Given its market-leading performance in recent years, technology has become a popular sector across global listed equity portfolios. Assets have flowed into traditional industry indices as well as into focused thematic indices targeting specific topics within the broader technology megatrend.

A new whitepaper1 from Diana R. Baechle, PhD, Principal, Applied Research at Qontigo, explores the risk, returns and performance of four such thematic indices: STOXX® Global Artificial Intelligence, STOXX® Global Automation & Robotics, STOXX® Global Digital Security and STOXX® Global Fintech.

These four indices form part of the STOXX Thematic framework, which is designed to track the beneficiaries of disruptive economic and social forces arising from three broad megatrends: demographics, sustainability and technology. The indices are built using a revenue-based approach that allows a detailed breakdown of companies’ sales sources, helping to identify and select businesses with substantial exposure to each theme.

The whitepaper finds there are risk, return and exposure differences between such thematic indices and a broader technology index such as the STOXX® Global 3000 Technology. Those differences also exist, unsurprisingly, when running the comparison against ‘the market’ as defined by the STOXX® Global 3000 index.

While there are also clear fundamental similarities between the various technology portfolios, investors should be aware of the differences and of the risks and other characteristics associated with such indices to ensure that these attributes are aligned with their objectives and do not introduce unwanted biases into their investments.

A strong run for tech

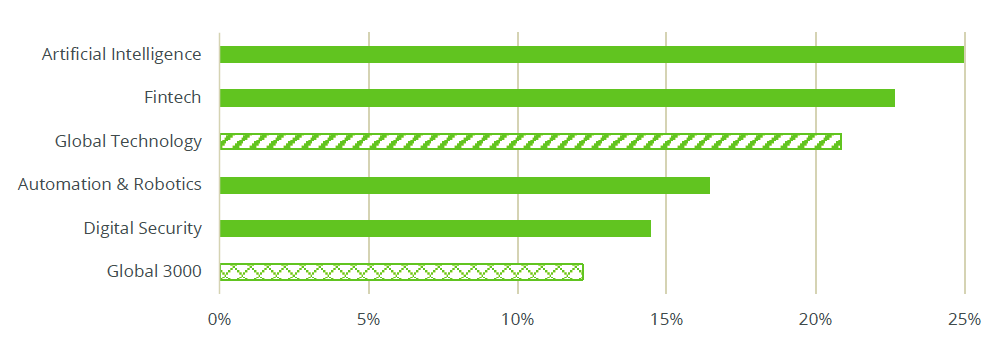

No other market sector has performed as well as technology in recent years.2 All four tech-oriented STOXX thematic indices have reflected this bullish investor sentiment, posting double-digit annualized returns in the past nine years (Figure 1). While the Artificial Intelligence and Fintech themes outperformed the broad Global 3000 Technology index during this period, Automation & Robotics and Digital Security lagged. All tech-oriented thematic indices beat the broad Global 3000 index.

Figure 1 – Annualized returns, 2012-2021

Drivers of returns

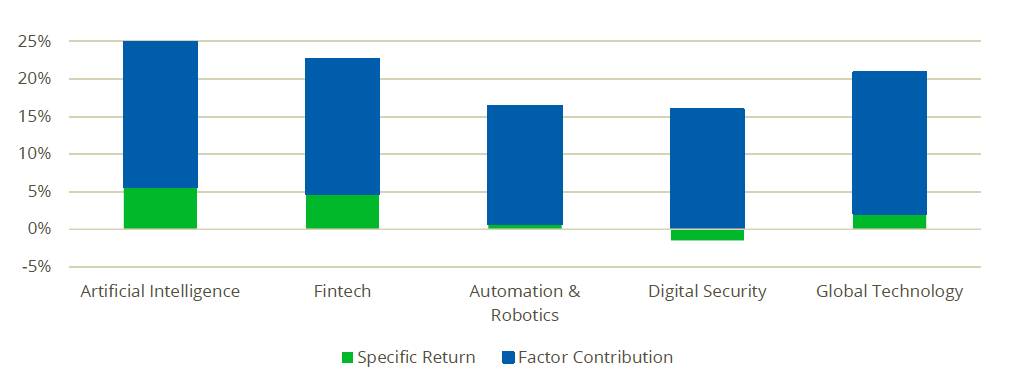

Fundamental factors, as reflected by the Axioma Worldwide medium-horizon fundamental model, contributed the most to all four thematic indices and to the sector index return during the period analyzed, and were largely responsible for their positive returns, Baechle writes (Figure 2). Specific returns (individual attributes of each index component), on the other hand, made only a small contribution and in the case of Digital Security in fact detracted from it. However, the specific return did push the total returns for Artificial Intelligence and Fintech above that for the Global 3000 Technology index.

Figure 2 – Sources of index returns

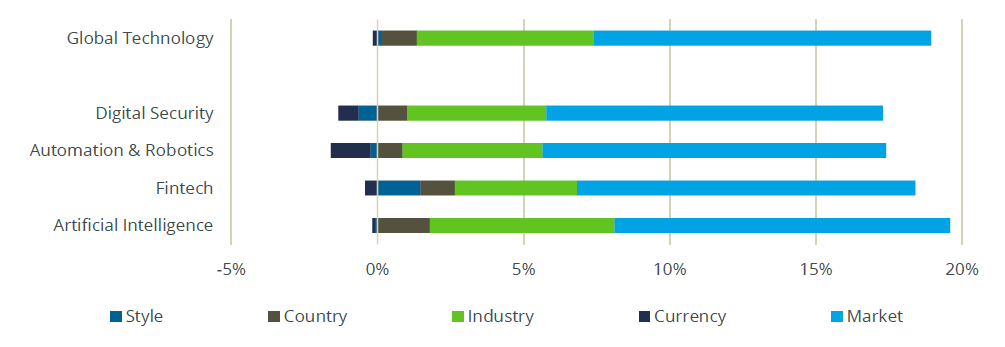

Delving deeper into the individual contributions from the fundamental factor groupings (Style, Country, Industry, Currency and Market), it emerges that Market and Industry were responsible for over 90% of the factor contribution (Figure 3).

“Perhaps this is not surprising, since these indices are designed to capture megatrends that target particular industries,” Baechle writes.

Figure 3 – Factor contribution to annualized returns

As Figure 3 shows, Style factors had a small effect overall, reflecting the offsetting impacts of individual factors, and were only positive for Global Technology and Fintech.

Still, the study presents a detailed review of each index’s exposure and returns attribution from Style factors to seek for any stand-out case. All tech-focused thematic indices had positive average exposures to the Liquidity, Market Sensitivity (high beta) and Growth styles, while they had negative average exposures to Dividend Yield, Leverage, Size and Value for the period under review. Somehow surprisingly, neither index had a particular strong tilt towards Momentum, despite the industry’s prolonged strong performance.

One notable deviation between the thematic indices and the Global 3000 Technology index came with the exposure to the Size Style factor. All thematic indices were tilted towards smaller-capitalization stocks during the period, the inverse from the broad industry gauge, which had a bias for large caps. Size was a positive contributor to thematic indices over the entire period, while it had a minor negative contribution to the Global Technology Index.

Further analysis

The whitepaper also shows the exposure to and cumulative returns from Style factors for all indices during the entire period. One of the findings was that all indices were significantly impacted by Momentum despite their small average exposure to this factor, due to its extremely large return over the past nine years. Growth saw large swings in its return generated over the period, ending with a relatively small positive cumulative return and a small impact on each index.

Elsewhere, the study also runs an analysis of the four thematic indices’ predicted risk, Sharpe ratio and evolving number of constituents, completing a risk-return picture on the portfolios as well as on the global technology index.

Interestingly, as Baechle notes, correlations between the thematic indices and the broader market have been low, suggesting they could add additional return to a broad portfolio without increasing its risk.

This study may provide a useful examination into one of the most popular industries of the past decade. With no shortage of sector and thematic indices to target technology, running an analysis of factor risks exposure can shed light on criteria that can help investors select the right index and investment approach.

We invite you to download the whitepaper and read its findings here >

1 Diana R. Baechle, ‘Tech-Oriented Thematic Indices Through a Factor Lens,’ Qontigo, August 2021.

2 For example, since data begins in November 2014, the STOXX® Global 1800 Technology Index has quadrupled in value. None of the other 19 ICB Supersectors comes close to that performance.