The biodiversity impact of investment portfolios is emerging as a key source of risk, and new ways of measuring companies’ nature-related footprint can help investors tackle the risks and opportunities in this field, according to a recent webinar organized by Investment & Pensions Europe (IPE).

At the event on July 11, representatives from STOXX, ISS ESG and DWS discussed how biodiversity considerations are gaining ground among investors and regulators. They also examined the recently launched ISS STOXX® Biodiversity indices as a framework to embed those considerations in investment portfolios.

“More and more investors are recognizing the potential financial materiality of biodiversity loss, which can be characterized as risk,” Frederike Bauer, Product Specialist for Xtrackers at DWS, which oversees more than EUR 840 billion in assets under management, said during the talk. Clients are asking how they can integrate biodiversity risk into portfolios, and what and how can be measured in that sense, she added. “Biodiversity is an emerging topic and is probably at a stage where climate was a few years back, where we were asking the same questions there.”

Resource exploitation, climate change, pollution and the introduction of invasive species are among the main drivers behind the rapid degradation of the world’s land and water. In a 2021 article on this blog, we discussed biodiversity’s relationship with climate change, the related regulatory landscape and challenges with data, and why investors should care. In a follow-up article last December, we provided an update on the extreme deterioration of our nature systems.

Core solution and holistic framework

To address those concerns was a driver behind the creation of the ISS STOXX Biodiversity indices, said Antonio Celeste, Director for Sustainability Product Management at STOXX.

“Investors wanted to have a solution that was designed for the core of their portfolios and that at the same time took into account a broad biodiversity framework with a holistic approach,” Celeste explained to the audience.

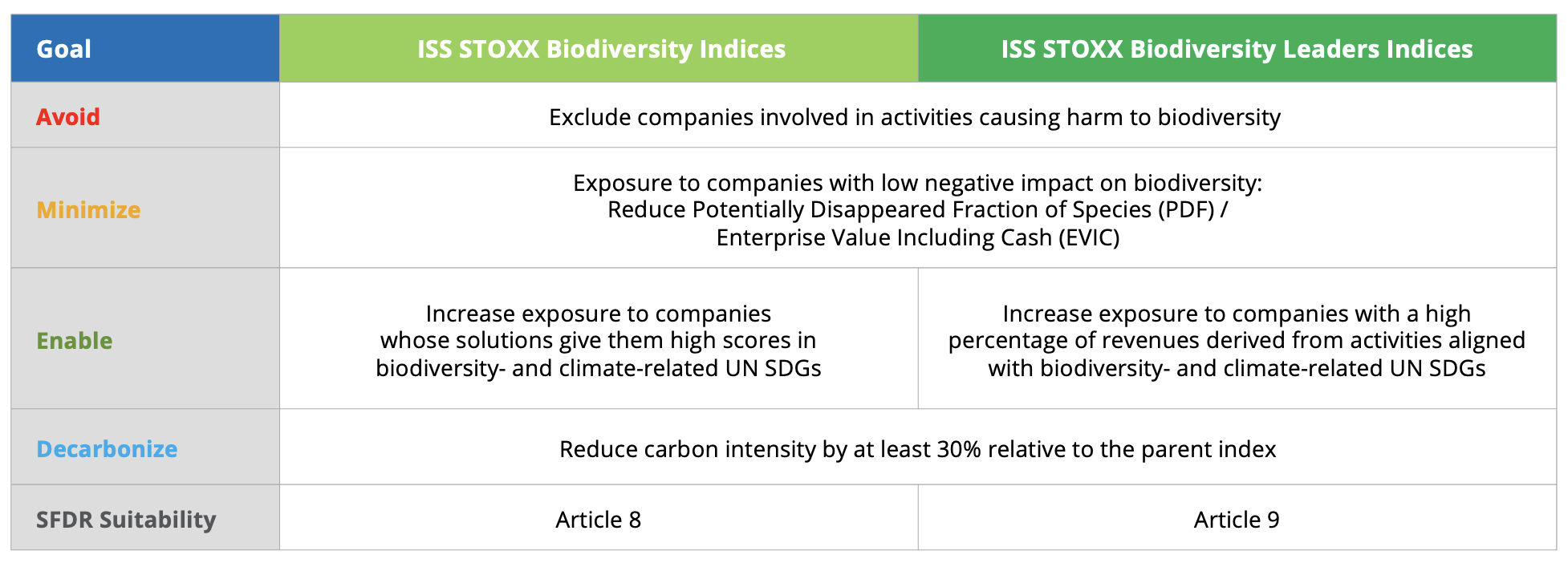

That approach rests on four pillars, called “Avoid,” “Minimize,” “Enable” and “Decarbonize” (Figure 1). The first one excludes companies involved in products or actions that harm biodiversity, such as pesticides. The second one selects companies with the best scores in a Potentially Disappeared Fraction of Species ratio (PDF). The “Enable” screen selects companies with the highest exposure to selected biodiversity- and climate-related SDGs. Finally, the fourth pillar seeks to achieve a 30% carbon footprint reduction in the portfolio relative to the starting universe.

Figure 1: ISS STOXX Biodiversity indices framework

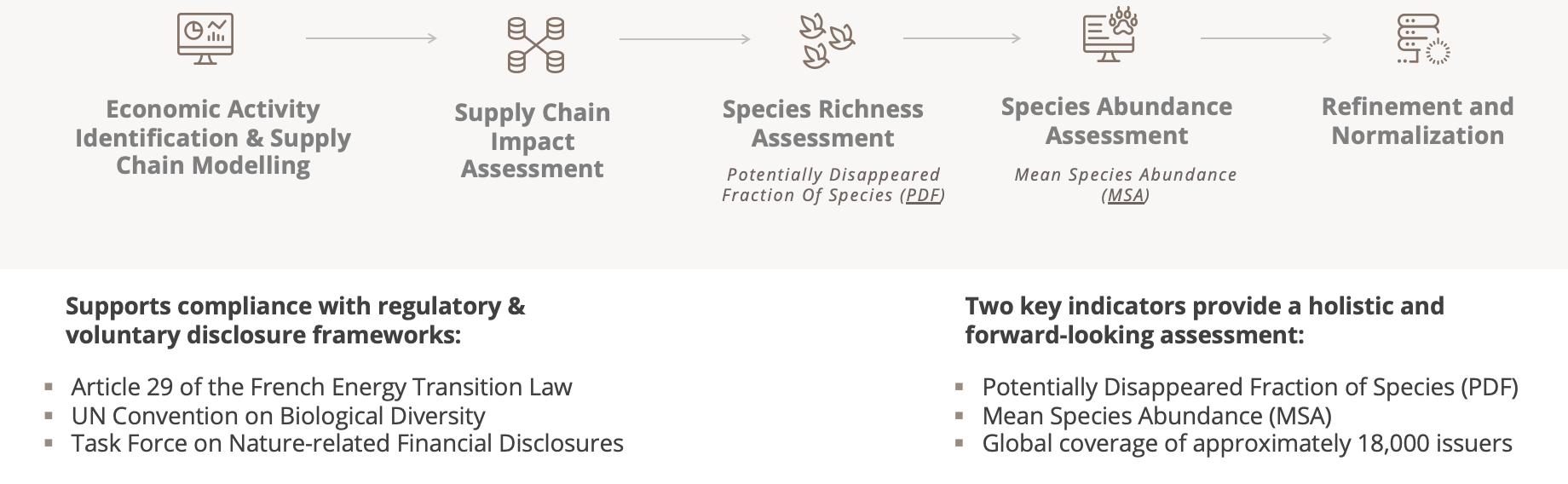

Hernando Cortina, Head of Index Strategy at ISS ESG, described the methodology and spirit behind the two key metrics employed in biodiversity analyses and assessed by his company: PDF and Mean Species Abundance (MSA). PDF represents the potential decline in species richness in an area over a period due to unfavorable conditions associated with environmental pressures. MSA reflects the change in the number of species, i.e., the relative abundance within each endemic region compared to a pristine state.

“We start by analyzing the activities of a company in its operating locations, then model its supply chain and inputs,” Cortina said. “That goes into various impact models that provide us PDF and MSA. All of this is estimated data. There is very little disclosure at this time. We are relying on well-established life-cycle and input/output models.”

Figure 2: ISS ESG’s methodology for assessing companies’ biodiversity impact

“Biodiversity has always been a key concept within the ‘E’ of ESG and is essential to environmental conservation,” added Cortina. “What is new now is the ability to model and quantify a company’s and its supply chain’s impact on biodiversity.”

Portfolio considerations

Celeste from STOXX explained that a biodiversity lens will lead to some deviations from a benchmark, as it happens with any other sustainability strategy. In that sense, investors can rely on an optimizer to obtain the maximum impact possible given specific constraints.

“It’s all about index construction,” Celeste said. “There are some biases that are implicit. When we think about a broad solution, biases are lower, but when we think of a darker green solution, the sector biases are larger. Here again, the methodology can be customized, and you can optimize some targets versus, for example, tracking error.”

Celeste and Cortina coincided that the ISS STOXX Biodiversity framework is a starting point rather than a destination. The indices are meant to be an engagement tool with companies, which may lead to more corporate disclosure on biodiversity and to enhanced metrics.

Regulators turn to biodiversity issues

Regulation is also due to play its part in improved company reporting, the panel said, as authorities increasingly turn their attention to the problem of a deteriorating natural capital. Bauer of DWS mentioned the Taskforce on Nature-related Financial Disclosures (TNFD) framework as a set of rules that may speed up the availability of biodiversity information from companies.

“That will bring forward reporting on biodiversity for companies on a voluntary level but also perhaps on a mandatory level,” Bauer said. “There may also be more harmonization going forward in terms of reporting,” she added.

Cortina and Celeste explained that the ISS STOXX Biodiversity framework aimed to comply with the spirit of the TNFD as well as with the Kunming-Montreal Global Biodiversity Framework from 2022. The latter introduced a number of environmental targets, such as the pledge to protect and restore 30% of the world’s land and water by 2030, and is likely to trigger new national legislations enforcing biodiversity obligations on companies.

“Today, we do not have a framework for biodiversity as we have for climate with the Paris-aligned Benchmarks (PABs) or Climate Transition Benchmarks (CTBs),” said Celeste. “We see biodiversity in the same trajectory as climate change in terms of momentum. When we think about climate change, between the Paris Agreement and the first PAB and CTB products, we had to wait for at least five years. I know there is a lot to do, but I hope momentum will be beneficial for biodiversity.”