The world’s fight against climate change has one of its key campaigns in modern mobility, with a focus on adopting transportation means that can reduce carbon emissions

Antonio Celeste is Director for Sustainability Product Management at Qontigo.

Transport — road, shipping and aviation — accounts for over a third of global emissions, according to estimates from the International Energy Agency (IEA).[1] The sector’s carbon footprint needs to fall by about 20% through 2030 if countries are to align with net-zero commitments[2], the agency has said.

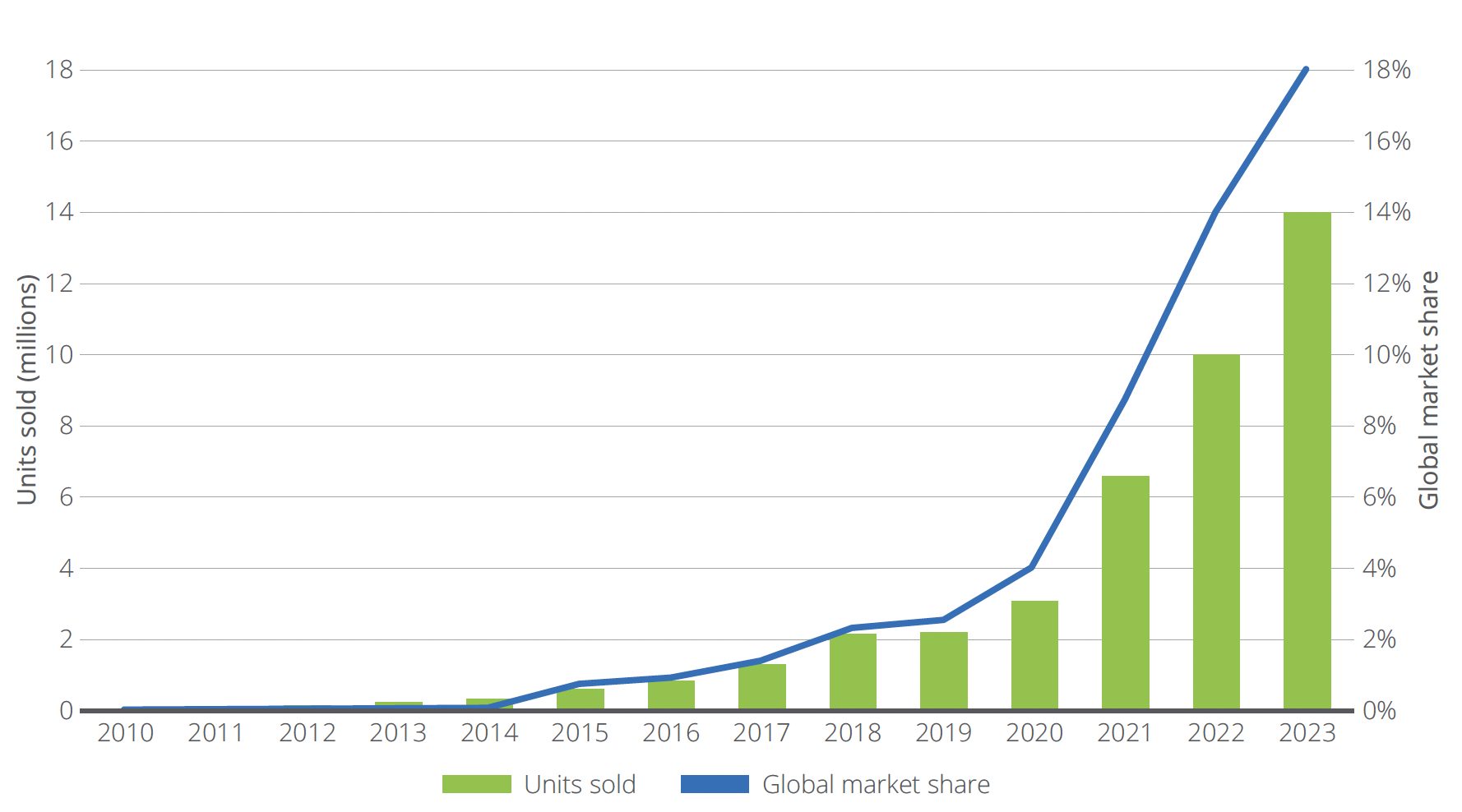

The electrification of road vehicles, in particular, is fundamental to limiting the world’s greenhouse gases, as well as reversing air pollution and minimizing biodiversity loss.[3] The IEA has estimated that electric vehicles (EVs) could, by 2030, remove enough emissions to offset the entire carbon footprint of Canada. If the world is to meet net-zero carbon emissions by 2050, clean cars should represent a 60% share of all vehicles sold worldwide, the agency calculates. Today, that share is 14% (Figure 1).

While large, that gap appears to be closing fast. Sales of EVs (cars and light trucks) rose more than four-fold between 2020 and 2022, to a record 10 million.[4] More units are now sold in a week than were dispatched in a whole year back in 2012. MIT researchers have estimated that the global EV fleet could surpass 800 million units by 2050 if current Paris Agreement targets are maintained.

Figure 1: Global sales (lhs) and market share (rhs) of electric cars

Underpinning the rapid growth in EVs has been sustained policy support, with governments around the world providing subsidies and tax breaks for car buyers to meet their Paris Agreement commitment: to cut emissions by 45% by 2030 and reach net zero by 2050.

China, the world’s largest market for EVs, has handed out subsidies and tax breaks, and implemented a green car credit system to incentivize manufacturers to boost EVs production. Some of the Asian country’s provinces may soon ban the sale of combustion cars.[5]

In August 2021, President Joe Biden set a goal for 50% of all new passenger vehicles sold in the US by 2030 to run on electricity.

The European Union (EU) has been tightening carbon-dioxide emission standards for new passenger cars and vans for years, and last March agreed to ban the sale of fossil fuel cars by 2035. The European Commission has allowed, following the ban, the continued sale of vehicles that run on carbon-neutral synthetic fuels (“e-fuels”).

As part of its 2018 Action Plan, the EU is set to reform the financial system as we transition to a low-carbon world. The European Commission has estimated it needs 180 billion euros a year to reach its climate targets as it replaces high-emission energy sources.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >The role of investors

Fundamental to closing the funding gap will be the private sector. To help investors channel capital towards businesses advancing the climate transition, index providers and asset managers have in recent years developed a whole new range of specialized solutions. Among them, thematic strategies include some of the most targeted methodologies. Qontigo has introduced several thematic indices, listed below, that specifically offer comprehensive coverage of the future mobility megatrend.

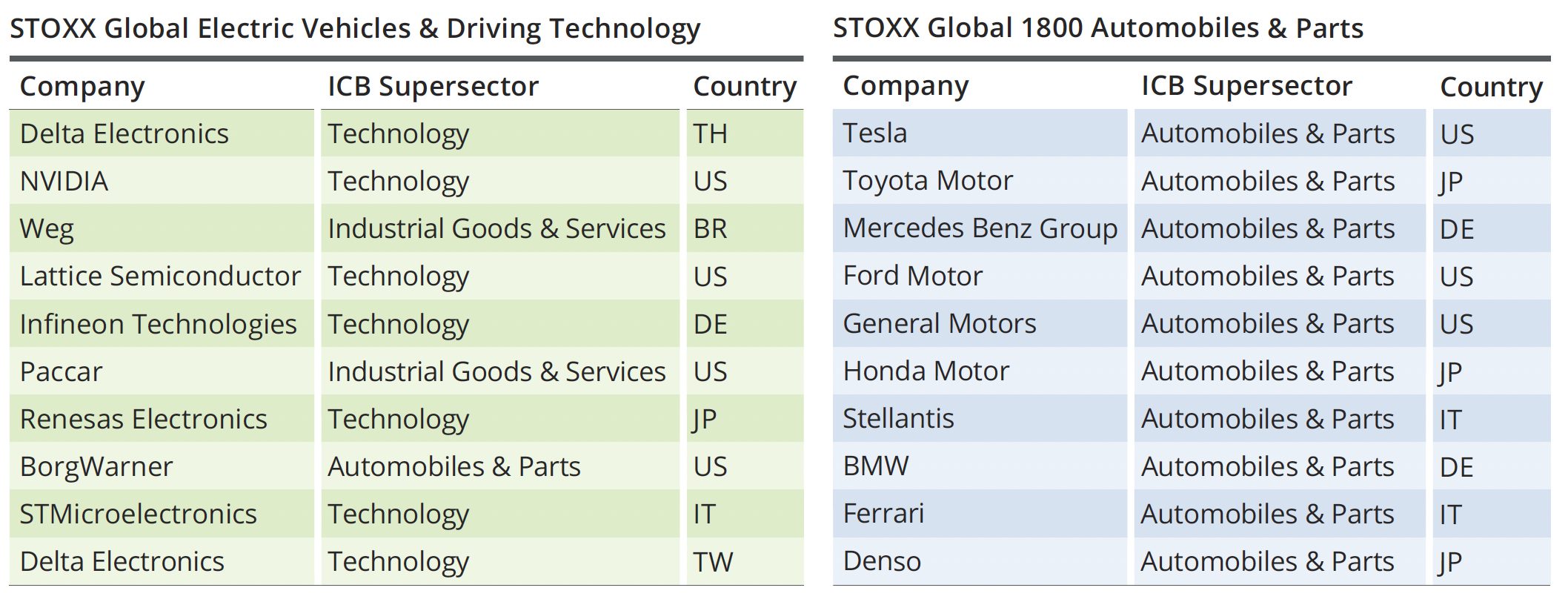

An accelerating trend: STOXX® Global Electric Vehicles & Driving Technology

The index tracks firms involved in the manufacturing of electric and autonomous vehicles, and ancillary services including suppliers of batteries and charging stations. Using a thematic index means investors get pure exposure to the electric cars segment rather than the broader automobile industry, where sales of legacy fuel-combustion cars remain high.[6]

STOXX uses FactSet’s Revere (RBICS) granular data for a detailed breakdown of the revenue sources of the eligible companies, to select those most exposed to the theme in question.

Figure 2: Top 10 components

Rethinking transport: STOXX® Global Smart City Infrastructure

Besides a changing attitude towards private car usage, the future of mobility will also evolve around a more efficient urban public-transportation network. As home to half of the world’s population, a share that is predicted to rise to nearly 70% by 2050, cities will be the key battleground in climate action.[7]

The STOXX Global Smart City Infrastructure index tracks the performance of companies deploying the physical structures and facilities needed as urban development gets more intelligent and sustainable. Nearly 50 RBICS sectors have been associated with the theme, including Multi-Type Passenger Transportation, EV Charging Stations and Transportation Construction — hence covering the entire spectrum from EVs to electric buses and light trains.

New consumption patterns: STOXX® Global Sharing Economy index

The sharing economy trend addresses a lot of the issues in carbon emissions by reducing resource consumption. Perhaps the clearest example is car-sharing and hailed-mobility services, which are predicted to cut the number of cars on the road and sitting in parking lots. The STOXX Global Sharing Economy index targets Food Delivery Services, Passenger Car Rental, and Truck, Trailer and Recreational Vehicle Rental.

A glimpse into the future: STOXX® Global Metaverse index

Cars may not be the first thing that springs to mind when thinking about the Metaverse, but indeed the virtual world is increasingly providing a considerable industrial use case for carmakers through the ‘digital twin’ technology.

Mercedes Benz, for example, is using a software from NVIDIA to plan and optimize its EVs plant in Rastatt, Germany. By building a digital twin of the factory, the automaker is able to simulate and monitor new processes without disrupting existing production. Other benefits include reacting to supply-chain disruptions, reconfiguring the assembly line as needed and decreasing energy consumption and emissions.

The STOXX Global Metaverse index offers exposure to companies with high-quality patents and specialization in services and products supporting technologies such as digital twin. In using patents, the index relies on forward-looking data to capture a theme that is still in its infancy. The Metaverse may represent the next stage in the transition to electric transportation, allowing investors to gain exposure to a future chapter in the modern mobility megatrend.

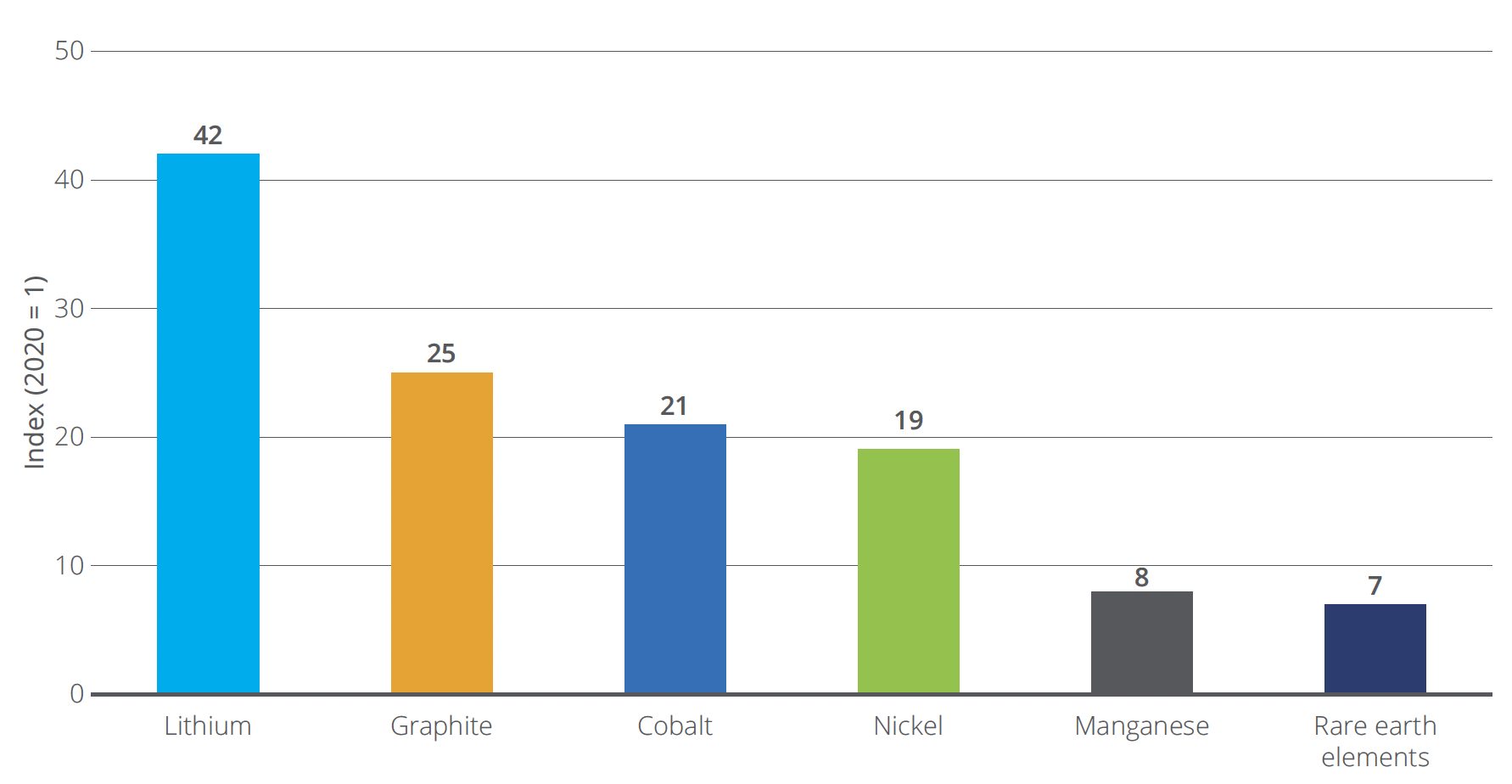

Positioned for growth: Energy transition metals

Elsewhere, investors can also target the electric-car revolution via the high-growth sector of energy transition metals, through new and planned indices covering minerals that are needed in the manufacturing of EVs. A typical electric car requires six times the mineral inputs of a conventional car.[8] According to the IEA, a typical EV battery pack requires 8 kg. of lithium, 35 kg. of nickel, 20 kg. of manganese and 14 kg. of cobalt.[9] Graphite, aluminum and rare earth elements are also employed in car production.

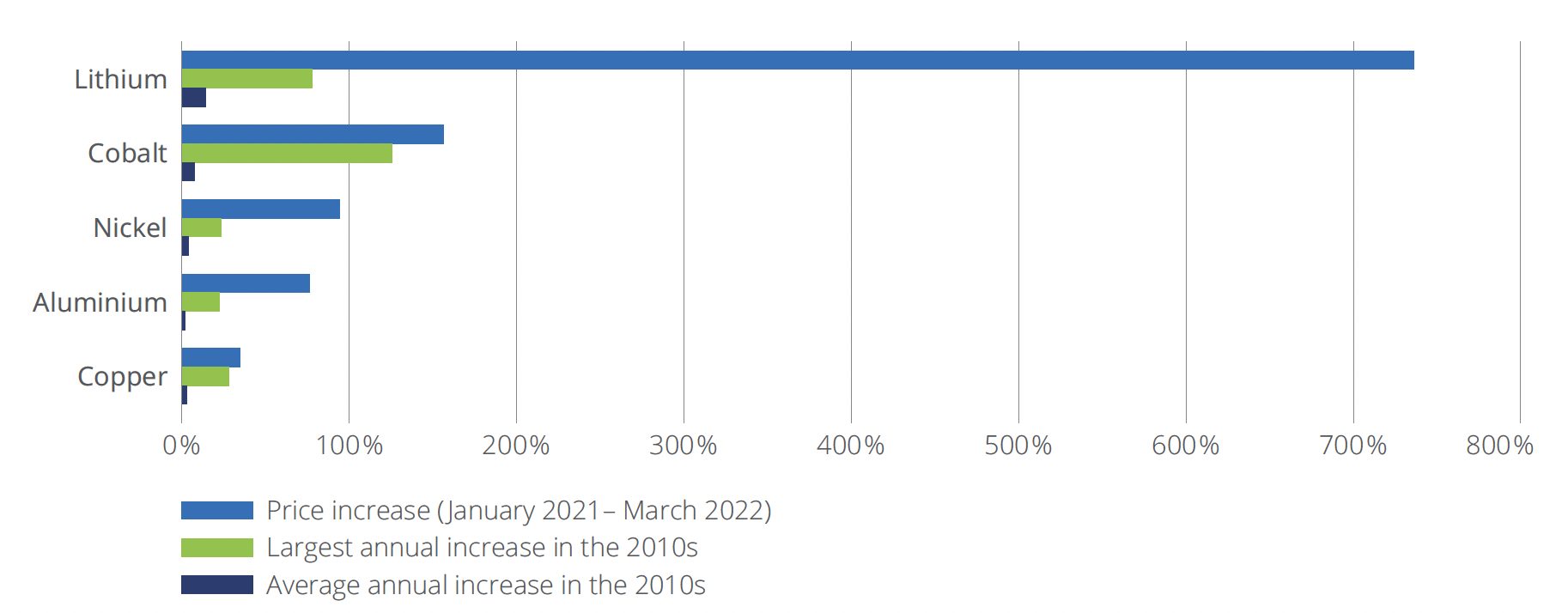

The IEA expects mineral demand for use in EVs and battery storage to surge by 2040 in a concerted effort to reach the “well below 2°C” world temperature increase goal.[10] Lithium would see the fastest growth, with demand growing by over 40 times (Figure 3). Lithium miners, for example, have been unable to scale supply as rapidly to match the boom in batteries demand, driving a surge in prices (Figure 4). However, investment in mining has grown significantly in recent years so output is expected to increase.

Figure 3: IEA’s growth expectations for selected minerals 2020-2040 in a Paris Agreement scenario

Figure 4: Scale of price increase for selected energy transition minerals and metals

Conclusion

Governments around the world are pushing ahead to meet global warming goals by 2050, and the deployment of EVs — as well as the electrification of the entire transportation ecosystem — is central to that objective. The transition to a green and efficient mobility market creates multiple risks and opportunities for investment portfolios, and these are likely to play out in themes such as EVs, battery producers, and sustainable mobility-related infrastructure and materials. For investors seeking to target that shifting landscape right at its core, thematic indices are a transparent and precise way to do so.

[1] IEA, “Improving the sustainability of passenger and freight transport.”

[2] According to the UN, net zero is “cutting greenhouse gas emissions to as close to zero as possible, with any remaining emissions re-absorbed from the atmosphere.”

[3] Other measures mentioned by the IEA include “operational and technical energy efficiency measures, the commercialisation and scale-up of low-carbon fuels, especially in the maritime and aviation sub-sectors, and policies to encourage modal shift to lower carbon-intensive travel options.”

[4] IEA, “Global EV outlook 2023.”

[5] ‘China ends electric vehicle subsidies,’ China Dialogue, Jan. 12, 2023.

[6] Revere (RBICS) data allow a detailed breakdown of the revenue sources of the eligible companies, helping this index to select companies with substantial exposure to the theme.

[7] Source: The World Bank.

[9] IEA, “The Role of Critical Minerals in Clean Energy Transitions.”

[10] IEA, “In the transition to clean energy, critical minerals bring new challenges to energy security.”