With US demand for environmental, social and governance (ESG) investment strategies on the rise, it is timely to look at the recent performance of the STOXX® USA 500 ESG-X Index.

The index is part of STOXX’s ESG-X Index family, composed of versions of established, market-capitalization-weighted benchmarks that exclude companies based on standard ESG considerations. The exclusions follow norms (United Nations Global Compact principles) and product involvement (controversial weapons, tobacco and thermal coal).

STOXX analysis shows that negative ESG screens tend not to cause any statistically significant divergence on a portfolio’s returns or risk relative to the benchmark.1 However, differences vary from region to region, and tracking error, biases and exposures — albeit relatively small and often immaterial — emerge as a result of implementing the screens.

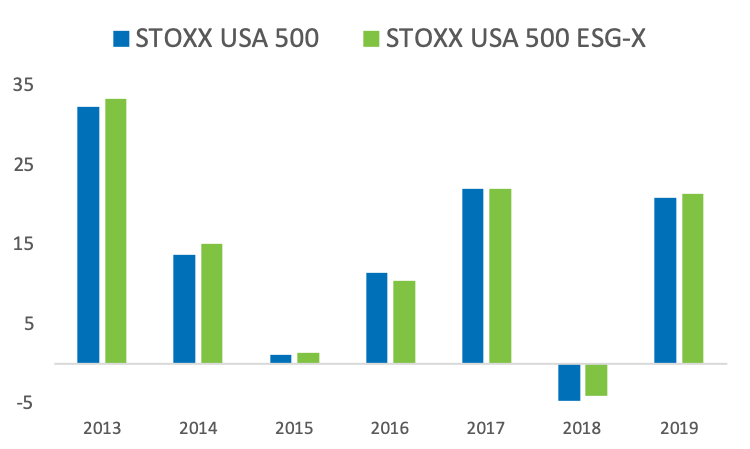

Chart 1 shows the annual returns of the STOXX USA 500 ESG-X Index and its benchmark, the STOXX® USA 500 Index.

Chart 1

Narrow advantage for US ESG strategies

Through September, the STOXX USA 500 ESG-X Indexrose 21.4% in 2019, compared with a 20.9% advance for the benchmark.2

So where is this difference coming from? Until the latest review took place on Sep. 23, the STOXX USA 500 ESG-X Index excluded 39 companies from the benchmark. The majority of exclusions stemmed from exempting utilities that use thermal coal for power generation, and from removing companies involved in the defense business.

Beyond them, a handful of companies in other industries have been accretive to the STOXX USA 500 ESG-X Index’s returns because of their weight in the benchmark and their relatively weak performance in 2019.

Some examples appear below.3 Their year-to-date performance and weight in the benchmark appear between brackets:

Johnson & Johnson (YTD +0.3%, 1.4% weight): The 133-year-old maker of shampoo and medicines has been deemed by Sustainalytics4 to be non-compliant with UNGC principle 1 of protecting human rights. J&J shares slumped last December after Reuters reported that the company knew for decades that its popular Baby Powder talc contained cancer-causing asbestos.

Wells Fargo (YTD +9.5%, 0.8% weight): The bank is considered to have breached UNGC principle 10 of working against corruption, extortion and bribery. Wells Fargo has fired thousands of employees for allegedly opening millions of fraudulent accounts on behalf of clients without their consent. The stock has lagged behind the STOXX® USA 900 Banks Index’s 21% gain this year.

Altria Group (YTD -17%, 0.3% weight) and Philip Morris International (YTD +14%, 0.4% weight): For a second year in a row, tobacco producers have strongly underperformed. Even Philip Morris’ advance this year is nearly half that of the STOXX® USA 900 Personal & Household Goods Index.

Designed to stay close to benchmark

This year’s narrow return gap aside, longer-term, the risk and returns profile of the sustainable portfolio doesn’t differ much from those of the benchmark. This is an intended characteristic of the STOXX ESG-X Index family.

A STOXX research paper5 published in August provides detailed insight into the long-term comparative returns, performance analysis, and effect on industry weights and stock constituency of the STOXX USA 500 ESG-X Index.

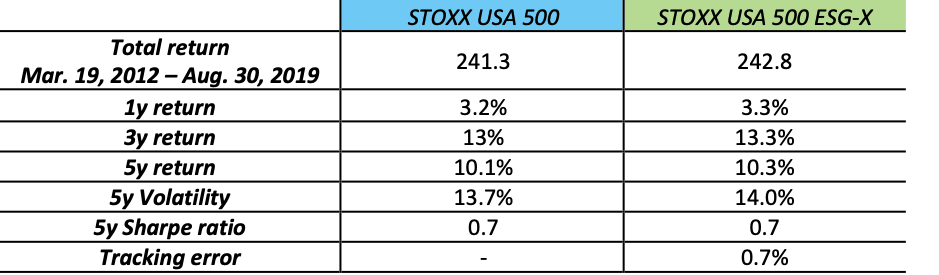

Table 1 from that report shows the risk and return profiles of the STOXX USA 500 ESG-X Index and its benchmark.

Table 1

Between March 2012 and Aug. 30 this year, the STOXX USA 500 ESG-X Index outperformed its benchmark by 152 basis points, or 12 basis points in annualized returns. This outperformance was the net result of accruing extra returns from UNGC principles, tobacco and coal exclusions, while sustaining a drag from controversial weapons exclusions.

Overall, the ESG portfolio’s outperformance came with a slight increase in volatility relative to its benchmark, although the resulting Sharpe ratios are similar. Since inception, an average weight of 9.2% has been screened out from the STOXX USA 500 ESG-X Index relative to its benchmark.6

An established family of indices in Europe

The STOXX USA 500 ESG-X Index offers exposure to a liquid universe of US large-capitalization stocks that observes basic responsible parameters. The index is designed from a common rules framework and infrastructure of established benchmarks that are popular with Europe-based investors, including the STOXX® Europe 600 Index. As such, the index comes to help increasing demand for overseas exposure from this pool of investors.

The true cost of implementing an ESG strategy

For readers interested in more information about the effect of exclusions on performance, volatility and portfolio composition, we invite you to download August’s ESG-X research paper. The study also includes a historical factor-based performance attribution analysis of ESG-X indices, a helpful guide to accurately examine the cost of implementing an ESG strategy.

With responsible investing gathering pace, ESG indices are meeting the need for market-capitalization-weighted benchmarks that are in line with sustainable policies. As more investors replace traditional benchmarks with ESG indices, the more the latter will eventually become the go-to gauges for mainstream portfolios, further aiding the responsible revolution.

Featured indices

1,5 Venkataraman, A., Williams, L., ‘STOXX® ESG-X INDICES,’ STOXX, August 2019.

2,3 Year-to-date are gross return in dollars through Sep. 30, 2019.

4 Sustainalytics, a leading provider of ESG data and research, is STOXX’s partner in the ESG-X family.

6 Data through Jun. 28, 2019, in Venkataraman, A., Williams, L. (Aug. 2019).