The STOXX Willis Towers Watson Climate Transition Indices (CTIs) were introduced in 2021 in collaboration between WTW and Qontigo to help investors reduce climate-transition risk.

At a webinar hosted by Investment & Pensions Europe (IPE) on Dec. 13, David Nelson, Senior Director of Climate Transition Analytics at WTW’s Climate and Resilience Hub, explained the philosophical premise behind the CTIs and the unique measure at their core: WTW’s Climate Transition Value at Risk (CTVaR) ratio.

CTVaR quantifies the anticipated impact on equity and fixed-income valuations of moving to a world consistent with the goals of the Paris Agreement. The ratio incorporates hundreds of factors — from fluctuating demand for commodities, to evolving technology, to changing consumption habits in products and services such as electric vehicles. The CTIs allocate constituents’ weights based on their CTVaR (companies with a positive CTVaR are overweighted, and those with negative ones underweighted).

“Rather than develop a net-zero portfolio that says, ‘you need to be at 30% of emissions by 2030 and 0% by 2050’, we say: ‘what happens if the world is going to decarbonize along that pathway?’ ‘What investments would you then choose?’” David explained to the audience.

“We are actually developing portfolios for a decarbonized world, rather than developing decarbonized portfolios,” he added. “And if that means you miss your emissions target because you were investing in the very things that were needed to make the transition happen, so be it.”

Nevertheless, the CTIs tend to have lower carbon emissions than the market benchmark, a side effect of its stock-picking methodology.

“It means that we are investing that carbon budget in those things that are going to benefit from the transition,” David said. “It’s a more rational approach to reaching net-zero.”

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >What is climate transition risk?

David explained that climate transition risk is one of three climate risk drivers identified by the Task Force on Climate-Related Financial Disclosures (TCFD). The other two are physical risk and liability risk.

The relevance of climate transition risk means that “we are not going to come anywhere near meeting our climate goals just by decarbonizing our supply chains and buying offsets,” said David. “There is a much more fundamental transition. Policy and regulation will develop, there will be complete changes in the markets that we operate in, there will be new technologies, consumers will change the way that they behave. The question is to understand how each one of these pieces will affect the valuations of your portfolio.”

Controlled risk

Speaking at the same event, Qontigo’s Melissa Brown focused on the CTIs as a practical application of the concept in an investment portfolio. At the same time, the CTIs avoid creating excessive risks relative to the benchmark.

“We wanted to create a strategy that was investable, systematic and that lowered the financial risk of the climate transition,” Melissa, who is Managing Director for Applied Research at Qontigo, said. “But importantly, we wanted to maintain broad market exposure.”

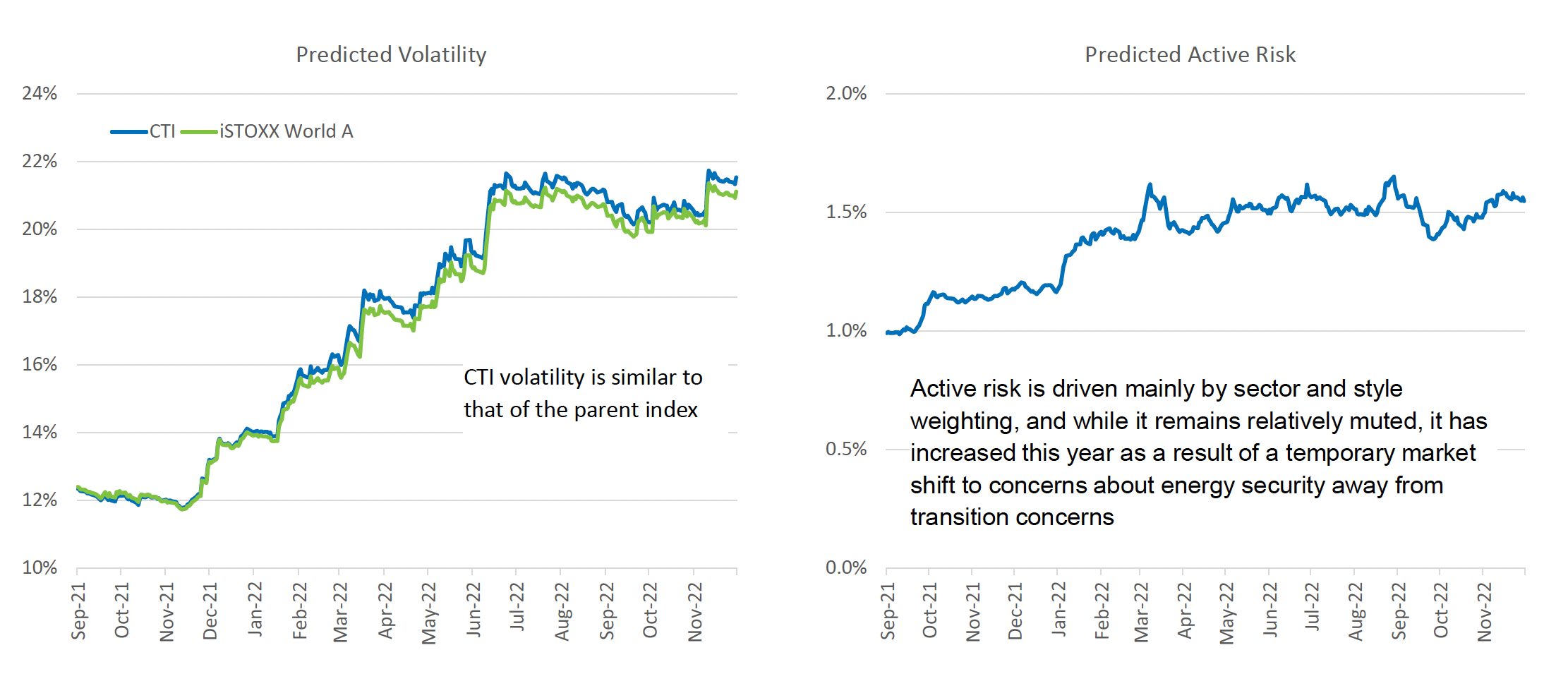

Exhibit 1 shows that the CTIs take on very limited volatility and tracking error relative to the iSTOXX® World A index.

Exhibit 1 – Predicted volatility and active risk comparison

The CTIs were conceived as market-cap-type indices, with single stock, country and industry caps in place to obtain similar industry and style risk exposures to those of broader benchmarks, Melissa told the audience.

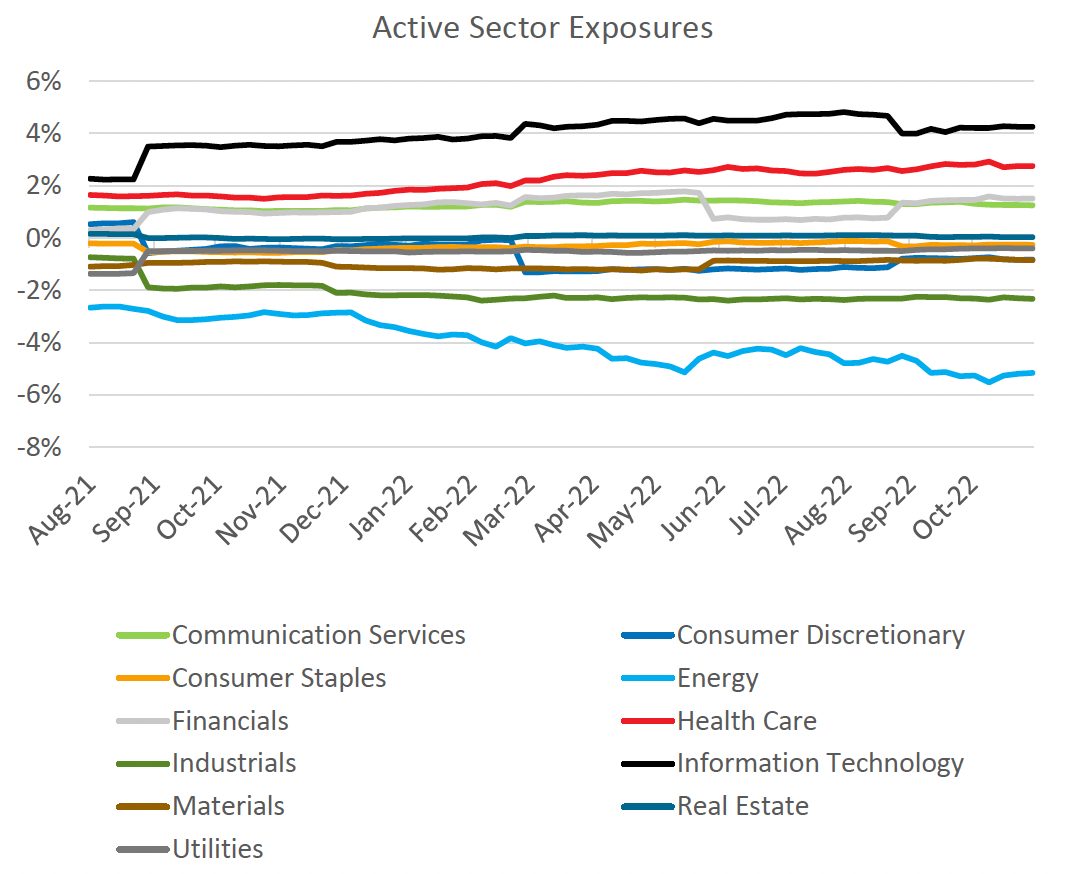

Indeed, sector weights have been quite close to benchmark, with the exception of energy and IT, Melissa explained (Exhibit 2).

Exhibit 2 – Sector active risk of CTIs relative to benchmark

Sector exposure accounts for 50%-75% of the CTI’s overall active risk, Melissa added, and it drives about half the improvement in the CTVaR. Active style exposures explain 5%-15% of the active risk.

“This index can be fit easily into an equity allocation or overall asset allocation, without changing your risk profile,” Melissa said.

Higher returns

As the CTIs tilt away from companies that are likely to experience meaningful losses in value in a climate transition, and favor those that will benefit, this has strong long-term return implications, Melissa concluded.

“You are getting those higher returns without having to take on higher volatility,” she said.

This is a key consideration for asset allocators, who are mostly concerned about how sustainability considerations impact performance, said Paul Alakija, Head of Asset Owner and Consultant Coverage for EMEA at Qontigo, also speaking at the webinar.

Integrated vision

WTW’s studies have shown that there is little to no correlation between a low-carbon footprint and a company’s future financial and balance-sheet strength in a decarbonizing world. Therefore, investing in companies with the lowest carbon emissions might not be the correct way to manage risks from the net-zero transition.

Moreover, carbon footprint is a backward-looking measure that says little about the prospect for a company’s future cash flows. It gives only a limited understanding of transition risk, whereas investors should instead focus on a more integrated vision that includes future changes in economic demand, technology and regulation.