booms,” May 25, 2023.

[5] NVIDIA, “NVIDIA Announces Financial Results for First Quarter Fiscal 2024,” May 24, 2023.

[6] IDC, “Worldwide Spending on AI-Centric Systems Forecast to Reach $154 Billion in 2023, According to IDC,” Mar. 7, 2023.

[7] FT, “Meta’s revenue growth boosts shares as it touts AI progress,” Apr. 27, 2023.

[8] MarketWatch, “AMD is becoming ‘closest competitor’ to Nvidia in AI hardware, and that could extend stock’s rally,” June 12, 2023.