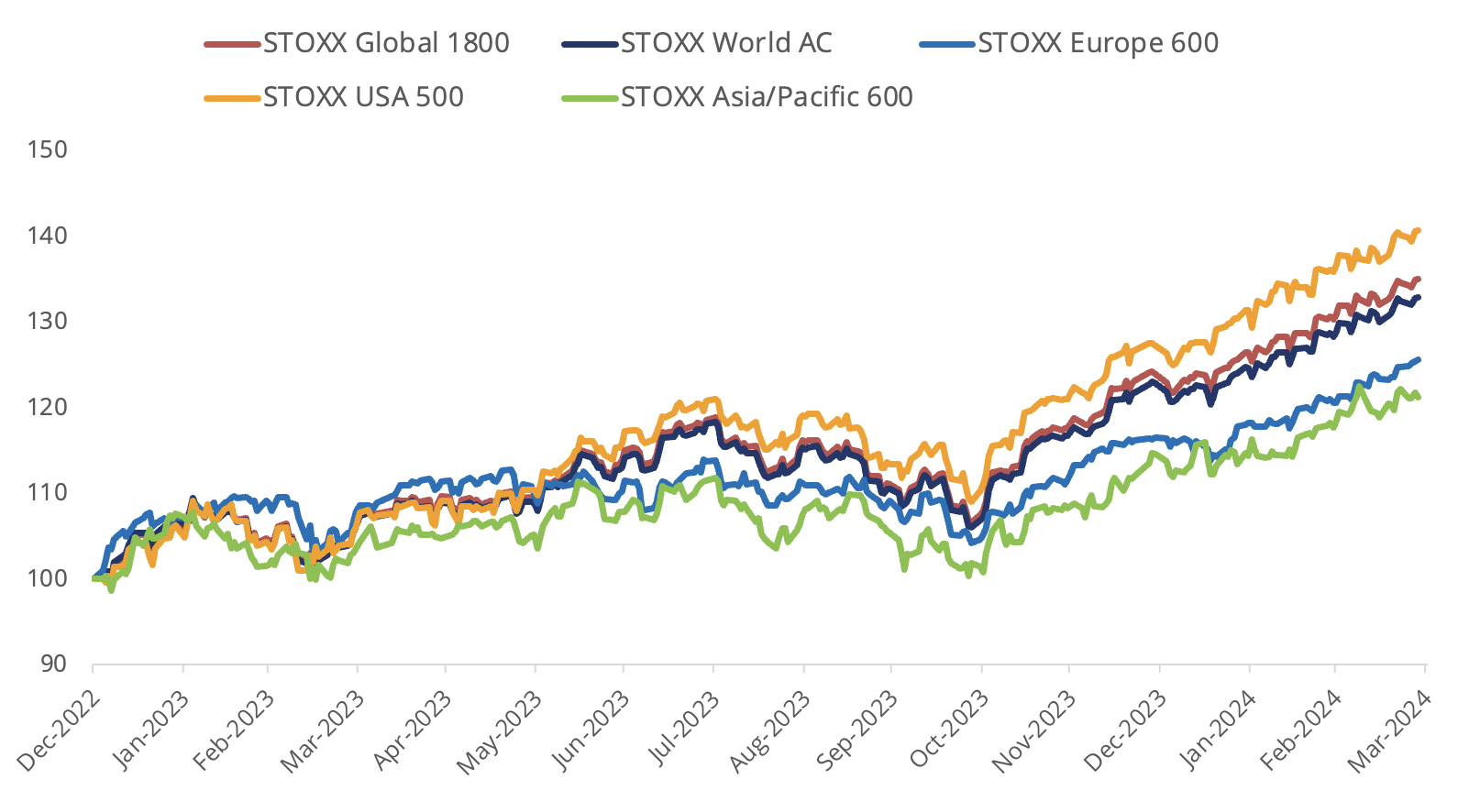

Stocks gained for a fifth straight month in March, lifting the STOXX® Global 1800 index to a new all-time high, as investors raised their estimates for global economic growth.

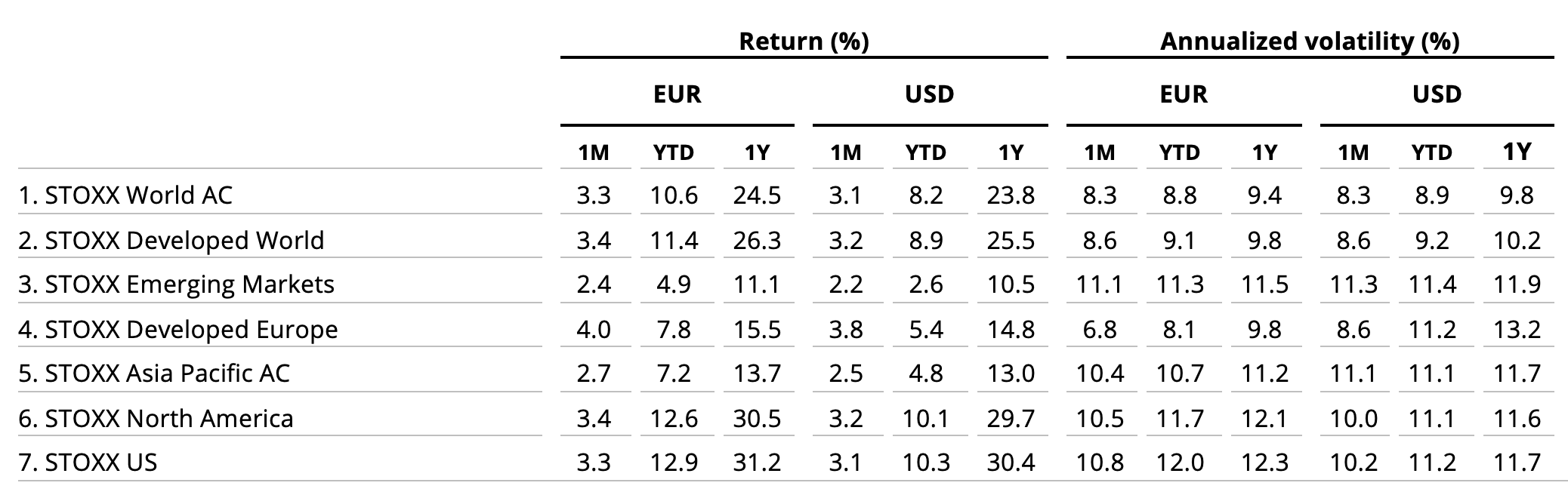

The global benchmark jumped 3.2% last month when measured in dollars and including dividends[1], for a 9% advance in the first quarter. It added 3.4% in March when measured in euros. The STOXX® World AC index rose 3.1% in the month.

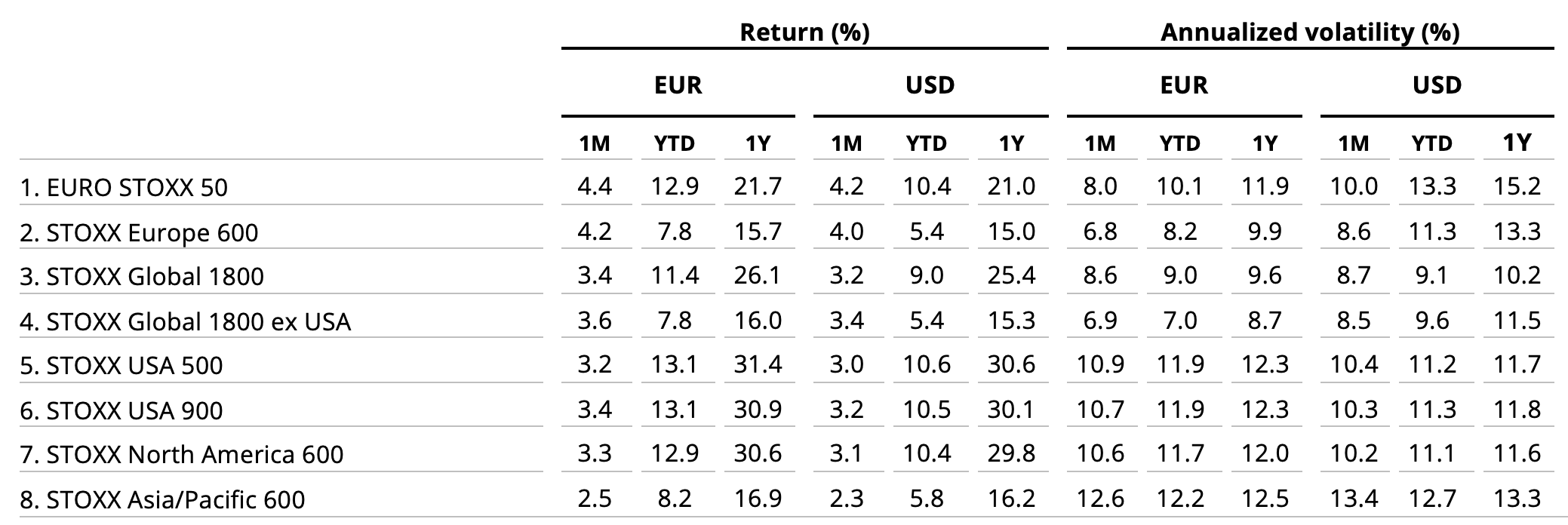

The Eurozone’s EURO STOXX 50® added 4.4% in euros, while the pan-European STOXX® Europe 600 advanced 4.2%[2]. The STOXX® North America 600 gained 3.1% in dollars, while the STOXX® USA 500 rose 3%. The STOXX® Asia/Pacific 600 climbed 2.3% in dollars. The STOXX® Developed World rose 3.2% and the STOXX® Emerging Markets gained 2.2%.

Figure 1: STOXX Benchmark indices’ March risk and return

Figure 2: STOXX Equity World indices’ March risk and return

Germany’s DAX® rose 4.6% in the month. MDAX®, which gauges the performance of German mid-caps, increased 4.7%.

| For a complete review of all indices’ performance last month, visit our March index newsletter. |

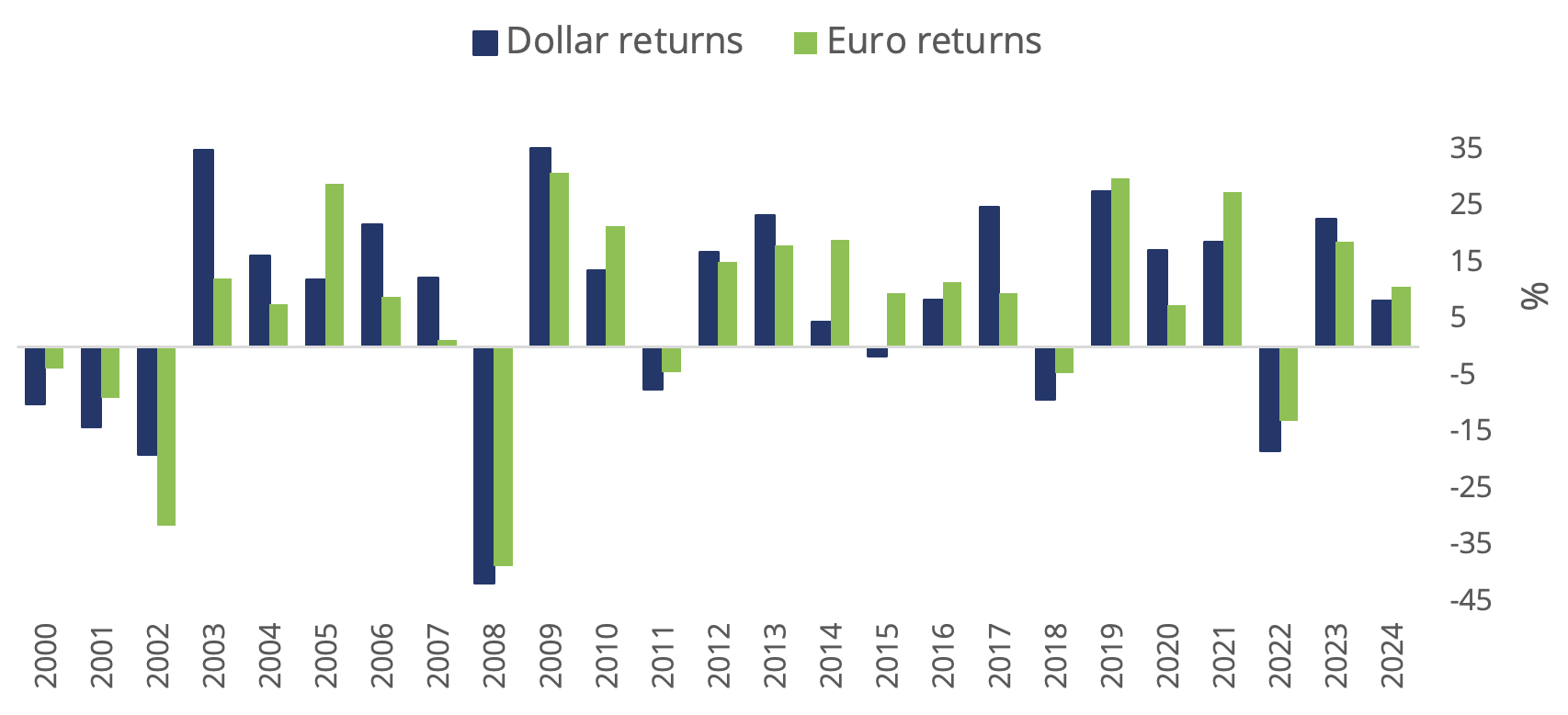

No hard landing

The US added 275,000 jobs in February, the government reported on March 8, more than the 200,000 openings that had been expected on average by economists.[3] In the Eurozone, Purchasing Managers’ Indices for February released in March suggested the industry sector is rebounding from a period of stagnation.[4] A string of economic reports has bolstered expectations that the global economy has avoided a recession amid high interest rates.

Figure 3: Total annual % returns for STOXX World AC index

Figure 4: Select STOXX benchmarks’ returns since 2023

Volatility little changed

The EURO STOXX 50® Volatility (VSTOXX®), which tracks EURO STOXX 50 options prices, fell to 13.4 at the end of last month from 13.8 in February. A higher VSTOXX reading suggests investors are paying up for puts that offer insurance against stock price drops. The VDAX-New®, which measures volatility in German equities, eased to 12.8 from 12.9 in February.

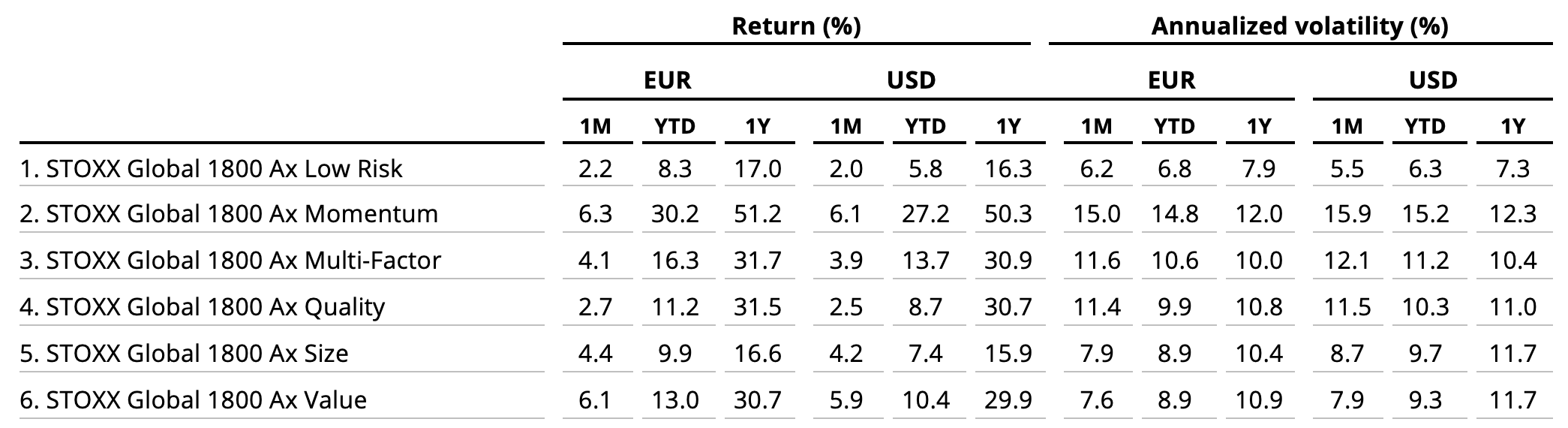

Factor investing

The Momentum signal ruled across geographies for a second straight month, according to the STOXX Factor indices (Figure 5). The Low Risk factor repeated February’s position at the bottom of the group.

Figure 5: STOXX Factor (Global) indices’ March risk and return characteristics

Climate benchmarks

Among climate benchmarks, the STOXX® Global 1800 Paris-Aligned Benchmark (PAB) rose 1.6%, as did the STOXX® Global 1800 Climate Transition Benchmark (CTB). The PAB and CTB indices follow the requirements outlined by the European Commission’s climate benchmarks regulation.

Sustainability indices

The STOXX® Global 1800 ESG-X index gained 2.9% in the month. The STOXX® ESG-X indices are versions of traditional, market-capitalization-weighted benchmarks that observe standard responsible exclusions.

Within indices that combine exclusions and best-in-class ESG integration, the EURO STOXX 50® ESG index rose 4.7%. Germany’s DAX® 50 ESG index (+4%), which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, lagged the benchmark DAX’s return in the month.

The STOXX® Global 1800 SRI advanced 3.8%. The STOXX SRI indices apply a rigorous set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.

Finally, the DAX® ESG Screened added 3.9% in the month. The index reflects the composition of the DAX benchmark minus companies that fail to pass norms-based and controversial weapons screenings, meet minimum ESG ratings or are involved in certain business activities considered undesirable from a responsible investing perspective.

Thematics, dividend strategies

Only nine of 35 STOXX® Thematic indices outperformed the benchmark STOXX Global 1800 last month. The STOXX® Global Copper and Metals Mining (16%) and STOXX® Global Copper Miners (16.2%) indices stood out with double-digit gains in the month.

Dividend strategies rebounded from two months of losses. The STOXX® Global Maximum Dividend 40 (+4.1% on a net basis) selects only the highest-dividend-yielding stocks. The STOXX® Global Select Dividend 100 (+3.9%) tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments.

Minimum variance

Minimum variance strategies failed to match the benchmarks’ returns last month against the market’s bullish backdrop. The STOXX® Global 1800 Minimum Variance rose 2.7% and the STOXX® Global 1800 Minimum Variance Unconstrained added 2.6%.

The STOXX Minimum Variance Indices come in two versions. A constrained version has similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

[1] All results are total returns before taxes unless specified.

[2] Throughout the article, all European indices are quoted in euros, while global, North America, US, Japan and Asia/Pacific indices are in US dollars.

[3] FT, “US jobs figures beat forecasts but downgrades complicate outlook,” March 8, 2024.

[4] Reuters, “Euro zone business activity moves closer to recovery, PMI survey shows,” March 5, 2024.