Investing in companies with the lowest carbon emissions might not be the correct way to manage risks from the net-zero transition, according to climate experts at WTW.

There is little correlation between a low-carbon footprint and a company’s future financial and balance-sheet strength in a decarbonizing world, Sarah Hopkins and David Nelson of WTW said during the Qontigo Investment Intelligence Summit. Investors should instead manage climate-transition risk by focusing on companies and sectors that make a positive contribution to the climate transition.

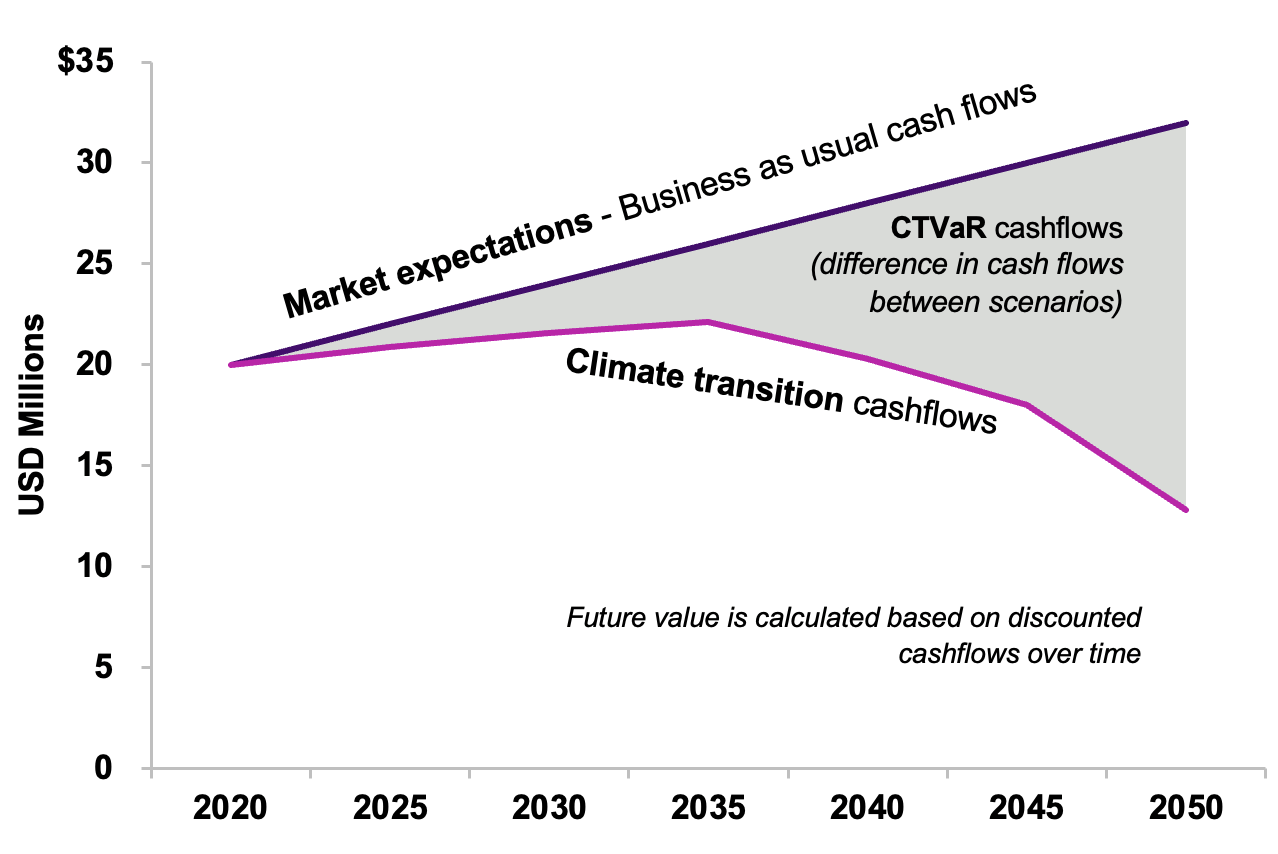

“The value of a company is the net present value of future cash flows,” Nelson, Senior Director at WTW’s Climate and Resilience Hub, told the audience. “We look to what the market’s current expectations are for the value of a company, and then we compare them to what those cash flows look like once we apply climate-transition scenarios. The difference between the two is what we view to be the financial risk for each company.”

This is the premise behind WTW’s Climate Transition Value at Risk (CTVaR) measure, which quantifies the anticipated impact on equity and fixed-income valuations of moving to a world consistent with the goals of the Paris Agreement (Figure 1 shows an illustrative example of a high-carbon company). CTVaR incorporates hundreds of factors — from fluctuating demand for commodities, to evolving technology, to changing consumption habits in products and services such as electric vehicles.

Figure 1: Indicative cashflows of a negative CTVaR company measured as net present value

WTW’s Climate and Resilience Hub has more than 100 specialists. Overall, the firm has USD 180 billion under management.

Risks and opportunities

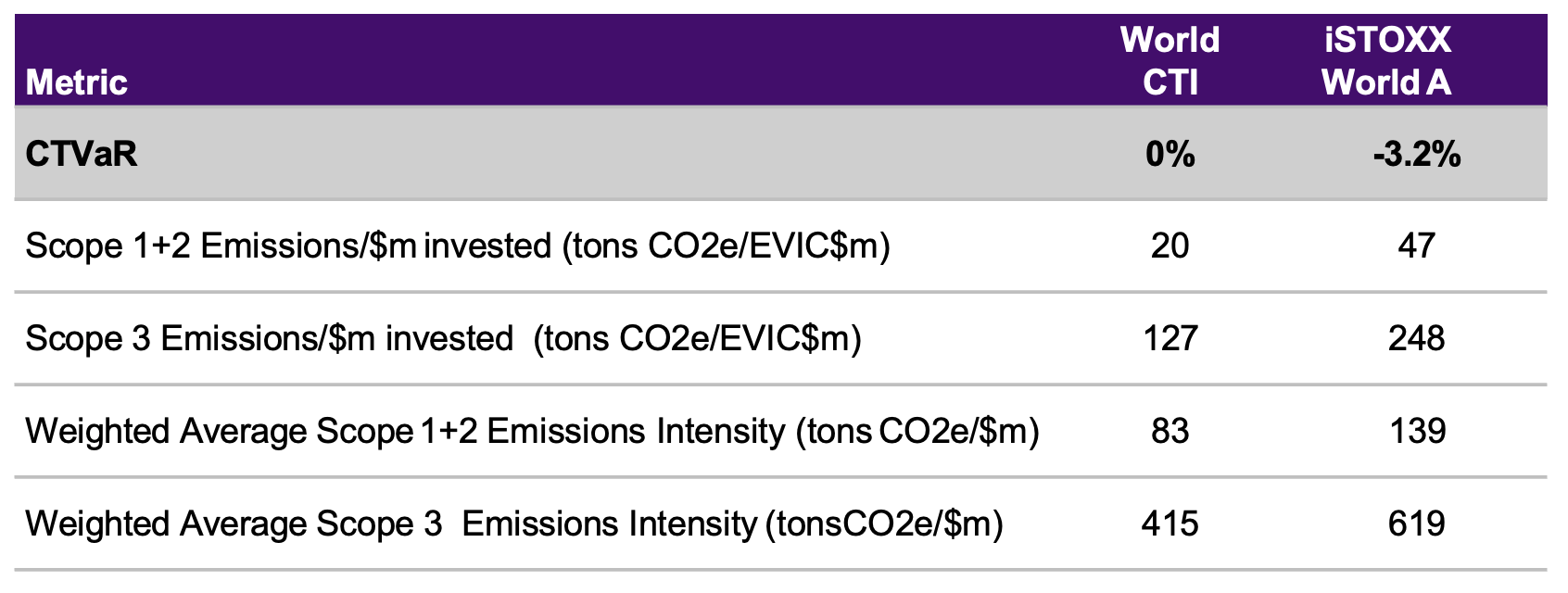

WTW’s Climate Transition Analytics team looked at the carbon footprint1 and climate-transition risk as measured by the CTVaR for a large pool of companies worldwide. They found that the overall correlation between the two measurements is close to zero, meaning that investors cannot use carbon metrics alone to inform their strategy.

“We don’t think it’s enough to just look backwards at carbon metrics,” Hopkins, WTW’s Head of Equity Solutions, told the audience. “It is really important that financial risks are taken into account, as are the opportunities that companies have as we go through the climate transition.”

Beyond carbon

The CTVaR methodology offers further advantages relative to traditional low-carbon strategies, the presenters said. CTVaR looks at deep, granular information rather than stopping at ‘surface-level’ data like carbon emissions. The approach quantifies risk through bottom-up fundamental analysis, business by business, oilfield by oilfield, looking not just at a company’s own carbon consumption but also at the system-wide climate transition impact on customers and suppliers.

Creation of the Climate Transition Indices

The wealth of data from CTVaR was last year made available in the form of an index solution with the introduction of the STOXX Willis Towers Watson Climate Transition Indices (CTI), aimed at helping investors reduce climate-transition risk. The indices start with broad, market-capitalization universes, implement standard ESG exclusions, and adjust constituents’ weights based on their CTVaR ratio (companies with a positive CTVaR are overweighted, and those with negative ones underweighted). Single stock, country and industry caps are applied so the index doesn’t deviate too much from its benchmark.

“What you end up with is a market-cap-type index, similar factors, no particular biases, but with a very, very low CTVaR,” said Hopkins.

By using the CTVaR projections, the indices tilt towards companies that are expected to fare well from the climate transition and away from companies that are expected to experience meaningful losses in value.

The STOXX® Willis Towers Watson World Climate Transition Index (World CTI) removes almost all transition risk from the portfolio – compared with the 3.2% value-at-risk ratio in the starting iSTOXX® World A universe (Figure 2). As a bonus, the World CTI has a non-mandated outcome of significantly reducing the portfolio’s carbon emissions. Importantly, remaining emissions are from companies helping the world to transition.

Figure 2: Transition risk analysis of CTI and benchmark

In the words of Nelson, the CTIs turn the complex data of CTVaR into something investable through a simple indexation strategy that allocates capital away from businesses that are ill-prepared for, or vulnerable to, the transition. In doing so, the asset-management industry will be more efficiently aiding the fight against global warming.

“The central role of financial markets is to make sure that the transition is well-capitalized and de-risked,” said Nelson. “The mission we should have as financiers is to make the most efficient transition, and as quickly as possible, using the tools that are at our disposal.”

1 GHG Scope 1 Emissions (Tonnes CO2e)/Market value ($).